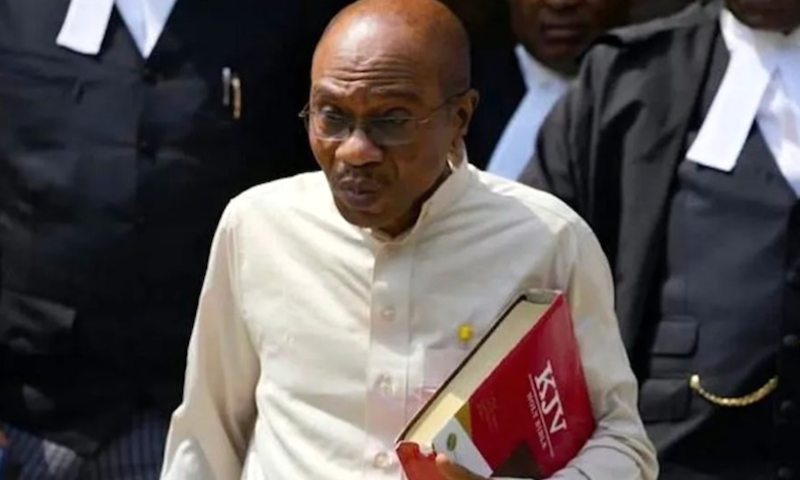

An FCT High Court on Wednesday admitted the embattled former Central Bank Governor, Godwin Emefiele to bail in the sum of N300 million .

Justice Maryann Anenih granted him to bail while ruling on his bail application over alleged unlawful naira colour swap.

The Economic and Financial Crimes Commission brought against him a-four – count amended charge bordering on disobedience to direction of the law marked charge No: CR/264/2024.

Anenih in addition, ordered Emefiele to produce for two sureties in like sum who must have property in Maitama district of Abuja.

The sureties who must in addition present the title documents and certificates of occupancy (C of O) to the court for verification.

The sureties in addition must submit to the Registrar of the court their recent passport photographs.

The judge further added that Emefiele should submit to the registrar of the court his travelling documents and must be within Abuja within the period of his trial.

The judge ordered that the certified true copy (CTC) from Justice Hamza Muazu’s bail conditions who granted him bail earlier must be submitted to her court.

Anenih adjourned until May 28 for trial.

The EFCC alleged that Emefiele, between October 2022 and March 2023, disobeyed the direction of section 19 of the CBN Act by approving the printing of 375,520,000 pieces of ”colour swapped” N1.000 for N11billon without the recommendation of board of the banl.

In count two, he was accused of spending N4.4 billion to print 172,070,000 pieces of N500 colour swap.

While count three stated that the embattled CBN governor used N3.4 billion to print colour swap of 137,070,000 pieces of N200.

EFCC accused Emefiele in count four of withdrawing N124.8 billion from the consolidated revenue fund of Federation in a manner not prescribed by the National Assembly which caused injury to the public , contrary to section 123 of the penal code.

He pleaded not guilty to the charge preferred against him.

Earlier counsel for Emefiele, Mahmoud Magaji, SAN argued his bail application praying the court to admit him(Emefiele) to bail in self recognises .

He added that in alternative, the court should grant him bail in the same conditions Justice Hamza Muazu of a Federal Capital Territory (FCT) granted him.

Magaji informed the court that the defendant had always been in court for his trial.

Responding, counsel for EFCC , Rotimi Oyedepo, SAN affirmed what Emefiele ‘s counsel told the court ‘ he is always present in court for his trial.’

Emefiele is also standing trial before Justice Hamza Muazu of FCT high court on an alleged 20-count amended charge, preferred against him by the Economic and financial Crimes Commission (EFCC).

He was alleged to have engaged in criminal breach of trust, forgery, conspiracy to obtain by false pretence and obtaining money by false pretence, when he served as the apex bank’s boss.

Justice Olukayode Adeniyi of a Federal Capital Territory (FCT) high court also on Jan. 8 awarded N100 million damages to suspended former governor of the central bank of Nigeria (CBN) against the federal government and Economic and financial Crimes Commission (EFCC) for violations of his right.

Adeniyi further restrained the federal government and it’s agents from arresting Emefiele unless an order was obtained through a competent court.

The judge held that the respondents need not incarcerate the applicant in other to carry out investigation for a long period as against the provisions of the law.

” No material placed before the court to show that the release of the applicant will in any way interfere with the investigation of allegations preferred against him.

The embattled Emefiele had dragged the Federal Government, Attorney-General of the Federation (AGF), Executive Chairman, the EFCC before the court to enforce his fundamental rights to life, personal liberty, fair hearing and freedom of movement.

Emefiele sought a declaration of the court that his continued detention by the agency of the first and second respondents since June 10, 2023 and subsequent transfer to the custody of the third and fourth respondents on Oct. 26, 2023 without being arraigned in court is unlawful.

He said the respondents in deviance of several valid subsisting court orders for his release amounts to a grave violation of his fundamental rights to life, personal liberty, as guaranteed by the 1999 Constitution of Nigeria (as amended) and the African Charter on Human and Peoples’ Rights.