Read all you need to know about the Tax Reform law approved by President Bola TInubu today.

Federal Inland Revenue Service (FIRS) will now become Nigeria Revenue Service (NRS)

-The Nigeria Revenue Service (NRS) will now collect revenues previously handled by agencies such as the Nigeria Customs Service, NUPRC, NPA, and NIMASA.

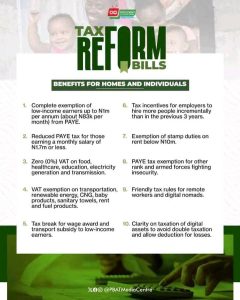

Tax exemption for workers earning ₦800,000 and below annually.

-25% personal income tax applies only to individuals earning above ₦50 million annually.

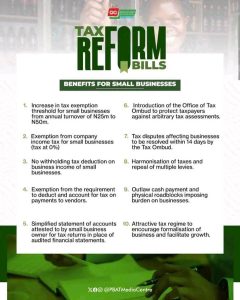

-Small businesses owners are exempted from paying income tax.

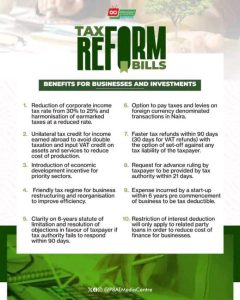

-Company income tax for medium and large companies will be reduced from 30% to 25% starting in 2026.

Value Added Tax (VAT) exemptions on essential goods and services consumed by the poor, including food items, medical services, pharmaceuticals, educational fees, and electricity.

-VAT remains at 7.5%, and corporate income tax stays at 30%. NO INCREMENT!

Introduction of a Development Levy ranging from 4% to 2%, allocated to support the NELFUND, TETFund, NITDA, and NASENI.