“Professor! Professor! Let’s hear the Professor!” chanted some youths as the bespectacled young man dished out anarchic social commentaries laced with unprintable invectives against what he described as “the ruling oligarchic buccaneers, who are strangulating the suffering masses of Nigeria through the diabolic combination of petrol scarcity and Naira notes shortage.” Others chorused: “Professor is our man! Professor for president!”

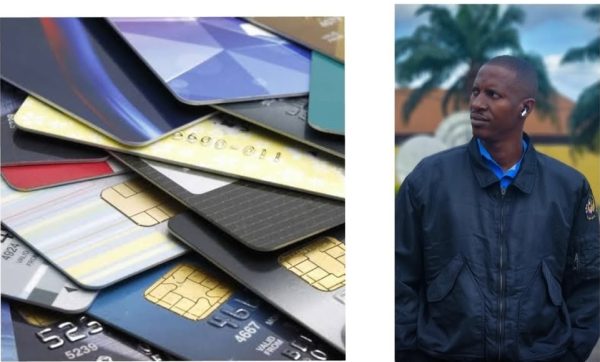

Dressed in tattered sagging Jeans trousers and a red T-shirt, the “Professor” was neither delivering a classroom lecture nor was he engaged in an intellectual presentation. He was only one of a multitude of bank customers that had besieged an Automated Teller Machine (ATM) in the Edo State town of Uromi, amidst the lingering scarcity of new Naira notes occasioned by the Central Bank of Nigeria (CBN) currency redesign exercise launched in December 2022.

The “Professor,” a final-year student of political science, had arrived at the ATM location as early as 6.00 a.m., hoping to avoid the snaking queues that often degenerate into mob violence as desperate customers battle each other for the new Naira notes that are in short supply, nationwide. Unfortunately, the ATM failed to dispense a single cash note to any of the multitudinous customers even as the day was far spent, thus occasioning frustration and anger. It was in this circumstances that some youths donned the toga of impromptu politicians, social activists, comedians, conspiracy theorists, etc., all in a bid to ease the simmering tension.

Assuming the role of a social crusader, the “Professor” railed against the CBN and the politicians: “Let me make it abundantly clear that the great patriotic masses of Nigeria will not stand idly by while a brood of vipers and black mambas continue to hold our country to ransom. We the great youths will never yield to the evil machinations of the ruling oligarchic predators, who have deliberately orchestrated this Naira notes scarcity as part of their grand design to subjugate, emasculate, and exterminate the downtrodden masses … “

But for the intervention of a self-appointed “Comedian,” the “Professor” would have continued with his endless rabble-rousing as his fellow youths yelled “More! More! Fire On!” in a manner reminiscent of university students’ union electioneering campaigns. The “Comedian” began his act by teasing the “Professor” about his bombastic oratory, telling him that “big, big grammar does not put money in the pocket,” in a veiled reference to a popular local musician, who once sang that “grammar, grammar, grammar no be success.”

The ovation that greeted his introductory remarks had hardly died down than the “Comedian” proceeded to inform the crowd about the “actual cause” of the scarcity of the new Naira notes: “Let me tell you what my friend in the EFCC told me yesterday, although he warned me against telling anybody. We are all part of the suffering masses of Nigeria, and we deserve to know the truth. Ten trailer-loads of the new 1000 Naira notes belonging to Bola Ahmed Tinubu were apprehended yesterday by a vigilant team of EFCC officials, who refused to be bribed with two of the trailer-loads. The APC’s presidential flagbearer, popularly known as the Lion of Bourdillon and the Jagaban of Borgu, will soon appear in court.”

The “Comedian” went further to state the respective roles of Atiku Abubakar and Peter Obi in the new Naira notes scarcity: “If you think Tinubu is the only one involved in the hoarding of the new Naira notes, you better think twice. My EFCC friend also told me that Atiku maintained a secret warehouse loaded with 500 Naira notes, which was uncovered by a crack team of EFCC detectives. The PDP’s presidential candidate is presently helping the EFCC in their investigations. On his part, Peter Obi had requested the MD of a bank to help him with one bullion van of 200 Naira notes, but the MD refused, because he didn’t trust Obi to remain silent in case the bullion van was apprehended by the EFCC. The Labour Party’s presidential flagbearer is too talkative.”

At some point, the “Comedian” brought out his mobile phone that was held intact with a thick yellow rubber band. He took a long hard look at the screen, shook his head vigorously, and then announced: “I have just received a message from a reliable source in New Zealand, that Tinubu has decided not to spend the Naira during the presidential election coming up on February 25th. Instead, he will be spending only Dollars. But, Atiku has vowed to match every of his Dollar with a Pound Sterling. So, there will soon be a rain of Dollars and Pounds in Nigeria. Anyone who wants to buy Dollars and Pounds should wait till the presidential election is over, because both currencies will be available like the sand of the earth.”

