Eleven Electricity Distribution Companies operating in the country are collectively indebted to the Federation Account to the tune of ₦2.6 trillion, the Nigerian Bulk Electricity Trading Company (NBET) PLC has said.

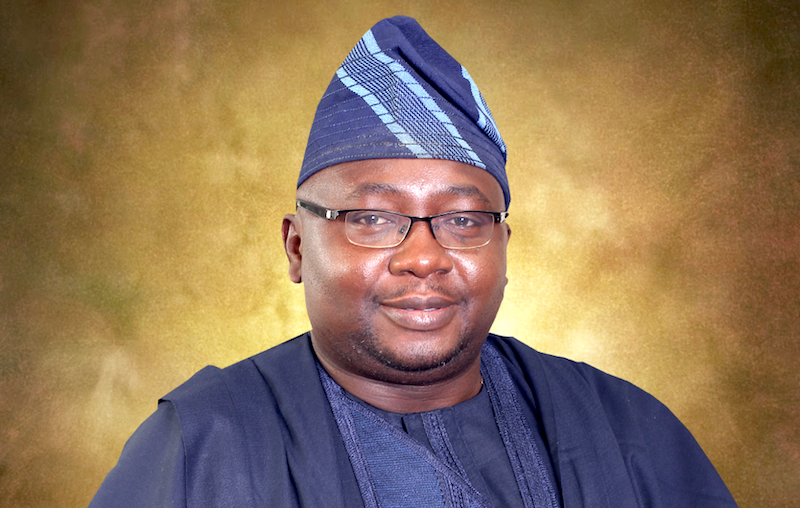

Managing Director of NBET, Johnson Akinnawo disclosed the scale of the liabilities when he appeared before the House of Representatives Committee on Public Accounts on Wednesday.

The Committee has however summoned the 11 electricity Distribution Companies (Discos) to appear before it over the outstanding debt.

Documents submitted to the committee by NBET revealed that as at September 30, 2020, the 11 Discos collectively owe N2.6 trillion.

The DISCOs are Abuja Electricity Distribution Company (₦330.4 billion); Eko Electricity Distribution Company (₦231 billion); Benin Electricity Distribution Company (₦233.2 billion); Enugu Electricity Distribution Company (₦258.3 billion) and Ibadan Electricity Distribution Company (₦325.7 billion).

The others are Ikeja Electricity Distribution Company (₦310 billion); Jos Electricity Distribution Company (₦161.7 billion); Kaduna Electricity Distribution Company (₦277.7 billion); Kano Electricity Distribution Company (₦211.7 billion); Port Harcourt Electricity Distribution Company (₦239.7 billion) and Yola Electricity Distribution Company (107.4 billion).

According to The Nation, the 2021 Auditor General’s report, which prompted the hearing also flagged multiple irregularities in the power sector.

The Auditor General alleged N30 billion in uncollected debt by NBET from market operators, N549 million shortfall in NBET’s 1% income from institutional charges, N100 billion paid by NBET to Generation Companies (GENCOs) for electricity not delivered to the national grid, N26 billion owed to Nigeria by two foreign firms for power exported to Togo, Benin, and Niger, N166 billion in under-remittance by Discos, below the Nigerian Electricity Regulatory Commission’s (NERC) minimum threshold and N2.7 billion in unpaid invoices by the 11 Discos.

At the investigative hearing, Yahya Kusada moved a motion that all the 11 Discos be summoned to explain the persistent non-settlement of their financial obligations to the Federation Account and seconded by Billy Osawaru.

“With the magnitude of liabilities before us, it is imperative that these companies appear before the Committee to clarify their positions and outline plans for repayment,” Hon. Yahya Kusada said.

The Committee has also resolved to invite other market operators and participants to address concerns raised in the Auditor General’s report.

A date for the appearances will be communicated to the affected parties in due course.