With barely two weeks until Christmas and the subsequent new year celebrations, getting cash in Kaduna, Kano and Katsina States has now become an extremely herculean task.

Residents in the State have bemoaned the obnoxious situation which was reminiscent of a similar ugly development during the 2022 yuletide season.

The distrausted residents have therefore called for an urgent action by the concerned authorities in order not to hamper the forthcoming Christmas and end-of-year festivities.

In Kaduna city, some Point of Sale (POS) vendors have lamented the unbecoming and unnecessary cash shortage as banks were no longer dispensing cash more than N20,000.

Some of the vendors, who spoke to NAN said they started experiencing the cash shortage in December.

Adamu Amadu said he got his cash from a business man by making transfer to him with little charges.

“We used to charge N100 per N10,000 transaction but now we charge N200 and most of the times our cash finish early due to the high demand. I don’t think Nigerians are ready for a cashless policy,” he said.

Similarly, Ibrahim Nur stated that he was only attending to customers requesting for lesser amounts ranging from N1000 to N10,000 only due to the dire dearth of cash.

Meanwhile, some customers patronising POS vendors have decried the high service rates, saying that the bank also charges for transactions.

Bilkisu Moda said she visited three POS centres searching for cash, with no positive response, adding that she eventually withdrew from an Automated Teller Machine after trekking a long distance.

On her part, Jamila Sani said she withdrew N5,000 and paid N100 service fee, which she said was the normal price she usually paid.

She urged the government to ease the stress of the masses as most small business owners heavily depended on cash for transactions.

In Kafanchan, the residents have expressed their frustration over the current cash situation in separate interviews with NAN.

Felicia Christopher, a POS operator, told NAN that the situation had greatly impacted her business.

“The lack of cash has seriously affected my business as i don’t make much profit as before. The banks don’t give cash beyond a certain limit in a day and it’s really frustrating,” she stated.

Another POS operator, Sadiq Abdulazeez, explained that the cash crunch had forced him to temporarily shut down operations.

An event planner, Bulus Audu, said the lack of information on the cause of the cash shortage was not helping matters.

For Nathaniel Bawa, a civil servant, he wondered why cash scarcity has become common at the end of every year.

Bawa called on the Federal Government to take necessary steps to address the situation as the yuletide season approaches.

Most POS operators now collect twice the amount they hitherto charged per transaction as a result of the difficulty in sourcing cash.

In Zaria, Malam Bilyaminu Musa, a businessman, of Layin Zomo Area of Sabon Gari LGA said grains merchants defied risks and reverted to the old style of sourcing cash from Abuja and other parts of the country for their businesses.

He said the cash scarcity had negatively impacted on grain businesses at major markets in parts of Kaduna, Kano and Katsina States.

Musa, who trades in maize, cowpea, soybean and pepper, said the influx of merchants from other parts of the country and neighbouring Niger Republic had stabilized the prices of grains in the markets.

According to him, most of the merchants were coming with huge amounts of money to purchase the farm produce from the local farmers.

“If not because of these cohorts of merchants, prices of grains would have crashed due to scarcity of cash.

“We are in harvest season now, many farmers are not accepting cash transfers, some do not have bank accounts while others are afraid of fake alerts,’’ Musa said.

He said most of the grain merchants have partners who provide funds for the large-scale purchase of farm produce during harvest season, stressing that cash scarcity was a major bottleneck for the large-scale purchase.

Musa explained that in spite of receiving such funds from their partners for the large-scale purchase of grains, they find it difficult to access cash from the commercial banks.

Similarly, some commercial banks’ customers and Point of Sale (PoS) operators in Zaria have also decried the inability of the banks to give cash in the banking hall.

Customers who were in the banks to withdraw cash were informed by the bank officials that they do not have cash.

Some of the customers interviewed by NAN expressed sadness over the inability of some of the commercial banks to give them cash for their needs.

Malam Awwal Abdullahi, who spoke after going round many ATM machines to withdraw noted that they had no cash.

