Justice Yusuf Halilu of a Federal Capital Territory high court on Tuesday reserved a ruling in a trial-within-trial filed by a former Director-General of the Bureau for Public Enterprises (BPE), Benjamin Dikki.

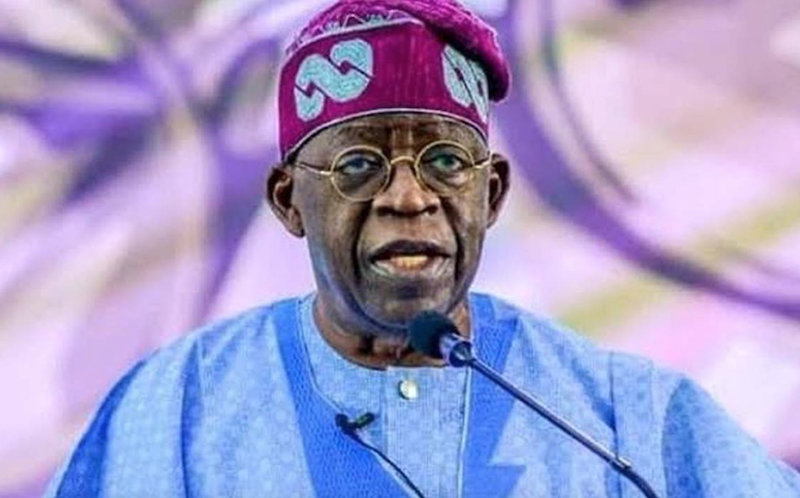

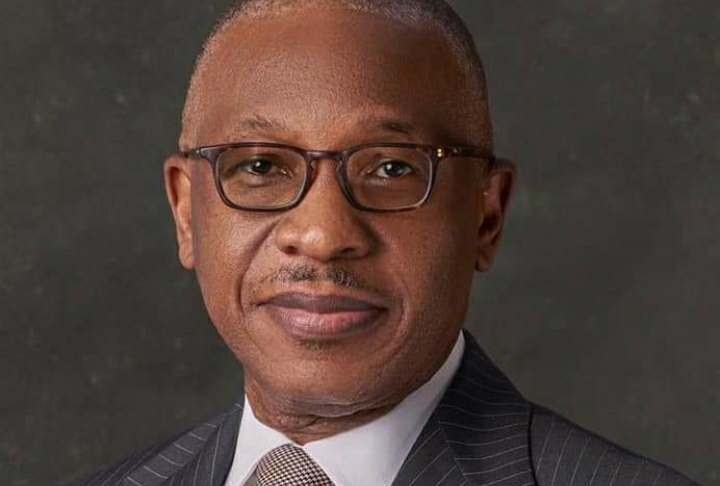

Dikki is being prosecuted by the Economic and Financial Crimes Commission (EFCC) alongside his company, Kebna Studio, and Communications Limited on allegations of receipt of an N1 billion bribe

He is dragged to court on a four-count charge bordering on receiving bribe and abuse of office.

He was alleged to have received N1billion bribe from Bestworth Insurance Brokers for his role in facilitating the approval of outstanding insurance premiums and claims of deceased and incapacitated staff of the defunct Power Holding Company of Nigeria (PHCN).

EFCC stated that the offence was contrary to Section 17(1)(a) of the Corrupt Practices and Other Related Offences Act, 2000 and punishable under the same Act, between Jan. and Feb. 2015 when he was serving as BPE DG.

The defendants pleaded not guilty to the allegations and stated that the confessional statement EFCC presented was not voluntarily made.

The court therefore, ordered a trial within-trial to ascertain the voluntariness of the statement and adoption of addresses fixed for today.

Halilu after listening to the submissions of all the counsel in the matter , reserved ruling to a date that would be communicated to parties.

Earlier, Abdul Mohammed, SAN, Dikki ‘s counsel in his argument, told the court that section 17 of the Administration of criminal justice Act (ACJA) provides that suspect should give statement freely without force.

He said the defendant ‘s statement was taken in 2016 while ACJA was enacted in 2015 and there is no way the statement would be admitted because it was obtained by force.

According to him, everything about the manner in which the statement was obtained pointed to intimidation.

” The defendant said he was psychological tortured.

” The EFCC has CCTV covering the entire premises but failed to provide the clips on how the statement was taken to the court .”

He therefore urged the court to reject the statement and move ahead with the trial.

Sherif Mohammed, counsel for the 2nd defendant aligned with the learned Silk and prayed the court to declare the statement unreliable.

The prosecution counsel, Chris Mshellia asked the court to discountance the defendants ‘ arguments and admit the confessional statement.

According to him, what governance the admissibility of a confessional statement is the Evidence Act and not the ACJA.

He therefore urged the court to disregard the arguments of the defendants ‘s counsel and admit the statement in evidence.

Dikki had earlier on Nov. 14, 2023, told the court that he was informed on August 29, 2016 by an EFCC operative from Zuru that the commission had been looking for him and had gone to arrest his wife and son.

He said this surprised him as he did not received any invitations from the anti-graft agency and he told the operative that he would appear before EFCC on September 1, 2016.

According to him, on arrival at the commission, he was taken by the operative who spoke with him on phone to the office of the team leader, one Bashir, where he was till 2pm when he was invited to the team leader’s office.

“Bashir told me that they have investigated the matter and there was nothing I could say other than to write a statement that I would refund the N1 billion paid into the account of Kebna Studio.

“I told him I cannot make such commitment and he said I was wasting their time and that the policy of government was recovery.

“He said I must make a statement that Kebna Studio was going to refund the money,” he told the court.

According to him, despite saying he could not make such commitment, the EFCC operatives were insistent that he should make the commitment and was taken to the cell.

He said he told them that he was being stubborn as others had made refund to the government,

He added that he was detained in the cell from 6pm to 7:40pm when he was brought and assured of being released only if he made the commitment.

Dikki said he was neither with his lawyer, Ali Suberu, when he was made to write his statements nor advised to get any lawyer before writing the statements.

He told the court that, “on Sunday, Sept. 4, 2016, Bashir came into the cell and told me that I was the one detaining myself because I was blowing long grammar, that once I commit to refund, I would be released.”

He said for the sake of his freedom, he made arrangements for N50 million payment to be made to EFCC, adding that the money came late on Monday, September 5, 2016 and was released the following day.

Under cross examination by EFCC counsel,Chris Mshellia, Dikki told the court that he was not arrested by the EFCC.

”I got the the EFCC office by myself and was interviewed by officers of the commission.

“I wrote down my statement after being cautioned. I had no option but to write my statement,” he said.

He informed that EFCC operatives tried to dictate what he should write in his statement.

He, however, said though he was not beaten by the operatives, he was harassed and tortured psychologically.