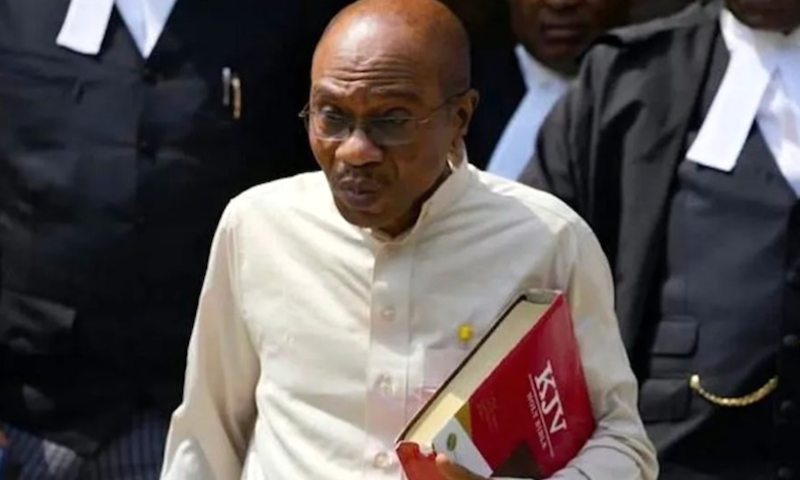

A Seventh Prosecution Witness, PW7, in the trial of a former governor of Central Bank of Nigeria (CBN), Godwin Emefiele on Monday, March 11, 2024 told Justice Hamza Muazu of the Federal Capital Territory, FCT, High Court, Abuja, how Emefiele allegedly signed and approved award and payments of contracts to April 1616 Investment Limited and Architekon Nigeria Limited, companies that allegedly belong to Sa’adatu Ramalan Yero, his wife, Margaret Emefiele and his in-law respectively.

The witness, Agboro Michael, an investigator with the ICPC, led in evidence by the prosecution counsel, Rotimi Oyedepo,SAN, was part of the investigation team that comprised the EFCC, ICPC, CCB, DSS and the Nigerian Police. He testified on the count-charge of abuse of office and conferring an unfair advantage to a public officer and relatives, preferred against Emefiele.

“My Lord, these companies were awarded about 45 contracts to supply Toyota Vehicles. We were worried as investigators as to how a particular company would get bids concurrently to supply vehicles. We did our investigation, and discovered that the company was not even accredited by Toyota.

“In the companies my Lord, one has Sa’adatu’s husband and siblings as directors, and the other one has Sa’adatu as the director of the company while she is still a civil servant.

“Document ‘F1’ shows the signature and approval of the defendant to pay the sum of N854, 700,000 (Eight Hundred Fifty-Four Million, Seven Hundred Thousand Naira) His signature was number three on the document”, he said. Testifying further, Michael said in ‘F3’, the defendant approved 1, 85,700,000 (One Billion, Eighty-five million, Seven Hundred thousand) for the supply of 47 units of Toyota Hilux.

While ‘F4’ was the defendants approval to purchase for the bank an armoured Toyota Avalon car at the cost of N99,900,000 (Ninety-Nine Million, Nine Hundred Thousand Naira), and ‘F5’ was the approval to procure two units of Toyota Hilux for the bank, and all were bought from April 1616 Investment limited.

Speaking on the findings of the investigative team on exhibit P26, page 86 of 107 on November 6, 2021. Michael said; “It is a credit into the account from the CBN to the tune of N41, 943, 400, 34 (Forty-one Million, Nine Hundred and Forty-three Thousand, Four hundred and Thirty four kobo).

“Page 87 was also a credit in April 2016 from the CBN, N304, 853, 50 (Three Hundred and Four Million, Eight Hundred and Fifty Three Thousand naira, Fifty kobo).

“26 January, 2021, April 1616 Investment Nigeria limited also received N304, 853, 720, 55 (Three Hundred and Four Million, Eight Hundred and Fifty Three Thousand Seven Hundred and Twenty Naira Fifty-Five kobo) from the CBN.

“On the 10th of February, 2021, the CBN paid N201, 23, 323, 31 (Two Hundred and One Million, Twenty-Three Thousand, Three Hundred and Twenty-Three Naira, Thirty-One kobo).

The approval of payment of March 24, 2021 was N304,843,720,85, April 27, 2021 was 60,976,744,17 (Sixty Million, Nine hundred and Seventy Six thousand, Seven hundred and forty-four naira, Seventeen kobo) May 31, 2021 was a payment of 60,976,744,17 (Sixty Million, Nine hundred and Seventy Six thousand, Seven Hundred and Forty-four Naira, Seventeen kobo), and February 21, 2021 was a payment of N50,547,508,30 (Fifty Million, Five Hundred and Forty-Seven Thousand, Five Hundred and Eight Naira Thirty kobo) were equally approved by the defendant.

The witness further told the court that the team recorded the defendant’s statement under caution and video recorded in a conducive environment.

Testifying further, the witness said; “In 2019, again, we discovered the defendant also used his office and position to confer a corrupt advantage to one of the staff of CBN, Sa’adatu Ramalan Yero to supply one unit of Toyota Land Cruiser V8 at the cost of N73, 800,000 (Seventy-Three Million, Eight Hundred Thousand to her company April 1616 Investment Nigeria limited where she is a director, and equally a director in the CBN.

“Again my Lord, the defendant also approved the payment of renovation of the CBN Governors’ residence at No 2. Global road, Ikoyi Lagos to a company named; Architekon Nigeria Limited where his wife and brother-in-law are both directors.

“Sometime in 2020, the defendant used his position as CBN Governor to confer on his wife and brother in-law corrupt advantage by awarding their company landscaping of the CBN governor’s residence in the sum of N39,46,000 (Thirty-Nine Million, Forty Six Thousand Naira”,he said.

Continuing, Michael said a contract to procure furniture items was also awarded to his brother in-law in the sum of 97,000,000 ( Ninety Seven Million Naira), and again, a contract to procure a power line at the same CBN Governor’s residence in the sum of N68,568,740 (Sixty-Eight Million, Five Hundred and Sixty-Eight Thousand, Seven Hundred and Forty naira).

While cross examining the witness, counsel to the defendant, Matthew Burkaa SAN queried the witness that though there are many signatories in the memo only his client was on trial. In response, the witness told him that the defendant was on trial because he was the approving authority, while others only minuted on the documents to justify the process, and didn’t have the power to make such payments and approvals.

Burkaa also wanted to tender the defendant’s statement at the Nigerian Police force before the court, but Oyedepo objected, stating it was a public document and needed to be certified before it can be tendered as an exhibit. Burkaa then withdrew the document and promised to provide the true certified copy at the next adjourned date.

Justice Muazu thereafter adjourned the matter till 25 and 26 April, 2024 for continuation of trial.