Indications emerge over the weekend that over 700 Bureaux De Change (BDC) operators are inactive in the Central Bank of Nigeria’s (CBN’s) Forex Window as forex end users embrace commercial banks.

The preference for commercial banks followed the uncompetitive rate regime that shifted the business patronage in favour of the lenders. The practice has cut BDCs’ turnover, putting their businesses under threat.

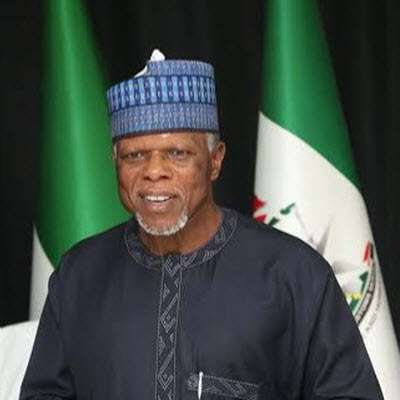

Confirming the development at the weekend, Association of Bureaux De Change Operators of Nigeria (ABCON) President Aminu Gwadabe said the BDC business had been badly affected by the uncompetitive rate as the CBN sells dollars to BDCs at higher rate compared to what the regulator sells to commercial banks, yet both institutions target the same market segment and customers.

On the CBN’s approved list, 3,389 BDC operators have been licensed and are expected to get $40,000 weekly from the CBN Forex Window. The apex bank disburses about $135.5 million to the 3,389 registered BDCs weekly to sell to forex end users. The funds are for Personal Travel Allowances (PTA), Business Travel Allowances (BTA), medical needs and school fees.

The BDCs, Gwadabe said, buy dollar from the CBN at N360/$1 and sell to end users at N362/$1 while the regulator sells to commercial banks at N358/$1 and the banks sell to end users at N360/$1.

Gwadabe described the buying rate for the BDCs as “uncompetitive” and “a big disincentive for many forex users to patronise the operators. He said the banks and the BDCs service the same market segment, they should get dollars at the same rate to enable both institutions compete favourably.

According to the ABCON boss, the banks enjoy a large customer base with the customers having their accounts debited to cover the cost of purchase. Such convenience plus a lower rate put the banks at an advantage position to attract more customers than BDCs, he said.

He lamented that BDCs are not only buying at exorbitant rate, but also sell at a rate higher than that of the banks, hence creating low patronage for the operators.

Gwadabe advised the CBN to review the rate at which the dollar is sold to the BDCs to boost the recovery of the naira against dollar. The naira has remained at N368/$1 at the parallel market in the last one week, a major improvement from N520/$1 it exchanged last February.

He said the success recorded by the CBN in stabilising the naira was largely contributed by the BDCs, which remain backbone of the retail forex segment of the economy.

“The CBN should be proactive enough to quickly review the BDC buying rate to ensure effective competition among all the stakeholders. There is no need to give the banks undue advantage over the BDCs as is currently the case based on the level of disparity seen in the dollar buying rate by both sectors. Nothing stops the CBN from ensuring that both the banks and BDCs buy dollars at same rate,” he stressed.

Gwadabe said the rate challenge faced by BDCs, if not checked, would trigger a liquidity crisis that may derail the ongoing recovery of the naira against the dollar. He said the BDCs will continue to support CBN’s determination to stabilise the exchange rate, and strengthen the value of the local currency.

Gwadabe also called on the CBN to increase the volume of Personal Travel Allowances (PTAs) from $4,000 to $8,000; Business Travel Allowances (BTAs) from $5,000 to $10,000; school fees from $5,000 to $20,000 and medicals from $5,000 to $15,000 quarterly to deepen liquidity in the market.

Gwadabe praised the CBN for liberalising the forex market and making more dollars available, adding that making the funds readily available in right volumes will double the positive impact of the policies on the economy.