The Federal High Court in Abuja, on Wednesday, dismissed a 990 trillion pounds suit filed by a claimant, Mr Tunde Omosebi, against the Central Bank of Nigeria (CBN) for being incomprehensible.

Justice James Omotosho, in a judgment, also held that the suit filed by Omosebi to seek redress over alleged breach of his fundamental rights, failed to disclose any reasonable cause of action against CBN and other defendants.

Justice Omotosho, therefore, gave an order restraining Omosebi from filing any suit or process except same is filed by a legal practitioner or accompanied by a medical clearance from chief medical officer of National Hospital attesting to his state of mind and sanity.

The judge also gave an order restraining all the registries of the Federal High Court of Nigeria from accepting any process from the claimant for purpose of filing except same is done by a legal practitioner or accompanied by a medical clearance from chief medical officer of National Hospital attesting to his state of mind and sanity.

“This suit is hereby dismissed for not being a fundamental rights suit, for lack of reasonable cause of action against any of the defendants and for being incomprehensible,” he declared.

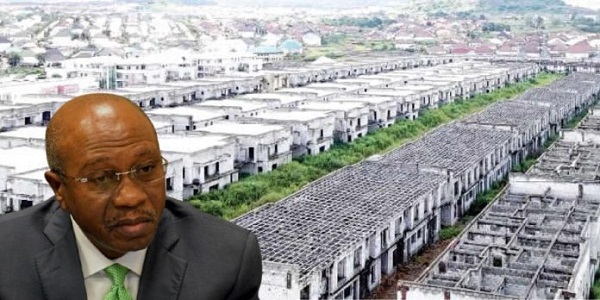

Omosebi had, in the originating motion, sued the CBN Governor, Mr Olayemi Cardoso, as 1st defendant. He also joined the Chairman/Chief Executive Officer (CEO) of United Bank for Africa (UBA) Plc, Guarantee Trust Bank (GTB) Plc, Zenith Bank Plc respectively as 2nd to 4th defendants.

Omosebi equally sued the Senate President, Godswill Akpabio, and House of Representatives’ Speaker, Tajudeen Abbas, as 5th to 6th defendants in the suit marked: FHC/ABJ/CS/766/2024.

In the originating motion dated June 5, 2024, but filed Jan. 29, the claimant sought six reliefs.

Omosebi prayed that “an order be entered for the sum of 990 trillion pounds for traumatic torture and Enforcement of Fundamental Rights Rule, 2009 as guaranteed by the Constitution.

“An order be entered that converts CENTRAL BANK OF NIGERIA to RESERVE BANK OF NIGERIA as guaranteed under SEC 212 of CRIMINAL CODE OF NIGERIA BANKS.

He also sought 10 per cent interest on the total recoverable amount and N5million cost of suit.

The claimant, in the course of proceedings, joined more defendants in his suit without the leave of court.

Omosebi, who referred to himself as “His Majesty,” a businessman and a politician in the statement attached to the application, also said he was as “the Chairman, Federal Executive Council, and Prime Minister of Federal Republic of Nigeria.”

He said he gets paid based on his role, projects and contracts executed by his businesses, investments portfolio as contained in the corporate resolution.

“At the trial of this suit, the applicant shall rely on the terms of the corporate resolution and schedule of distribution,” he said.

Omosebi alleged that the defendants breached the assembly industrial agreement/arrangement, denied his Fundamental Right (Enforcement Procedure) Rule 2009, Sections 35, 43, 45 and Fundamental Objectives and Directives of State Policy 14(2)(b) and 16(1)(a-b).

According to him, approximately four years ago, the applicant opened and operates few corporate and personal accounts with defendants 2 with aim of managing these finance per the constitution.

In a preliminary objection by the CBN governor’s lawyer, Favour Maikano, the lawyer argued that the court lacked jurisdiction to entertain the matter as the claimant had failed to disclose cause of action against her client.

She said the suit was bereft of facts, hence, it was incompetent.

The UBA, GTB, Zenith Bank, including the Senate President and the House speaker in their respective submissions, urged the court to dismiss the suit for failure to disclose cause of action against them.

They argued that the claimant lacked the locus standi to sustain the action for the failure to disclose cause or reasonable cause of action against them.

Delivering the judgment , Justice Omotosho held that two issues for determination “are whether the suit is competent or not and whether it discloses any reasonable cause of action.”

He said in considering whether the claims of the plaintiff fell within Chapter 4 of the Constitution, the court looked critically at the reliefs to decipher if it really constituted fundamental right breach or not.

“This court painstakingly read the reliefs and all the processes of the plaintiff and the more the court read, the more the court became confused as to what exactly the plaintiff was claiming.

