Prices of cement has increased by 67 per cent in the South East states of Abia, Anambra, Ebonyi, Enugu and Imo, engendering a lamentation galore.

A market survey at various wholesale and retail shops in the zone by NAN shows that the price of the product has increased almost by double when compared to the price in 2020.

A cement dealer at Kenyetta Market in Enugu, the Enugu State capital, Ifeanyi Amadi, said the increase in the product’s price started last year due to the COVID-19 pandemic and increase in the naira to dollar exchange rate.

Amadi noted that a trailer load of Dangote Cement with 600 bags which sold for N1.5 million in 2020, is now N2.3 million in the first quarter of 2021.

“The prices change on daily basis, so as we are talking now, I cannot guarantee the prices it will be sold for tomorrow,” he said.

Another retailer at Uwani, Samuel Uwakwe, said he was surprised at the rate the prices of the product change in the country.

According to him, a bag of Dangote Cement is sold at N3,900, Unicem for N3,700, Bua Cement for N3,700 and Kogi Super Cement at N3,600.

Uwakwe lamented that few individuals were given opportunity to supply the product and pleaded with suppliers to reduce the prices and make it available for the citizens.

He maintained that the prices would likely crash during raining season.

A block mounding industry owner, Albert Okechukwu, noted that increase in the price of the product affected his business though he still sells six-inch and nine-inch blocks for N170 and N180 respectively.

Okechukwu said: “This is the same price we sold last year and it is same till date because we cannot change prices in order to retain our customers but most block industries have reduced quality of their blocks.”

A site Engineer, Emma Ugwuoke, said he wanted to start a building in the village when the price was N2,800 last year, but was waiting to see if it would come down.

Ugwuoke said: “When I went back next time, I was told it was N3,000 and to my greatest surprise, they sell N3,900 and N4,000 now in my village.

“There is nothing one can do than to buy it like that.

“I want government to do something urgently about it because it is frustrating buying cement at that price.”

In Abia State, a cross-section of residents of Umuahia, the state capital, also decried the high price of cement, which ranges from N4,000 to N4,100 per 50kg bag.

Those who spoke to NAN said the price hike had further dashed the hope of many Nigerians, wishing to own their personal homes.

A businessman, Victor Ugwu, said he had to suspend his building project because of the “unfortunate development”.

Ugwu said: “I have stopped my project for now.

“I cannot afford to continue with the current price of the commodity.

“The economy is very bad so I hope to wait until there is a drop in the price.

“I think the hike can be attributed to the monopoly being enjoyed by the cement producers in the country.

“Unfortunately, there may not be any respite until that monopoly is broken.”

However, a cement dealer, James Ogbonna, said the problem had nothing to do with the manufacturers of the commodity.

Rather, Ogbonna blamed the price hike on the activities of “shylock distributors” of cement.

He said the hike had affected his business adversely, adding that cement patronage had been at the lowest ebb, since the price hike.

He said: “In the first and second week of March, we sold a bag for N3,200, but within the third week we started selling at N3,500.

“By the end of March, the price moved up to N4,000 and now, we sell between N4,000 and N4100, depending on the brand.”

Another dealer, Godwin Okafor, said his sales had dropped drastically as a result of the hike.

Okafor said: “We have a lot of challenges in this cement business now.

“When we make deposit and order for the goods, it takes about one month before we get delivery.”

It is a similar situation in Awka in Anambra State as stakeholders decry the situation.

Kenechukwu Okoye, a cement dealer along Zik Avenue, Awka, said before the #EndSARS protest in 2020, a 50kg bag of cement was sold at N2,500.

“Shortly after the #EndSARS, the price rose to N3,000 and from there to the present price of N4,000 and N4,100, we are selling today,” he said.

Okoye said though the distributors initially blamed the problem on difficulties encountered by the hauling firm transporting the product, the situation had come to stay.

In Owerri, the Imo State capital, price of cement is between N3,850 and N4300, depending on the brand.

At the Building Materials Market in Naze, Owerri North Local Government Area, Dangote and BUA cement are sold at N4,000 per bag, while UNICEM is sold for N3,900.

