The Federal High Court in Abuja has granted a bail to two of the detained Crypto Bridge Exchange (CBEX)’s promoters in the sum of N10 million each with two sureties each in like sum.

Those admitted to bail by Justice Mohammed Umar are Awerosuo Otorudo and Chukwuebuka Ehirim.

Justice Umar, in a ruling, ordered that the sureties must have property worth the bail sum within the jurisdiction of the court.

He directed that the residence of the sureties must be verified by the registrar of the court.

The judge subsequently adjourned the matter until Oct. 13 for commencement of trial.

The News Agency of Nigeria (NAN) reports that Justice Umar had, on July 7, adjourned for ruling on their bail application, after it was argued by the defendants’ lawyer, Justice Otorudo, and opposed by EFCC’s counsel, Fadila Yusuf.

The development followed their arraignment by the anti-graft agency on three-count charge over allegations bordering on illegal financial operations and unlicensed investment activities.

They were arraigned on amended three-count charge marked:

In the charge marked: FHC/ABJ/CR/216/2025, the defendants were alleged to have collected public funds and promised up to 88 per cent returns on investment without regulatory approval.

In a related development, Justice Umar has also fixed July 25 for ruling on the bail application filed by Adefowora Abiodun, Managing Director of ST Technologies International Limited, allegedly using another company, CBEX, to perpetrate investment scam.

Justice Umar fixed the date after his bail application was argued, following Abiodun and his company’s arraignment on amended eight-count charge marked: FHC/ABJ/CR/215/2025.

While Abiodun is the 1st defendant, ST Technologies International Limited is named as 2nd defendant in the amended charge dated July 9.

The allegations, in the earlier charge, bordered on alleged case of obtaining by false pretense, money laundering and carrying on the activities of other financial institutions without having the required license from the Central Bank of Nigeria (CBN) and Security and Exchange Commission (SEC).

They, however, pleaded not guilty to the amended counts.

The defendants’ lawyer, Babatunde Busari, informed the court of a bail application dated and filed on Abiodun ‘s behalf on June 30.

Busari urged the judge to admit his client to bail on liberal terms.

He said the charge showed that the alleged offences against his client were bailable.

Besides, he said two critical exhibits attached to their application showed that Abiodun voluntarily submitted himself to the commission for investigation.

“He (Abiodun) came to us as counsel and we took him to the commission.

“He also has a medical report that shows that the 1st defendant requires urgent eye surgery and that has not been possible for him for the past 80 days that he has been in detention.

“We, therefore, urge the court to admit the defendant on bail as the total of the monetary claim Is about N20 million naira,” he said.

Busari prayed the court to release Abiodun to him for the purpose of bail.

But EFCC’s lawyer, Fatsuma Mohammed, vehemently opposed the bail plea, saying a counter affidavit dated July 7 was filed in respect of the motion.

The lawyer urged the court to refuse bail and order for expeditious trial of the case, adding that investigation had been concluded “and we are ready for trial.”

“Is it a bailable offence?” the judge asked.

Responding, Mohammed said: “The section consequent to which the defendant is being charged, upon conviction, is seven years and it is enough number of years which is enough for him to try to run.”

Justice Umar,who adjourned the matter until July 25 for ruling, ordered Abiodun to be remanded in the EFCC’s custody pending ruling on bail application.