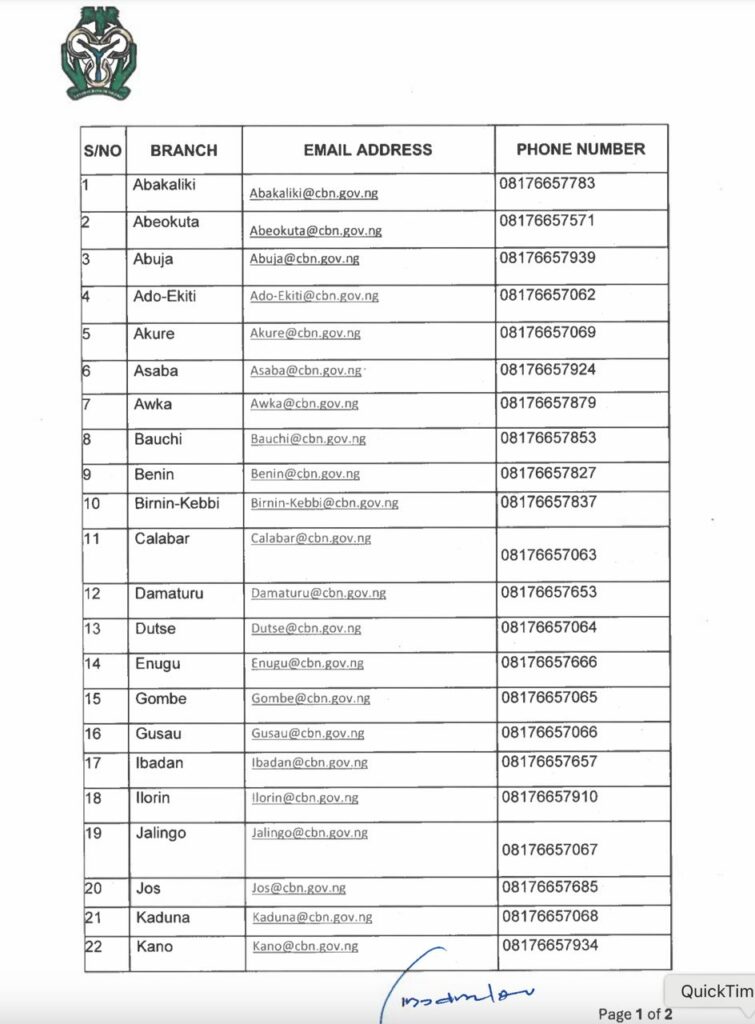

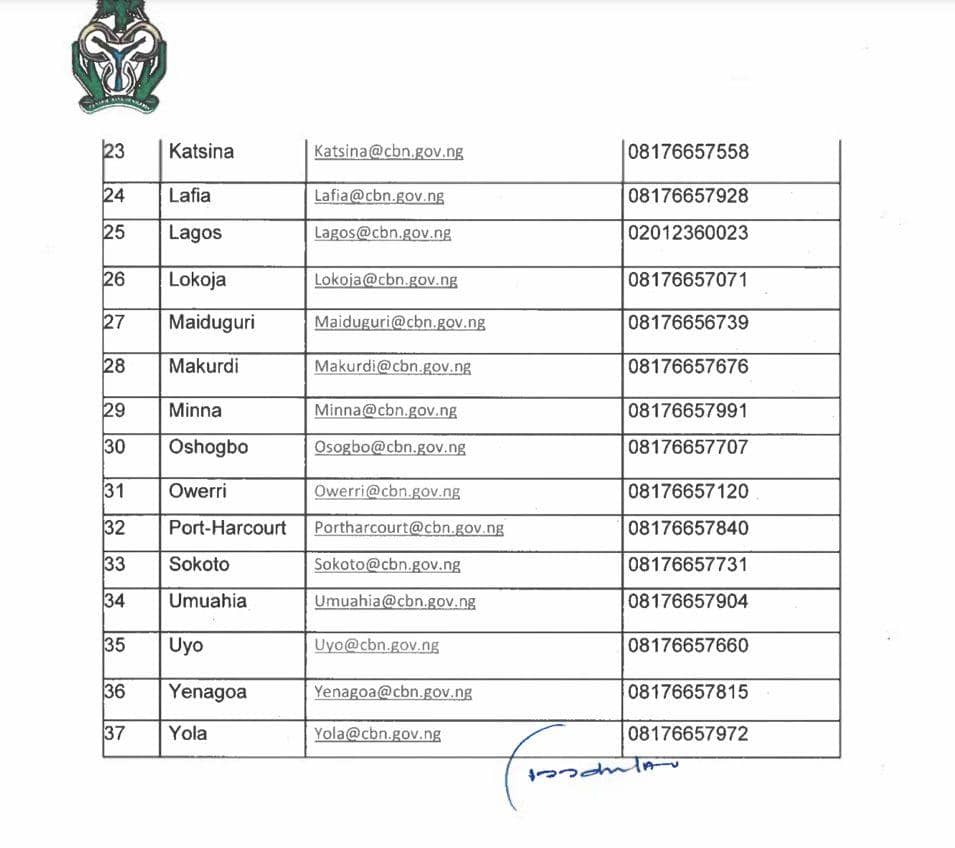

Abdullahi stressed the need for the Central Bank of Nigeria and other regulators to take concrete actions against some of the commercial banks that were not putting cash in their ATM machines.

In Kano, the residents have raised concerns over the ongoing scarcity of Naira notes across the state,with many resorting to alternative payment methods like POS services, which have also been affected by the crisis.

They said the situation was once again plunging them into hardship, reminiscent of the currency swap period.

The residents urged the Central Bank of Nigeria (CBN) and commercial banks to take an urgent action to resolve the cash crisis, which is severely disrupting daily life in the state.

Some of the residents, who spoke to NAN explained that the scarcity was making it increasingly difficult for them to meet their daily needs.

A resident, Aliyu Yakubu, lamented the inconvenience caused by the limited access to physical cash, particularly as businesses, transportation, and daily transactions increasingly depend on electronic payment systems.