Okechukwu Okonya, a seller, said the cost could be attributed to high cost of transportation as a result of fuel price.

Okonya also said major dealers sometimes hoard the product in their warehouses to create artificial scarcity.

Another trader, Marcel Iwu, agreed that although there had been hoarding by major dealers, manufacturers had also complained of increased cost of raw materials.

Iwu added that the prices could go higher or reduce at any given time, noting that even if prices fall, traders would want to sell off their old stock at higher rates.

NAN reports that in Abakaliki, Ebonyi State, prices of almost all building materials have gone up.

The prices of cement, rods of various sizes, corrugated roofing sheets and other building materials and accessories, according to NAN findings, have been on the increase since January.

The price of Dangote and Bua, which sold at N2,500 earlier in November and December 2020, now sold between N4000 and N4500.

Similarly, Unicem Cement, which also sold at N2,300 within the same period, had also gone up to N4,000 and N4,300.

John Okoh, a cement dealer at Kpiri-Kpiri market, in an interview with NAN attributed the development to lack of price control mechanism and high rate of exchange rate of the Naira against the dollar.

Okoh said: “The development is indeed affecting sales and business because many builders have put a stop to their building and other construction projects because they cannot cope with the present high cost of the product.”

Another resident, Clement Igbo, who owns a block moulding industry, said the high cost of cement was hampering production, adding that he no longer produced maximally due to lack of buyers.

Igbo said: “A bag of Dangote Cement, which is one of the best products for our business, is selling for N4,500 and it is difficult to buy at this prevailing price and make enough production.

“We sell six inch and nine-inch block before this price increase at N150 and N200, but now 6 inch-block is sold at N220, while the 9 inch sells for between N250 and N300.

“Many block industries in the town have closed down production while some have compromised standard which pose great dangers to the building industry.”

Igbo expressed fears that the high cost of cement, which had led to improper ‘mixture’ of concretes for building purpose, might affect quality and standard of buildings.

Jerry Onwe, an economic activist ,urged the Federal and States Governments to revive moribund cement factories across the states to meet the increasing demands of cement consumption in Nigeria.

He noted that the quest for mass housing for poor Nigerians would remain elusive if urgent steps were not taken to address the high cost of building materials in Nigeria.

One said: “In a nation where an average worker earns N30,000 monthly as take-home wage, how can such a person afford a house of his own in view of the prevailing price of building materials?

“We have reached a cross road as far as the issue of building materials is concerned and this is a time for government to intervene and bring the situation under control.

“The Nkalagu Cement Factory in Ebonyi is capable of supply the cement needs of the entire South-East if properly revived.”

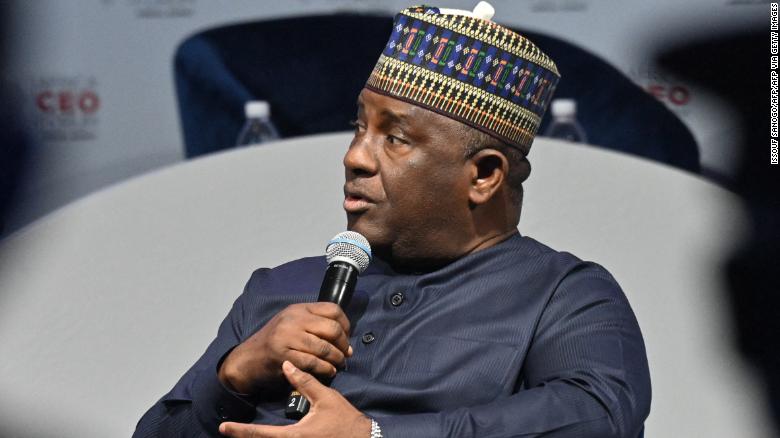

![Rivalry war: Ganduje, others wade in, reconcile Aliko Dangote, Abdussamad Isyaka-Rabi’u over sugar plant saga [Photo]](https://thenewsguru.ng/wp-content/uploads/2021/04/Governor-Ganduje-settling-rifts-with-Dangote-BUA-sugar.jpg)