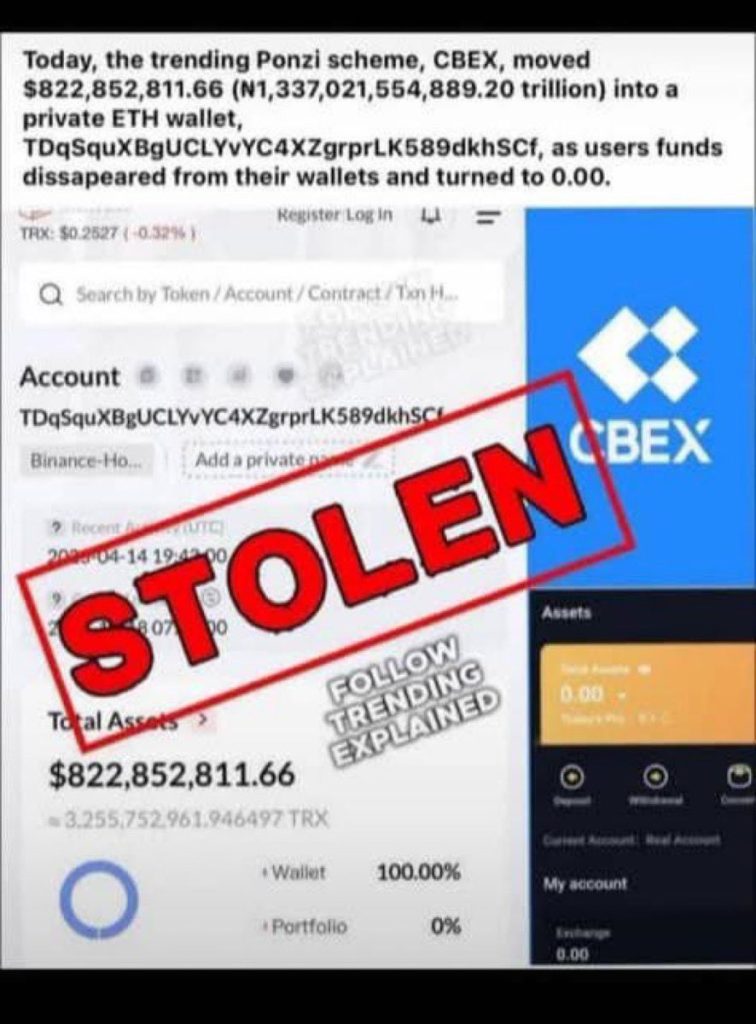

NAN reports that CBEX was one of several digital platforms that collapsed after allegedly collecting billions of naira from unsuspecting investors.

NAN reports that Justice Emeka Nwite of a sister court had, on April 24, gave the EFCC the go-ahead to arrest and detain six operators of CBEX over their involvement in the fraud.

The judge, who gave the order after the EFCC’s lawyer, Fadila Yusuf, moved an ex-parte motion to the effect, said the detention would be pending the conclusion of investigation of the alleged offences and possible prosecution.

The six suspects include Adefowora Abiodun, Adefowora Oluwanisola, Emmanuel Uko, and Seyi Oloyede.

Others are Avwerosuo Otorudo and Chukwuebuka Ehirim as 1st to 6th defendants respectively.

In the motion ex-parte dated and filed April 23 by Yusuf, the anti-graft agency gave four grounds for its application.

She said the EFCC had a statutory duty of prevention and detection of financial crimes through investigation.

Yusuf said that “the defendants are at large and a warrant of arrest is required to arrest the defendants for proper investigation and prosecution of this case.”

NAN reports that Adefowora Abiodun (1st defendant), Avwerosuo Otorudo (5th defendant) and Chukwuebuka Ehirim (6th defendant) had been in the EFCC custody on investigation.

Justice Nwite had, also on June 30, declined to grant the bail application filed by the three detained alleged promoters of CBEX.

The judge, in a ruling, held it was obvious that from the totality of the affidavit evidence of both parties, it was glaring that the character of evidence against the defendants was strong.

He also held that due to the nature of the case, the EFCC obtained an order of remand of the defendants by court of competent jurisdiction.

The EFCC, in the affidavit in support of the motion ex-parte filed before Justice Nwite, said sometimes in April 2025, it received an intel bothering on an alleged investment scheme fraud against the defendants.

It alleged that the defendants and their company, ST Technologies International Limited, using another company, Crypto Bridge Exchange (CBEX), perpetrated the alleged fraud and the case was received and assigned to its Cybercrimes Section for investigation.

The EFCC averred that the defendants promised unrealistic return on investment of up to 100%.

“That the victims were made to convert their digital assets into a stable coin of USDT for onward deposit into the suspects crypto wallet.

“That the victims were initially given full access to the platform to monitor their investment.

“That following deposits valued at over one Billion Dollars by the victims, the CBEX investment platform became inaccessible to them and they could no longer withdraw from the investment made.

“That the victims later discovered that the said scheme is a scam.

“That during the course of investigation, it was discovered that the said ST Technologies International Limited, though registered with the Corporate Affairs Commission (CAC), it was not registered with the security and Exchange Commission (SEC) for investment purposes.

“That it was also discovered during investigation that the defendants had moved out of their last known address in Lagos and Ogun States.”

The anti-graft agency said that a warrant of arrest was required to place the defendants on red watch list so that they could be traced and arrested to answer to the case against them.

According to the commission, investigation into the allegation against the defendants revealed a prima facie case of investment scam. It said it would be in the interest of justice to grant the application.