“We are aware that the Federation Accounts Allocation Committee (FAAC) shared N1.1 trillion amongst the three tiers of government, so why the delay,” workers under the aegis of Association of Senior Civil Servants of Nigeria (ASCSN) have queried.

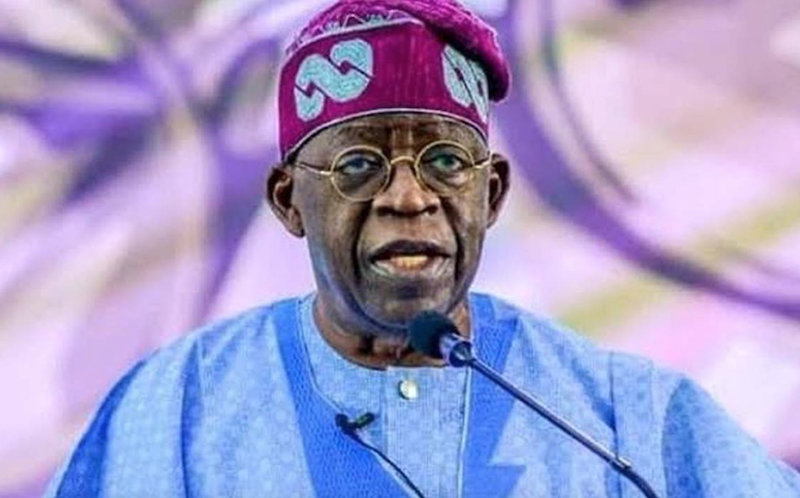

TheNewsGuru.com (TNG) reports the workers accused the President Bola Tinubu-led administration of being insensitive to their plights in reaction over recurrent delay in payment of their salaries, wage award and other emoluments.

The Association specifically expressed discontent over the delays in payment of monthly salaries to civil servants.

Speaking on Tuesday, Mr Tommy-Etim Okon, President of ASCSN urged the government to be prompt in payment of salaries and emoluments of workers.

He said, since President Tinubu assumed office, the payments of monthly salaries and emoluments of workers have not been done on time, which he said have affected the productivity and well being of workers in the country.

According to him, government should be sensitive to the plights of the workers, considering the economic hardship in the country.

“Everyday the cost of living is skyrocketing, how will workers pay for their transportation to the office, how will the economy and other industries survive, if there is no exchange of money.

“Today is the 7th of February, and I can categorically tell you that a lot of workers are yet to receive their salaries,” he said.

Okon said, even the monthly wage award promised to federal government workers to cushion the effects of the fuel subsidy removal was not paid as of when due.

“When we brokered and arrived at N35,000 wage award, government promised to pay for six months before the implementation of the new national minimum wage.

“But as I speak, government had only paid for the months of September and October last year, this means that November, December, 2023 and even January 2023 are still outstanding.

“Upon assumption of office, this administration promised to ensure that workers will be paid as of when due with good incentives but the reverse is the case.

“If the government cannot pay N35,000 wage award in this situation, I wonder how they can convince us that they will keep to the promise of giving workers a living wage,’’ he said

Okon, therefore, called on President Tinubu to be sensitive to workers’ plights and the masses in general, by expediting action on economic policies, beneficial to their well being

Similarly, Mr Olorunsuyi Ademola, the Branch Chairman, Senior Staff Association of Nigerian Universities (SSANU), National Mathematical Centre, said the government should show concern to workers on the high cost of living in the country.

Ademola said the present administration should be sensitive to the plight of workers considering the effects of removal of fuel subsidy and the high exchange rate of naira to dollar, among others.

“The economic policies, though desirable, have negatively impacted the standard of living of Nigerian worker.

“It is unimaginable that with the sufferings brought about by these policies, the salary and emoluments of Nigerian worker’s are being delayed beyond expectations,” he said

Ademola said that the 25 per cent salary increase approved by the government for the university sector that was supposed to take effect from January 2023 was yet to be implemented.

He added that the withheld salary of the university workers that the government promised to release was also yet to be paid.

Also, Mr Eric Haruna expressed disappointment over the activities of the present administration in the area of prompt response to salary payment since its inception, adding that the delay had negative effects on workers’ productivity.

“You will agree with me that there has been an irregular payment of workers’ salaries in recent times.

“The delay in payment has posed difficult situations to not only workers alone but other Nigerians, market women/men in particular, who make reasonable sales whenever workers receive their salaries,” he said.

According to him, the civil servants are the engine room of any government and anything that goes wrong in the system will have spiral adverse effects on the administration.

“Since this government came on board, it has never paid salary as and when due.

“It will always cross to the following month before payments are made and this is affecting the entire system negatively,” he said.

Mrs Grace Ezekiel, another civil servant, said she has been in great pain as she has not been able to pay her children’s school fees and other unavoidable bills.

She said the present administration has not been fair to workers’ plight, considering the delay in payment of salaries and wage award to workers.

“You can see the continued rise in the prices of goods and services in the market. Inflation is high, coming to work has not been so easy for workers,” she said.

Another civil servant, Ibrahim Alli who spoke specifically on the February salary said the situation is no longer acceptable for the government to keep delaying salaries without explanation.

“We are aware that the Federation Accounts Allocation Committee (FAAC) shared N1.1 trillion amongst the three tiers of government, so why the delay?’’ he queried.

Also, Mrs Hauwa Sule condemned the idea of delaying the monthly salaries of some government workers while others will be paid.

Responding to the accusation, the Office of the Accountant-General of the Federation (OAGF) said that many Ministries, Departments and Agencies (MDAs) of government have received their February salaries.

Mr Bawa Mokwa, the Director of Press, OAGF, said the delay in payment of salaries of some MDAs is due to discrepancies in their 2024 budgets.

Mokwa gave the assurance that most of the discrepancies had been reconciled. and the outstanding salaries should start dropping,” he said.

Recall FAAC shared N1.13 trillion among the three tiers of government as revenue generated in December 2023.

In a communiqué issued at the end of its January meeting, the Committee said the total figure shared represented an increase of N40 billion or 3.67 per cent compared to the N1.09 trillion shared for November 2023.