The Federal Government says it recognises the threat posed by inflation to the welfare of Nigerians, and is taking strategic measures to bring it down to single digit.

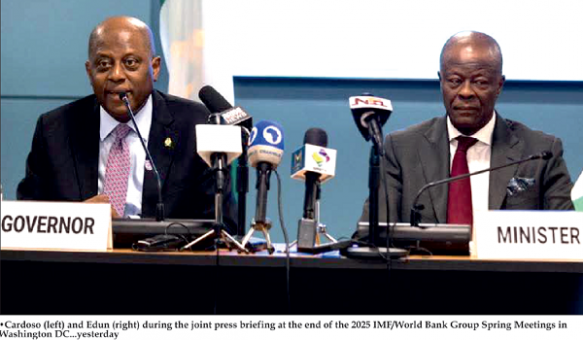

The move is also aimed expanding investment frontiers of the economy, Finance Minister and Co-Ordinating Minister for the Economy, Olawale Edun and Central Bank of Nigeria (CBN) Governor, Olayemi Cardoso, said on Saturday at a joint press conference at the end of the 2025 Spring Meetings of the International Monetary Fund (IMF) and World Bank Group, in Washington DC.

According to National Bureau of Statistics (NBS) data, inflation rate in Nigeria rose to 24.23 per cent in March from 23.18 per cent in February 2025.

We recognise that inflation remains the most disruptive force to the economic welfare of Nigerians. Our policy stance is firmly focused on bringing inflation down to single digit in a sustainable manner over the medium term,” Cardoso said.

He said the aim was to “restore price stability, protect household purchasing power, and lay the foundation for long-term investment.”

The CBN boss said the recent Fitch Ratings upgrade, which applauded the exchange rate unification to reduce arbitrage in the markets, the introduction of electronic FX matching platform and a new FX code to enhance transparency and efficiency in the market as well as deployment of monetary policy tightening to keep inflation on check, showed that the reforms were succeeding.

Edun put Federal Government’s economic growth target at seven per cent, an ambitious projection which has the potential to substantially reduce the current level of poverty and improve the standard of living of Nigerians significantly.

That’s a commitment and target, and the way to get it is by focusing on agriculture, increasing productivity, as well as making food more available to the people,” the Minister said.

Edun said government was also focused on “building more infrastructure, particularly in the digital economy area that will benefit young people, and supporting businesses through improved access to finance.

He said President Bola Tinubu’s desire was that the poor and the most vulnerable were not left behind in the benefits from the ongoing economic reforms.

His words: “We have a social and direct benefit transfer programme. It started off and it wasn’t robust enough or up to standard, so we stopped it.

“We are back to the drawing board, and now have a standard that requires payments going out to people on the social register, and allow each person to be identified biometrically, through a National Identity Number. Each person has a digital methodology for reaching them.”

Twenty million Nigerians are currently on social register, with one million monthly addition which is expected to rise to three million monthly in due course.

Addressing the benefits of the spring meetings, Edu said the just concluded one came at a time ofglobal uncertainty, structural shifts, rising trade and geopolitical tensions, elevated interest rates and high debt levels of which many of the heavily impacted countries are in Sub Saharan Africa.

He said although tariff hikes were impacting real wages and disruption of global supply chains disproportionately affecting Emerging Market Developing Economies (EMD’s) in view of the limited diversification of their economies and greater dependence on imported goods, domestic policy re-strategising should be the first line of defence.

Fiscal Fiscal policies should safeguard sustainability and rebuild buffers; remain investment friendly to create job opportunities and enhance resilient growth.

“Policy calibration should be toward further restoring confidence and stability, reducing imbalances and improving productivity to drive sustainable growth. Regional and cross regional economic integration and cooperation is critical,” he said.

He explained that in line with the Renewed Hope Agenda of President Tinubu, Nigeria was pursing growth-oriented policies through various initiatives in agriculture and food security, road and rail infrastructure, social security as well as strong reforms in both the upstream and downstream sectors of the oil and gas arena.