As the “Comedian” made further revelations, some people, especially the illiterate women, began to lament the collaborationist attitude of all politicians in the looting of the national treasury. One young woman tearfully said: “Is it now a crime for people to be poor in Nigeria? What have we done that the rich people do not want us to live side by side with them? Is it not the same God that created all of us? Why are they stealing and hiding our money, while we go hungry because of lack of cash to buy basic food items? Now, we know that all politicians are the same; none is different from the other; they are all treasury looters.”

Realizing the devastating effects of his jokes, the “Comedian” changed tact: “Do you all know that you can dye your old Naira notes to the new colour?” he asked. Obviously, one elderly man had heard enough of his jokes, and he responded angrily: “Young man, you have been talking nonsense. If you are an expert at dyeing old Naira notes, why are you still here? See how you look; like a hungry leopard. You had better go and join Amotekun (the Pan-Yoruba security outfit codenamed ‘Operation Leopard’). They will welcome you very well. Stop disturbing us here. How am I sure you are not one of the Yahoo boys who scam people and steal money from their bank accounts.”

The response to the elderly man came, not from the “Comedian,” but from a shaven-headed muscular youth who cut the image of the character named “Ofoedu,” described in Chinua Achebe’s “Arrow of God” as someone “who was never absent from the scene of a fight.” He glared at the old man and berated him in severe terms: “Old man, you have no shame. It is people like you that are destroying our country. Who gave you the audacity to refer to us as Yahoo boys? Is it that you are too old to realize that we are the great leaders of tomorrow?”

The elderly man attempted to explain that the “Comedian” was trivializing a national issue that was occasioning a lot of hardship especially among the poor people, but the muscular youth would have none of it: “Shut up! Who are you to determine what the youths should be discussing? This is how you old people destroyed this country with your old ideas. Maybe you are one of the treasury looters, hence you don’t like our discussion. As educated as we are, are you not scared of referring to us as Yahoo boys? Be careful, or I’ll teach you a bitter lesson.”

As further attempts to explain himself were met with increased threats of violence, the elderly man quietly withdrew from the scene. For, it was said in his “Canterbury Tales” by the 14th Century renowned English Poet, Geoffrey Chaucer, that: “He who preaches to those who don’t wish to hear annoys them with his sermon,” and “Where you have no audience, don’t endeavour to speak.”

However, a plump young lady, decked up in jeans trousers and jacket, was indignant at the treatment meted out to the elderly man by the muscular youth, and she did not mince words expressing her indignation: “It is this kind of exhibition of thuggery that gives Nigerian youths a bad name. Perhaps, because of your size, you are feeling too big to respect your elders. If you had any home training, you would have known that old age is deserving of respect. There is a parable that says, a youth may run fast but the elder knows the way; and another one also say, an old man sitting down sees farther than a young man standing up.”

The plump lady’s insinuation that he lacked home training probably irked the muscular youth to the extent that he attempted launching a physical attack on her, but she was unexpectedly too quick for him as she landed a blinding slap on his face. Whether it was premeditated or spontaneous, no one could tell, but what everyone saw was the muscular youth being pummeled to submission by three hefty young men, who were said to be acquaintances of the lady. But for the timely intervention of a team of mobile policemen, the story might have ended differently for the bruised and battered muscular youth.

Dusk eventually turned to darkness as the frustrated and disgruntled ATM customers dispersed one after the other. The “Professor” and a group of friends could be heard ruing their fate as they walked away dejectedly, hoping to try their luck the next day. Yours Sincerely walked up to them and interrupted their conversation with a query: “I hope all of you will vote in the upcoming elections so as to try and change the state of affairs in our country.”

Expectedly, it was the “Professor” who responded: “We’ll surely exercise our inalienable right to vote and be voted for, because we are conscious of the fact that the decadent ruling oligarchy thrives on the politics of immobilism and violence. We’ll ensure that the buccaneers and their neo-imperialist masters fail woefully in their bid to deny us the opportunity to enthrone a people-oriented leadership. We’ll thwart their efforts to sow nationwide chaos and anarchy through this socio-economically debilitating scarcity of new Naira notes and other evil machinations.”

Quickly, I bid the “Professor” a “good night,” and walk away as fast as I could, so as to forestall another round of verbosity from the young student. Walking home, I realize, albeit regrettably, that no authority has taken responsibility for the crippling nationwide Naira notes scarcity; and of course, none ever will. For, as in Orwellian Animal Farm, things go the way they have always gone in Nigeria, i.e., badly. The situation cannot be much better or much worse. And for the masses, the unalterable law of life is hunger, hardship, and disappointment.

- Dennis Onakinor, a global affairs analyst, writes from Lagos – Nigeria. He can be reached via e-mail at dennisonakinor@yahoo.com