The Group Managing Director of the Nigerian National Petroleum Corporation, Mele Kyari, on Tuesday explained why the national oil company is purchasing a stake in Dangote oil refinery.

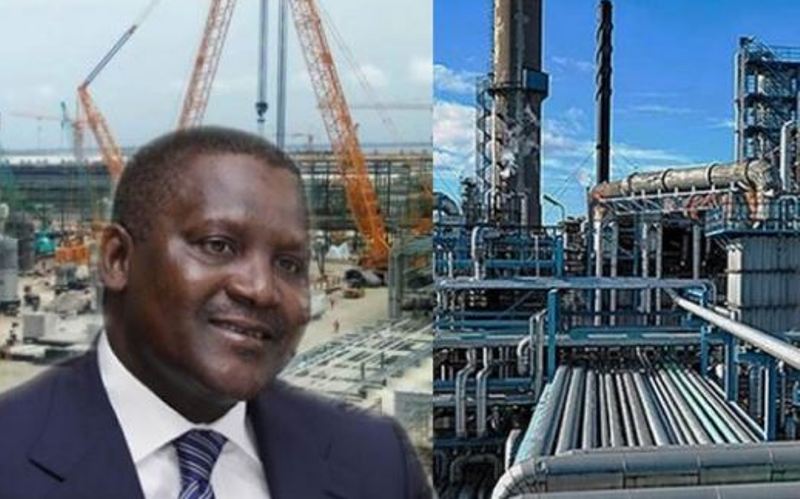

The refinery is expected to begin production in 2022 with an installed 650,000 barrels per day capacity.

It has been touted as a groundbreaking project for energy security in the country and for the African continent.

In May, the NNPC announced that it plans to acquire a 20 percent equity stake in the private company led by billionaire Aliko Dangote.

“There is no resource-dependent country that will watch a business of this scale, which borders on energy security and has implications for fiscal security of the country, and you don’t have a say,” The NNPC GMD said on Tuesday while appearing on a monitored Channels Television programme.

He argued that the decision was also driven by the profit potential of the refinery business.

“For the Dangote refinery, we are not taking government money to buy it, which is the mistake that people are making,” he said. “We are borrowing on the back of the cash-flow of this business.

“We know that this business is viable, it will work and it will return dividends. It has a cash-flow that is sustainable because refinery business, in the short term, will continue to be sustainable.

“That’s why banks have come forward to lend to us, so we can take equity in this.”

“Dangote refinery will come into production by 2022. And what that will do is to deliver over 50 million litres of gasoline into, to be specific, our markets. We are also working on our refineries, to ensure that we fix them. We have awarded the contract for Port Harcourt refinery rehabilitation. And ultimately we are going to close that of Warri and Kaduna very soon in July, so that all of them will work contemporaneously. The net effect is that you are going to have an environment where Nigeria becomes the hub of petroleum products and supply. It’s going to change the dynamics of petroleum supply globally in the sense that the flow is coming from Europe today and it is going to be reversed to some other direction. We will be the supplier for West Africa legitimately and also many other parts of the world.

“So the meaning of this is, there is an opportunity that has been thrown at us. And I’m not sure Mr Dangote wants to sell his equity in the refinery. I can confirm that it was at our instance that we started this engagement. He did not want to sell his shares in this refinery.

“There is no resource-dependent country that will watch a business of this scale, which has bordering on energy security and has implications for fiscal security of the country, and you don’t have a say. And for us, as a strategy, we started this process long before Dangote started his refinery project. We take equity in very significant businesses that are anchored on the oil and gas operations: fertiliser, methanol plants, modular refineries and some other businesses that we are dealing with.

“It is to expand our portfolio and also because we are the national oil company, we have the responsibility to guarantee energy security for our country. And there is no way you can have a say, except you have a seat on the board of these institutions. And that’s why anyone that is going to construct a refinery that is in the excess of 50,000 barrels per day, we will talk to them, take equity in it, as long as we have the money to pay for it.

“For the Dangote refinery, we are not taking government money to buy it, which is the mistake that people are making. We are borrowing on the back of the cash-flow of this business. We know that this business is viable, it will work and it will return dividends. It has a cash-flow that is sustainable because refinery business, in the short term, will continue to be sustainable. That’s why banks have come forward to lend to us, so we can take equity in this.

“We are very proud that we did this. This is good for our shareholders, which includes all 200 Nigerians who will also be happily buying shares from this company if they had the opportunity. But now we have done on their behalf, so that ultimately the value will come to all of us.

“But there is no way you can watch a business of this magnitude, of this sensitivity, to run without the involvement of the national oil company. No country does this.”

Kyari also suggested that the inability to find an appropriate price for petrol has forced the continuation of the subsidy scheme.

The NNPC is currently the sole, official importer of petroleum products into the country.

While its landing price is about N256 per litre, according to Mr Kyari, petrol sells for N162 to N165 in most parts of Lagos.

In March 2020, the Federal Government said it would allow market forces to dictate the pump price of petrol.

But after oil prices rose in the preceding months, the Federal Government decided not to adjust the price correspondingly under pressure from organised labour.

“The reality is that we cannot afford it,” Mr Kyari said.

“But also the second reality is if you don’t do something smart, you could end up throwing prices at Nigerians that are well above prices that they should pay for.”

The NNPC chief said the government is still engaging with organised labour and other stakeholders on how to properly price the product.

“The engagement is aimed at making sure there is a reasonable level of pricing that we can do that will recover the cost,” he said.

Meanwhile, a huge chunk of the petroleum the NNPC pays for is being smuggled to neighbouring countries where they are sold at higher prices.

“Petroleum consumption in Nigeria is not up to 60 million litres per day, but we supply up to that,” Mr Kyari said.

“We always plan with 60 million litres, because anytime we do below that, there is a crisis.”

He acknowledged that there “are sharp practices which we are trying to control” and “an organised cross-border smuggling of petroleum, which is associated with the price of petroleum itself.”

The smuggling, he noted, is exacerbated by the fact that Nigeria shares borders with countries who have no choice but to transport petroleum by road.

When borders were shut last year, the NNPC chief said, consumption fell to 52 to 53 million litres per day.

And during the thick of the COVID-19 lockdown in 2020, the number fell to about 42 million litres.

“If everything works well and consumption is limited to our country, we are dealing with about 42 million litres,” Mr Kyari said.