…begins 2024 Graduate Trainee Program.

NOVA Merchant Bank Limited, a leading merchant bank in Nigeria, has announced a substantial increase in staff salaries, effective November 1, 2023.

The increase in salary by up to 50% across all staff categories by the Board of Directors is a strategic move which shows a resounding display of commitment to its workforce and comes few months after the Bank announced the approval of its shareholders to transition into a commercial bank, marking a new era.

According to the Bank, the decision to up its salary structure comes after reviewing the impact of the escalating cost of living and dire global economic situations.

Acknowledging the challenges presented by the prevailing economic conditions, the Bank has thus taken proactive steps to tackle these issues reaffirming its commitment in prioritizing employee welfare with an aim to guarantee their well-being and financial stability.

In the same vein, the Bank has announced the commencement of its 2024 NOVA Graduate Trainee Program, set to begin in January 2024 in Lagos. This program is part of its commitment towards nurturing the next generation of banking professionals with relevant skills and knowledge required to drive innovation in the financial sector. The Program is also undertaken by the Bank to empower fresh graduates and equip them with relevant skills required for modern banking practice driven by cutting-edge technologies, fostering innovation while preparing them for leadership positions.

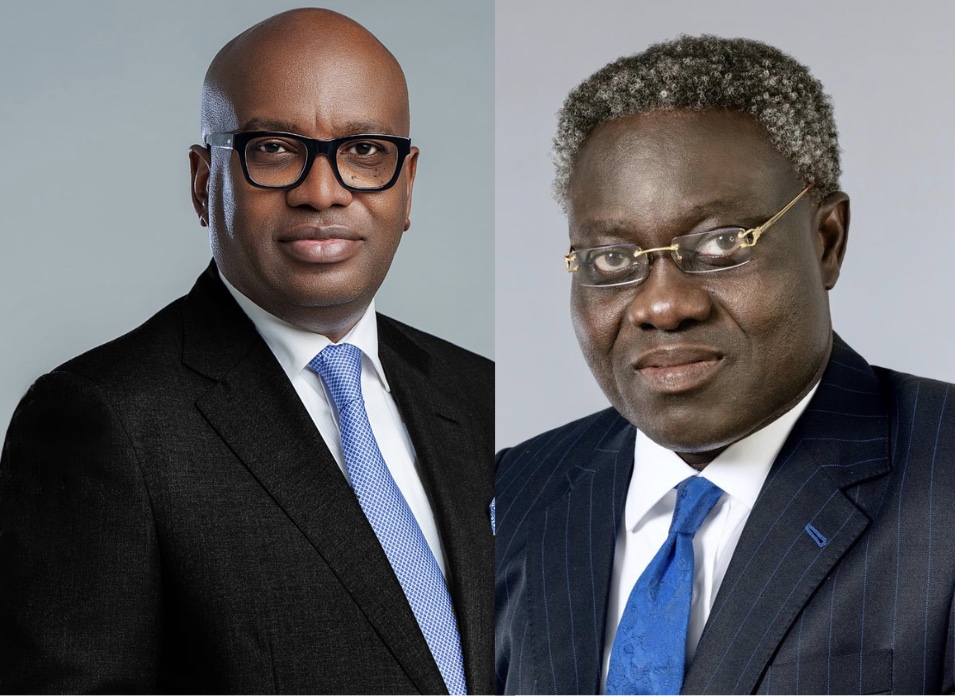

Explaining further, Mr. Wale Oyedeji, the Managing Director/Chief Executive Officer, said, “following a comprehensive assessment of the current economic conditions and their impact on our esteemed staff, we have opted to realign our salary structure to reflect the economic realities. We recognize the implications of recent economic policy actions on costs and this adjustment is aimed at easing the financial burden borne by our staff and their families”.

Mr. Oyedeji reiterated that the management places a premium on recognizing and promoting outstanding performance as integral to the Bank’s fundamental principles. He emphasized the belief that fostering a harmonious approach to both professional and personal growth, significantly enhances the overall well-being and satisfaction of its employees.

While emphasizing the significance of the Graduate Trainee Program, he added, “The NOVA Graduate Trainee Program is a pivotal initiative for us. We provide participants with curriculum taught by best-in-class faculty to empower them to create superior value in the markets we serve. This aligns with our mission to drive the next revolution wave of banking, and we believe these trainees will play a crucial role in shaping the future of the financial services industry.”

He emphasized that the NOVA Graduate Trainee Program represents the Bank’s dedication to investing in human capital, equipping trainees with essential skills and knowledge required to navigate their careers successfully.

About 70 staff are set to resume as the Bank prepares to commence operation on its Commercial Banking license. Close to fifty of these new staff have been scheduled for the Graduate Trainee Program and the Bank will continue to attract talents to drive its vision in the commercial and retail banking space.

Bede Alugbue, the Head of Human Capital and Culture Management at NOVA Merchant Bank, highlighted the rigorous selection process, saying, “Out of over one thousand applicants, we meticulously selected the best 49 candidates to undergo the intensive training and become banking professionals. The program offers valuable insights into the global banking business, providing essential skills and expertise to drive innovative financial solutions.”

Mr. Alugbue added that the Bank remains committed to recruiting outstanding individuals who will contribute to creating value for our shareholders, governments, and all stakeholders, particularly as the Bank transitions into a commercial banking franchise.

NOVA Merchant Bank Limited is an investment grade rated merchant bank in Nigeria that offers an integrated suite of financial solutions covering Financial Intermediation, Wholesale and Investment Banking, Asset and Securities Management, Trade Services, Cash Management, Transaction and Digital Banking. Just recently, the shareholders of the bank approved the convert to commercial bank.