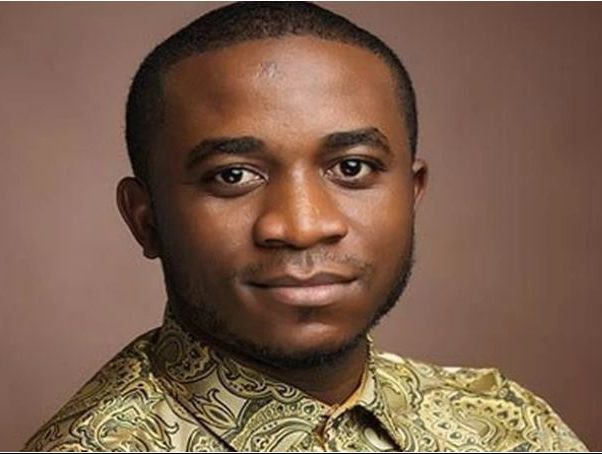

A Nigerian, Solomon Ekunke Okpe, 31, has been sentenced to four years in an American jail for taking part in online scams that targeted US citizens and banks, leading up to $1 million in losses to victims.

The 31-year-old was handed the prison term after being extradited from Malaysia, where he was arrested, to the US to stand trial.

The US Department of Justice, while announcing the sentence said Okpe and his accomplices “devised and executed business email compromise (BEC), work-from-home, check-cashing, romance, and credit card scams” between 2011 and 2017.

According to Infosecurity magazine, targeted victims included individuals, banks, and businesses in the US and other countries, who were subjected to email phishing attacks aimed at stealing login credentials and “other sensitive information.”

TheNewsGuru.com (TNG) reports that DoJ described the scams as “intended to cause more than $1 million in losses to US victims” although it is not clear if the cyber-fraud gang achieved this nefarious goal.

Financial institutions named by the DoJ as victims include First American Holding Company and MidFirst Bank.

Okpe now joins his fellow gang member, Johnson Uke Obogo, behind bars.

Obogo was sentenced on March 20 to a year and a day in prison for his role in the scams, a considerably shorter tariff than Okpe’s.

TheNewsGuru.com (TNG) reports that the United States Department of Justice (DOJ), also known as the Justice Department, is a federal executive department of the United States government tasked with the enforcement of federal law and administration of justice in the United States.

It is equivalent to the justice or interior ministries of other countries. The department is headed by the U.S. attorney general, who reports directly to the president of the United States and is a member of the president’s Cabinet. The current attorney general is Merrick Garland, who was sworn in on March 11, 2021.

The modern incarnation of the Justice Department was formed in 1870 during the Ulysses S. Grant presidency. The department comprises federal law enforcement agencies, including the Federal Bureau of Investigation, the U.S. Marshals Service, the Bureau of Alcohol, Tobacco, Firearms and Explosives, the Drug Enforcement Administration, and the Federal Bureau of Prisons.

It also has eight major divisions of lawyers who represent the U.S. federal government in litigation: the Civil, Criminal, Civil Rights, Antitrust, Tax, Environment and Natural Resources, National Security, and Justice Management Divisions. The department also includes the U.S. Attorneys’ Offices for each of the 94 U.S. federal judicial districts.

The primary actions of the DOJ are representing the U.S. government in legal matters and running the federal prison system.

The department is also responsible for reviewing the conduct of local law enforcement as directed by the Violent Crime Control and Law Enforcement Act of 1994