President Bola Tinubu on Sunday in Lagos praised the late Access Bank CEO, Dr Herbert Wigwe, for his contributions to the growth of various sectors of Nigeria’s economy.

Tinubu, represented by the Minister of Finance and Coordinating Minister of the Economy, Mr Wale Edun, spoke at the first-year memorial service for Wigwe, his wife, and his son.

The event, held in Victoria Island, honoured Wigwe, Group Managing Director and CEO of Access Holdings Plc, who died in a helicopter crash in the United States on Feb. 9, 2024.

He perished alongside his wife, Doreen, their son, Chizi, and a friend, Mr Abimbola Ogunbanjo, Group Chairman of the Nigerian Exchange Group Plc, as well as two crew members.

Tinubu described Wigwe as more than a banker, calling him a builder of institutions, dreams, and people.

He noted that Wigwe transformed Access Bank into a global financial powerhouse, elevating Nigeria’s banking sector to remarkable heights.

According to Tinubu, Wigwe’s brilliance, resilience, and foresight positioned Access Bank as a major player, not only in Africa but also globally.

He highlighted Wigwe’s contributions beyond banking, including achievements in education, youth empowerment, and healthcare through philanthropy.

“Through the Wigwe University project, he sought to redefine higher education in Nigeria, believing knowledge and skills are the greatest investments in a nation’s future,” Tinubu said.

“His impact extended beyond boardrooms and balance sheets. He touched lives, created opportunities, and inspired hope,” he added.

Tinubu stated that Wigwe’s loss left an irreplaceable void, but his enduring legacy offers solace amid the grief.

“His story reminds us that vision, hard work, and service to humanity are the true measures of greatness,” he said.

The President extended condolences to the Wigwe family, Access Holdings, and others, while praying for the repose of the departed souls.

“Nigeria has lost a shining star, but the light Herbert Wigwe ignited in our nation will never be dimmed,” he added.

Former President Olusegun Obasanjo also paid tribute, describing Wigwe’s death as an “indelible void” in Nigeria’s financial landscape.

Obasanjo, represented by Bolaji Agbede, Acting CEO of Access Holdings, recalled how Wigwe and Aigboje Aig-Imoukhuede reshaped banking through trust, respect, and commitment.

He praised Wigwe’s love for humanity, leadership qualities, and lasting legacies.

“To the Wigwe family, Access Holdings, Aig, and all who loved Herbert, let us honour his memory by continuing his work of building lasting institutions,” Obasanjo said.

“May his soul and the souls of his beloved wife, son, and friend continue to rest in perfect peace,” he added.

French President Emmanuel Macron, represented by the Consul General of France in Lagos, Laurent Favier, also honoured Wigwe.

Macron commended Wigwe’s entrepreneurial spirit and his passion for the arts.

He acknowledged Wigwe’s role in strengthening Nigeria-France relations as President of the France-Nigeria Business Council.

“The best tribute we can pay him today is to keep his legacies alive,” Macron said.

Aig-Imoukhuede, Barbados Prime Minister, others, honour Wigwe’s memory

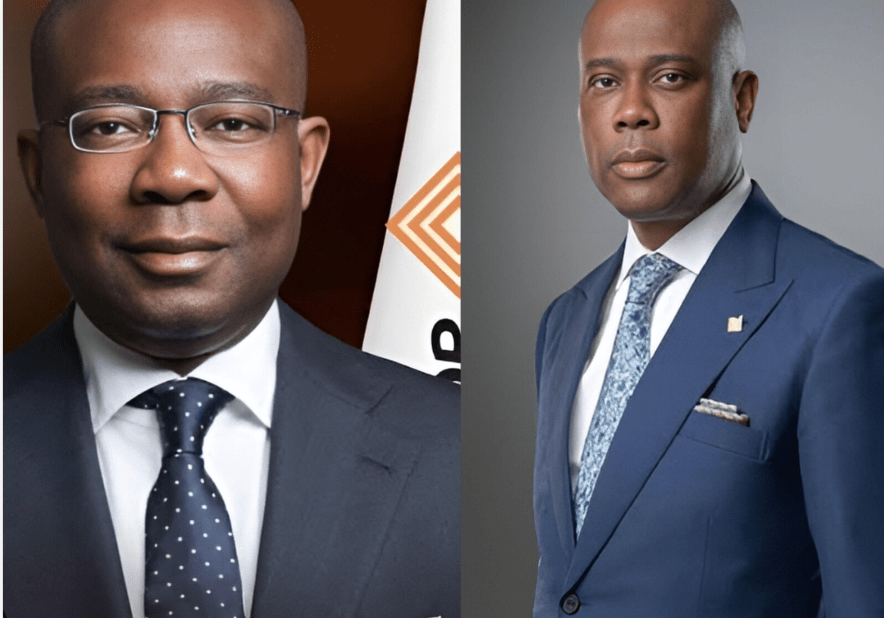

Chairman, Access Holdings Plc, Aigboje Aig-Imoukhuede, has described his relationship with his late friend and business partner, Dr Herbert Wigwe, as “sweet”and built on deep trust.

Speaking at the one-year memorial service for Wigwe, his wife, and son in Lagos, Aig-Imoukhuede emphasised that their relationship transcended business.

“We were bonded by trust, real and true trust, was something that we were both privileged to share,” he said.

Wigwe, along with his wife Doreen, son Chizi, and a friend, Mr Abimbola Ogunbanjo, Group Chairman of the Nigerian Exchange Group Plc, and two crew members, died in a helicopter crash in U.S. on Feb. 9, 2024.

Wigwe and Aig-Imoukhuede, his longtime business partner and friend, acquired Access Bank in 2002.

He narrated stories of close bond with the deceased and how the relationship extended between their family members.

“We shared the most intense relationship. A relationship that was indeed, I can only use the word, sweet.

“Sweet in good times, sweet in bad times, sweet in celebration, sweet at moments of despair. At all times, we were there for each other. Not sometimes, at all times,” he recalled.

He clarified that his tribute wasn’t solely about their remarkable business success.

“People speak about our partnership in terms of commercial or enterprise success, but the tribute I make to Herbert today is not that.

“Together, we enjoyed probably Africa’s most successful partnership in business. That’s not the tribute.

“The tribute I pay to Herbert today is that we were able to entrust each other with the things that were most important to us. He knew, just as I know, my most important secrets,” Aig-Imoukhuede revealed.

He pledged his support to Wigwe’s children and family.

Also, the first female Prime Minister of Barbados, Mia Mottley, while delivering a keynote memorial, shared the endearing nature of Wigwe and his impact on her country.

Mottley shared personal memories of Wigwe and highlighted his love for arts.

“I believe that Herbert is enough to ensure that this legacy will live on.

“The testimonies that we have heard this evening and the passion that we have heard from others will truly ensure that that his legacy lives on.

“I say to you from my part in the Caribbean, in Barbados, that linkage ironically between those of Rivers State and my own country will find its way of also living on,” she said.

Wigwe’s brother, Uche, his son David, his daughter, Tochi and other family members, friends of his late wife and those of his late son took turns to pay tributes.

Meanwhile, Pastor Ituah Ighodalo, Senior Pastor of Trinity House, called for forgiveness among people, emphasising the power of peace and harmony.

He also paid his tribute and later prayed for Wigwe and Ogunbanjo families, committing them unto Gods hands.

Similarly, Managing Director, Access Bank Plc, Roosevelt Ogbonna shared how the Access Bank family were able to wriggle through the painful moment of Wigwe’s demise in 2024.

He recalled Wigwe’s strengths and quality moments that the Access colleagues still cherished.