“There is no mention of the financial irregularities committed by the banks sued as defendants, including 1st defendant.

“There is also no ground made out for the order to convert the ist defendant to the Reserve Bank of Nigeria neither is there anything to show why the other banks should be converted to DRIG Bank with the Corporate Affairs Commission,” he said.

He said the court thoroughly researched the meaning of DRIG Bank without any result.

“The court also researched if there was any legislation like Criminal Code of Nigeria Banks. It is clear that these reliefs do not relate to breach of fundamental rights.

“Thus, this suit is incompetent as constituted as the claims and processes of the plaintiff do not make out a case for breach of fundamental rights,” he said.

Looking at the second issue, the judge observed that a reasonable cause of action is a claim with some chances of success.

According to him, it does not connote a watertight claim but one which when considered critically raises some legal questions for the court to answer.

“Usually, courts do not bother themselves with academic suits but on cogent and reasonable suits. Where the cause of action is unreasonable, the court automatically loses its jurisdiction,” he said.

The judge said a look Omosebi’s processes revealed he suffered no injury as a result of the CBN’s actions.

“There Is nothing to show that the monetary policy of the 1st defendant affected him in any way, He has also not disclosed if his money was misappropriated by any of the defendants. The suit as a whole is simply a figment of the plaintiff’s imagination.

“The entire processes are incomprehensible as it does not link any of the defendants to him in anyway,” he said.

Besides, Justice Omotosho held that Omosebi also failed to provide any evidence to establish that he indeed operated few corporate and personal accounts with the defendants.

“Also he did not place before the court how the defendants denied him access to the accounts. There is clearly no cause of action disclosed by the plaintiff against any of the defendants,” he said.

Commenting on Omosebi’s behaviour, the judge said he observed that the plaintiff filed the suit on June 5, 2024 with only seven defendants and six reliefs.

“On the July 10, 2024 the plaintiff filed a motion on notice where he added the Corporate Affairs Commission as 8th defendant and sought for nine reliefs without the leave of court.

“Subsequently, on Nov. 17, 2024 the plaintiff filed a motion ex-parte where the defendants became 57 in number, including all the airlines operating in Nigeria, and further increased the reliefs to 19 from the original six reliefs,” he said.

According to the judge, the plaintiff is simply trying to turn the rules of the court on its head through his confused and absurd amendment which are made without seeking leave of court to do so.

“I observed that the plaintiff is not in the right frame of mind as expected of a reasonable person. He is psychologically imbalanced and not fit to present his case if any in court.

“This court is a place of serious business and has no time to entertain frivolous and confusing suits. The time of this court is very precious and its docket is full of serious cases.

“This court will therefore not waste any of its judicial time on a frankly incomprehensible suit filed by the plaintiff,” the judge said.

Justice Omotosho also observed that Omosebi, in another suit filed against former Vice President Atiku Abubakar and others, equally exhibited the same behaviour.

He said he observed that in the suit, he listed the address of the former vice president to be National Assembly Compkex, even when Atiku had never been a lawmaker.

“The applicant claimed to be the Chairman of the Federal Executive Council as well as Prime Minister of Nigeria.

“It is common knowledge that the chairman of the Federal Executive Council is the President of the Federal Republic of Nigeria which at this moment is President Bola Ahmed Tinubu.

“Furthermore, Nigeria does not have Prime Minister, thus the applicant is occupying a nonexistent position,” he said.

Justice Omotosho described the act as “a typical summersault which the applicant has become notorious for.”

“This plaintiff must be prevented from filing these frivolous suits except he can present a certificate showing that he is psychologically normal or if he files through a verified legal practitioner,” the judge said.

It was observed that after the judge delivered the judgement, two senior advocates, who were in court for another matter, commented on the development.

Mr Ikechukwu Ezechukwu, SAN, in his reaction, said he had never seen such a case before.

“It gives me a reminder of Onitsha Market literature we read when we were small. I thank my lord for taking time to reading through this trash,” he said.

Ezechukwu, however, hailed the decision of the judge to bar Omosebi from further instituting suits personally any longer.

Mr Sanusi Musa, SAN, said he would have called on the Nigerian Bar Association (NBA) to take action against the lawyer that filed the suit if it was a legal practitioner.

“I was thinking who is this that filed this suit. This however calls for action that a fellow Nigerian is sick and lacks family support He is coming to ask before my lord the money that is more that the budget of Nigeria,” he said.

Musa, however, suggested that the suit be sent to the National Assembly as a case study on the need to amend the nation’s law to guard against the filing of frivolous cases.

“It serves as a case of retrospection as this suit should be sent to National Assembly for them to know that the law needs to be amended so that no nonsense suit is brought to the court, looking at the time my lord took to study and write the judgment,” he said.