Nigerian banks are migrating in the New Year (2021), into brand new cheque standards, on the order of the Central Bank of Nigeria (CBN).

The banks have in an official mail notification to their various customers said they will not accept the old cheques from December 31, 2020.

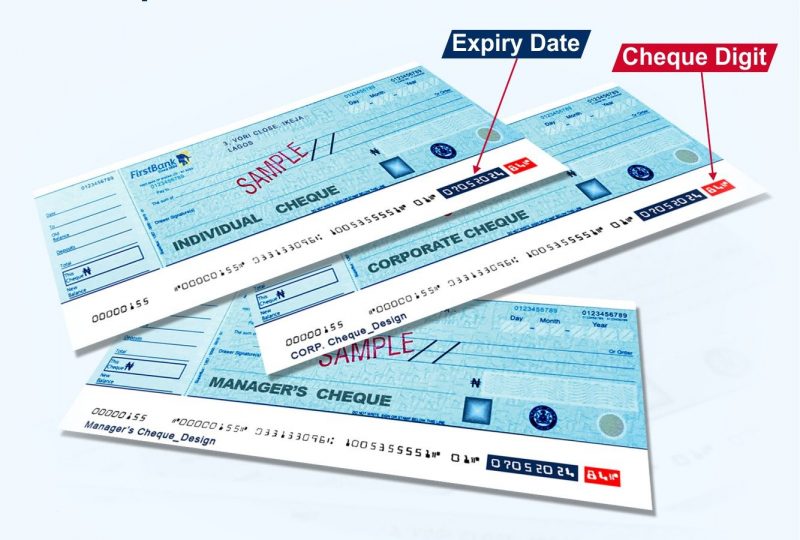

The new cheques come with unique features.

They have expiry dates and also have cheque digit included on the MICR code line.

The CBN has been working on moving to the new standard since 2018.

According to a 9 December circular sent to all deposit money banks, accredited cheque printers and Nigeria Interbank Settlement System [NIBSS], only new cheques will be allowed in the clearing system from I January.

The circular was signed by Sam C. Okojere, director Banking Services Department.

The circular, however, gave some banks, which are unable to meet the 31 December switchover three months of grace, to comply.

This will be allowed, if reasons for non-compliance were found to be satisfactory by the CBN management.

But the CBN said it will embark on a full enforcement of the new cheque standards by 1 April, 2021.