“I’ve been to several ATMs, but they were either out of cash or not working,” he decried.

He urged the authorities concerned to investigate the matter and punish those responsible.

Another resident, Aminu Yusuf, lamented that he was facing difficulty to pay for goods, and customers were also struggling to buy from him. Yusuf called on CBN to make more cash available and also sanction banks that hoard cash.

A civil servant , Aisha Ali, voiced her frustration over the difficulties she has been facing. She explained how it has become increasingly challenging for her to purchase essential household items due to the unavailability of cash.

“It is my hard-earned money and i can’t access it, especially at the bank. It’s frustrating, and it’s putting me in a very difficult situation,” she said.

Ali also called on CBN to urgently take action against the banks and persons responsible for the cash shortage.

A POS agent, Nura Abubakar, blamed the commercial banks for the difficulties in accessing cash. According to him ,the constant breakdown of POS terminals and the high transaction fees have exacerbated the challenges faced by the customers.

“Banks are not releasing enough cash to us,” he said.

Musa Saleh ,a POS agent, explained that the scarcity has also impacted their operations, attributing the problem to the banks. He said that the banks were no longer cooperative, even with their own POS agents.

Saleh decried, “When we go to the bank, they always tell us to come back next day. And when we return, they give us another excuse.

“Some people are unfairly blaming us for the charges,” he said, emphasizing that this not the right approach.”

In Katsina, a cross section of the residents have expressed concern over what they called lack of money at majority of bank’s Automated Teller Machines (ATMs) and the Point of Sale (POS) operators.

An investigation conducted by the Correspondent of the News Agency of Nigeria (NAN) in Katsina revealed that most of the banks’ ATMs were not functional.

The investigation further revealed that some few banks dispensing the cash were characterised by long queues where a person would spend several hours before getting some amount of money.

It also showed that the other banks’ ATMs were dispensing only a limited amount.

Malam Abubakar Muhammad, one of the residents, said that he went to an ATM to withdraw some amount of money, only to find out that the machine had no money.

He lamented that the banks now don’t put money at ATMs, the situation causing more hardship to the people, and crippling business operations.

Muhammad revealed: “Even inside the banking halls at the counter, his bank now gives only a limited amount of N20, 000. Majority of the banks don’t put cash in the ATMs”.

Muhammad, therefore, urged the Federal Government to hasten measures to address the problem.

On his part, Aminu Abdullahi, lamented how banks nowadays do not put money in their ATMs, leaving their customers in difficulty.

Abdullahi said that now that the customers have resorted to patronising POS operators who also charged higher money.

According to him, POS operators have increased their charges from N100 to N200 for every N10,000.

He also appealed to the authorities concerned to take urgent measures to address the problem.

In the same vein, some POS operators yave also complained about the cash crunch that forced them to increase their charges.

The operators claimed that they face difficulty in getting the cash to give to their customers.

A POS operator, who pleaded for anonymity claimed that the banks now don’t put money at the ATMs, preferring to give it to the POS operators.

“I ran out of money yesterday, I had to struggle to get the money for my operation. I was opportuned to get the money from a bank, but they charged N1,000 for every N100,000, that is why we jerked up our charges, because we cannot operate on losses,” he said.

Following the negative development, the operators increased their charges in most of the places.

The POS operators increased their charges from N100 to N200 and above for every N10,000 while some operators charge higher than that amount.

Tukur Hamza, a resident of Katsina, said that for long, he preferred to patronise POS operators, because their services were more accessible.

He said that as a result of the unavailability of the cash at most of the banks’ ATMs, withdrawing money from the POS outlets has also become a difficult thing.

Hamza, therefore, urged the relevant authorities to intensify efforts in finding lasting solutions to the problem before it worsens.

Meanwhile, Vice-President, Kashim Shettima, has urged Nigerian Deposit Money Banks (DMBs) to ensure seamless availability of Naira notes to the banking public.

Shettima made the call on Friday in Abuja, at the 2024 Bankers ‘ Committee Retreat.

He was represented by Tope Fasua, Special Adviser on Economic Affairs, Office of the Vice-President.

He urged the committee to address some unwholesome practices by some Point of Sale (PoS) agents which impeded the availability of cash.

According to him, the scarcity of cash is constituting an impediment to financial inclusion.

“We would like to take this opportunity to appeal strongly to the committee to urgently clear up thorny issues in the sector, some of which are impeding the efforts at financial and economic inclusion.

”Nigerians complain bitterly that they are unable to access even minimal cash when most needed. There seems to have been some moral hazard and adverse selection problem with the involvement of street-side PoS merchants.

”Nigerians complain about high and arbitrary charges and exploitation by rogue agents, which we are sure you will be able to tackle with concerted efforts,” he said.

It was learnt that CBN has reportedly set up various committees to monitor the activities of the commercial banks across the country.

This was with the view to curtailing the alleged unsavoury acts of some of the banks that have been exacerbating the cash crunch in the country.