The Central Bank of Nigeria (CBN) on Thursday ordered banks to establish a database of customers identified through their Bank Verification Numbers (BVNs) as fraudsters.

The directive was contained in the Regulatory Framework for Bank Verification Number (BVN) Operation and Watch-list for Nigerian Financial System released by the CBN.

According to the apex bank, the implementation of the framework takes immediate effect.

The Director Banking & Payments System of the regulatory bank, Dipo Fatokun, who signed the framework, said bank customers are to abide by the regulatory framework for BVN operations and the watch-list for the Nigerian Banking Industry and also report all suspicious or unauthorised activities on their accounts.

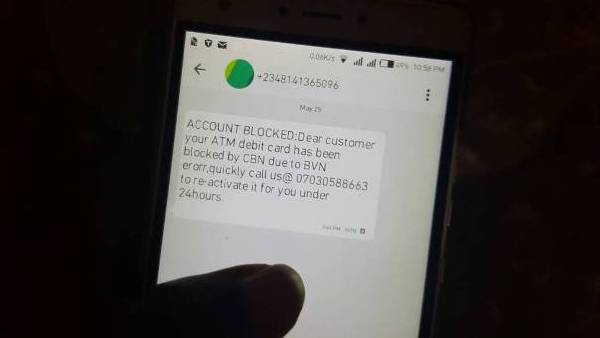

TheNewsGuru.com reports that recent data from the CBN showed that Nigeria experienced a total of 3,500 cyber-attacks with 70 per cent success rate and loss of $450 million within the last one year mainly through cross channel fraud, data theft, email spooling, phishing, shoulder surfing and underground websites.

Although e-fraud rate in terms of value dropped by 63 per cent, after the BVN introduction and improved collaboration among banks via the fraud desks, the total fraud volume rose significantly by 683 per cent.

The new regulation is expected to assist the CBN to a great deal, in curbing the menace of fraudsters

According to Fatokun, the new framework is in exercise of the powers conferred on the CBN, by Sections 2 (d) and 47 (2), of the CBN Act, 2007, to promote the development of efficient and effective payments systems for the settlement of transactions.

He said the framework provides standards for the BVN operations and watch-list for the Nigerian Banking Industry. The watch-list comprises a database of bank customers’ identified by their BVNs, who have been involved in confirmed fraudulent activity in the banking industry in Nigeria.

Fatokun said the regulatory framework shall guide activities of the participants in the provision of the BVN operations in Nigeria and that the CBN, Nigeria Inter-Bank Settlement System (NIBSS), Deposit Money Banks (DMBs), Other Financial Institutions (OFIs) and Bank Customers are participants in its implementation.

He said the CBN, in collaboration with the Bankers Committee, proactively embarked upon the deployment of a centralized BVN System and launched the BVN in February, 2014. This, he said, is part of the overall strategy of ensuring effectiveness of the Know Your Customer (KYC) principles, and the promotion of a safe, reliable and efficient payments system.

The BVN gives a unique identity across the banking industry to each customer of Nigerian banks.

“This framework also defines the establishment and operations of a Watch-list for the Nigerian Banking Industry, to address the increasing incidences, of frauds, with a view to engendering public confidence in the banking industry.

This framework, without prejudice to existing laws, is a guide for the operations of the watch-List in the Financial System”.

The Watch-list is a database of bank customers identified by their BVNs, who have been involved in confirmed fraudulent activities.

The framework is expected to clearly define the roles and responsibilities of stakeholders; clearly define the operations of the BVN in Nigeria; define access, usage and management of the BVN information, requirements and conditions and provide a database of watch-listed individuals.

It is also expected to outline the process and operations of the watch-List and deter fraud incidences in the Nigerian Banking Industry.

In implementing this framework, the CBN is expected to approve the Regulatory Framework and Standard Operating Guidelines as well as approve eligible users for access to the BVN information.

The Nigeria Interbank-Settlement System (NIBSS) is to collaborate with other stakeholders to develop and review the Standard Operating Guidelines of the BVN while the banks are to ensure proper capturing of the BVN data and validate same before the linkage with customers’ accounts.