The Presidency has requested the Interpol National Central Bureau to place a Central Bank of Nigeria (CBN) staff and two others on its Red Notice.

The request was in connection with their alleged conspiracy and forging of documents in the name of ex-president Muhammadu Buhari to steal the sum of 6.23 million U.S. dollars in cash from the CBN.

A document obtained on Tuesday put the names of Odoh Eric Ocheme, who is a staff of the CBN, Adamu Abubakar and Imam Abubakar on the list sent to the Interpol.

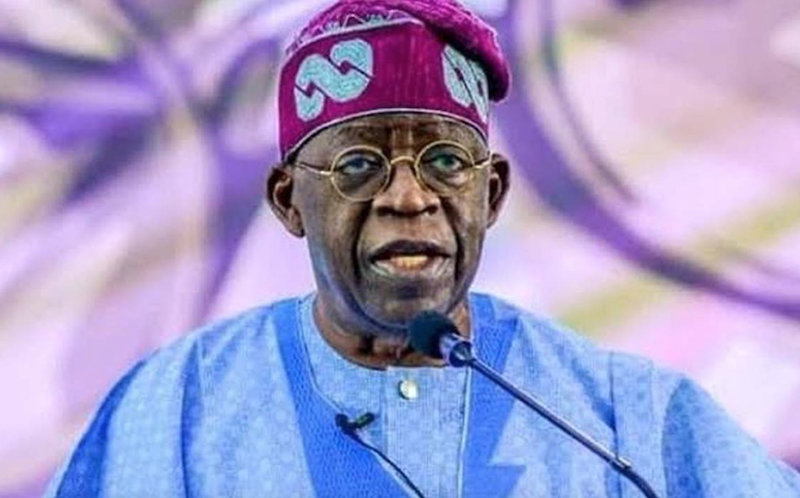

The request was made by the Office of the Special Investigator appointed by President Bola Tinubu to investigate the CBN, related entities and other key government business entities.

The government had been granted an application of warrant filed before a Federal High Court in Abuja for the arrest of the three persons.

The three persons are to be arrested and arraigned before the court on or before May 7, 2024.

The Interpol is expected to apprehend and repatriate the suspects, who are at large, from any of the Interpol members states to which they may have flown.

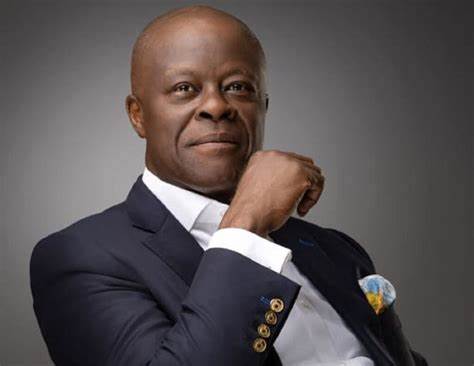

Boss Mustapha, a former Secretary to the Government of the Federation (SGF), on Tuesday testified at an Abuja High Court that former President Muhammadu Buhari’s signature was forged to withdraw the said 6.23 million US dollars from the CBN.

Mustapha, who testified in the trial of former CBN governor, Godwin Emefiele, said he knew nothing about the withdrawal of the money for the payment of foreign observers for the 2023 general elections.

He said that it was the responsibility of the Independent National Electoral Commission (INEC) to deal with issues of election observers.

An official of the CBN had on Monday told the court that the amount was given out in cash.

He said that it was given to an official from the office of the SGF following approvals by former president Buhari and Emefiele.

$6.2m fraud: Buhari’s signature on withdrawal from CBN fake – Boss Mustapha

Mustapha, who is the Second Prosecution Witness (PW2) in the ongoing trial of Emefiele on Tuesday February 13, 2024 told Justice Hamza Muazu of the Federal Capital Territory, FCT, High Court, Maitama, Abuja, that neither former President Muhammadu Buhari nor himself raised a memo directing the apex bank to pay the sum of $6,230,000 (Six Million, Two Hundred and Thirty Thousand Dollars) in cash for international election observers in the last 2023 general election.

Mustapha told the court he never came across anything about the transaction while he was serving as the Secretary to the Government of the Federation and till he left office.

“My Lord, all through my years in service at my capacity, I never came across such a document. Having served for five years, seven months, I can say this document did not emanate from the office of the President”, he said.

Continuing, Mustapha faulted the correspondence Emefiele claimed came from the President’s office with a reference number, pointing out that, “once a correspondence has the President’s seal, there is no need for a reference number, because the seal is the authority”.

“I have looked at it, read it, and the Federal Executive Council’s decisions are not transmitted by letters but through extracts, after conclusions were adopted.

“My Lord, I am a custodian of all records, therefore, the President cannot give me the records, and in all my years in service, I have never heard the term ‘Special Appropriation Provision’ that is referred to here. In all the correspondences I have received from my principal, it has never ended with ‘please accept the assurance of my highest regard’. I am his subordinate, so nothing of such would emanate. And lastly, my Lord, the Nigerian government has nothing to do with financing foreign observers. I know for a fact because I managed two elections, so the responsibility of such lies with INEC”, he said.

Asked by the prosecution counsel, Rotimi Oyedapo SAN, in respect of exhibit PD7 which states that it was 187 FEC meeting that held in 18 January, 2023; Mustapha affirmed that a FEC meeting held, but it was not 187 session, but rather first meeting of the year because it was January.

“My Lord, there was a meeting and it was the first meeting not 187. It was the first meeting of the year. My Lord, all FEC meetings are normally Presided over by the President or Vice president. In the case of the 18 January, it was the Vice president that presided over the meeting because the President was not around. My role was to prepare the agenda of the meeting and on that day, there was a16- point agenda, and there was no agenda that had to do with foreign observers, so it did not appear on the FEC of 18 January, there was no such approval or, anything else from the FEC”, he said.

Asked whether the letter for the approval of the money emanated from his office, Mustapha denied any knowledge regarding it.

“My Lord, to the best of my knowledge, that letter did not emanate from my office, not to talk of signing it. I am saying it was not from me for the following reasons; I was not privy to the operations of CBN, so I cannot write to the governor or the director. Secondly, the heading is defective because it reads: ref. for election observers”.

“It presupposed that there were previous correspondences when you say ref. So my Lord, it is not true because it does not carry any FEC approval. And finally, there was a reference at the end of the letter”, he said.

Mustapha further told the court that he was not aware of any Special Taskforce and had no idea who Jibril Abubakar is.

“I wish to state my Lord that, I am not aware of any Special Taskforce and I do not know one Jibril Abubakar, Principal Officer One, who was alleged as the coordinator of this Taskforce, so I did not introduce any Abubakar to CBN governor, he said.

While on cross-examination, Mathiew Bukka SAN, asked whether Mustapha received any amount from the money, he said he did not receive a single dollar when he was serving and when he left office.

Mustapha denied knowledge of Knowing Abubakar, stressing that he had never met him, nor did he ever work for him.

He further said that he knew about the scandal on social media when it was stated that the defendant and himself connived to steal the huge amount of money, and for him to protect and redeem his image and integrity before the world, he then made a Press Release exonerating himself and at the same time encouraged further investigation on getting to the root of the matter.

After his testimony, Justice Muazu adjourned the matter till 7, 11 and 25 March 2024 for continuation of trial.