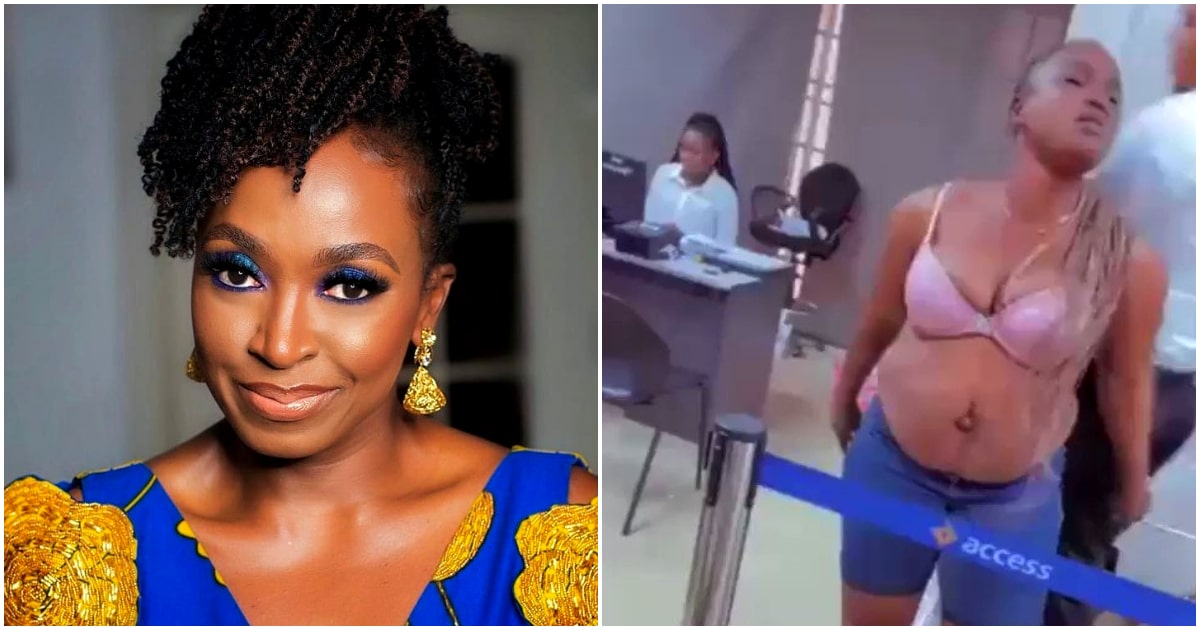

Award Winning Actress and social advocate, Kate Henshaw, has reacted to the video of a protesting woman who stripped herself naked in the Banking hall in a bid to withdraw money.

“Pls don’t share that lady’s video. She had no choice but to strip herself to get her own money because of Meffy and his cohorts. We have a choice to cover her nakedness at least. pls,.” the actress said.

TheNewsGuru.com (TNG) reports that the video has been going viral on social media causing a lot of people to talk.

In the video, the lady was seen striping herself naked at the Access bank hall while demanding all her money in her account and the closure of the account afterward.

The lady was seen wearing only a brassiere at the upper part of her body and her shorts while fuming in the Access bank hall.

Speaking in Yoruba (translated into English), she said “Close my account, I’m not using it again. My kids didn’t go to school yesterday; I’m not using again.”

Reacting to the video, the Cross River State-born actress (Henshaw) urged people to desist from sharing the video as the woman was frustrated and had no choice but to strip in the bid to get her funds from the bank.

In 2008, the actress won the Africa Movie Academy Award for Best Actress in a Leading Role for her performance in the movie ‘Stronger than Pain’.

Watch the video below:

JB Update: Customer strips in banking hall

A bank customer went half naked while demanding to have her money returned and account closed.

In the video which surfaced on social media on Wednesday, the woman can be seen in merely her underwear as she protested.#jbreport pic.twitter.com/wxtghOia44

— EchoeOfIslam (@echoe_of_islam) February 1, 2023

TheNewsGuru.com (TNG) reports that the Central Bank of Nigeria (CBN) had directed Deposit Money Banks to stop issuing new naira notes within the banking hall.

Instead, the apex bank directed the banks to load their Automated Teller Machines with only new notes to ensure that the currency circulates across the nation ahead of the January 31, 2023 deadline when the old notes will no longer be legal tender.

However, the banks had not been able to comply with the directive as they complained of inadequate supply of the new notes, prompting them to not load their ATMs with both old and new notes.

According to a source who is a bank manager, the CBN issued a memo in that respect to all the branch managers to enforce its order.

The memo, which was titled., ‘Urgent update on currency redesign’ and signed by the Group Head, Retail Operation, stated, “The CBN has mandated that we immediately stop the Over-the-Counter payment of the new N200, N500 & N,1000 currency. Instead, all new notes should be loaded into the ATMs for customer withdrawals. This is effective immediately please.”

The source complained that the new notes were in short supply, hence the branch decided to load a mixture of the old and new N1,000 and N500 notes in the ATMs for customers to withdraw.

The source stated, “We got a memo from the head office that we should stop dispensing new notes to customers who come to withdraw over the counter, but instead we should load the ATMs with the new notes. The correspondence from the head office said the directive was from the CBN and that we should implement it immediately.

“The directive has, however, thrown us into a dilemma as we are in short supply of the new notes and we can’t afford not to load the ATMs as there has been a surge in the number of customers coming to withdraw after the Yuletide holidays.

“Loading of ATMs is the responsibility of the banks. When our bank tested the ATMs, only one denomination of the new notes passed the test of dispensing seamlessly through our machines. The bank is working on reconfiguring the ATMs to be able to dispense the new notes. What we have done in my branch is to mix the few new N1,000 and N500 notes available with old ones so that desperate customers can make withdrawals and meet their immediate needs.

“If you observed, a lot of ATMs were inactive during the Christmas and New Year holidays. The idea was not to give out old notes, but unfortunately, the new ones are not in circulation. The banks have a mandate to evacuate N1bn old notes each to the CBN on a daily basis and our head office has set a strict vault limit or cash holding limit for each branch, which on no condition we must exceed.”