The three tiers of government – the Federal, States and Local Government Councils (LGs), shared a total of N4.37 trillion from the Federation Account as statutory revenue allocations between January and June 2023.

This is contained in the latest report by the Nigeria Extractive Industries Transparency Initiative (NEITI) on the Federation Account revenue allocations for the first half of the year.

Dr Orji Ogbonnanya Orji, Executive Secretary, NEITI, who announced the report on Thursday in Abuja, said total distributable FAAC allocations to the three tiers of government in first and second quarters (Q2) of 2023 stood at N2.32 trillion and N2.04 trillion respectively.

The NEITI quarterly review revealed that inflows into the Federation Account in Q2 of 2023 declined by 23 per cent which affected the distributable revenue which fell by 12 per cent when compared with the total revenue disbursed in the first quarter.

“Each tier of government received more than N1 trillion over the six-month period,” he said.

The report showed that a breakdown of the revenue receipts showed that the federal government received about N1.78 trillion, or 40.7 per cent, while the State governments received N1.5 trillion, or 34.5 per cent.

According to the report, the Local government councils received N1.08 trillion or 24.8 per cent of the total distributable revenue for the period.

It further disclosed that a comparative analysis of the total allocations on a year-on-year basis in the corresponding quarters of 2022 and 2023 showed that the distributable revenue of N4.366 trillion shared was higher by 16.7 per cent from about N4.05 trillion shared in 2022.

Consequently, it revealed that the allocation received by the federal government over the period under review increased by 19.8 per cent to N1.78 trillion in 2023, from the N1.48 trillion in the corresponding period in 2022.

Similarly, the report noted allocations to the State governments grew by about 11.2 per cent to N1.42 trillion in 2023 from N1.26 trillion in 2022, while allocations to the LGs rose by 16.8 per cent to N1.08 trillion in 2023, from N926 billion in 2022.

The increase in half-yearly allocations in 2023 was consistent with an upward trend from the previous period where the distributable revenue for the first half of the year rose by 16.7 per cent, from N3.47 trillion between January and June 2021 to N4.05 trillion in the corresponding period in 2022.

Also , allocations to the federal, states and LGs increased across board by 8.8 per cent 26.5 per cent and 14.2 per cent respectively.

However, compared to the same period in 2022, it said the report showed that FAAC distribution in Q2 declined in absolute value with total distributable revenue of N2.02 trillion being less by 13 per cent than about N2.16 trillion distributed in the second quarter of 2022.

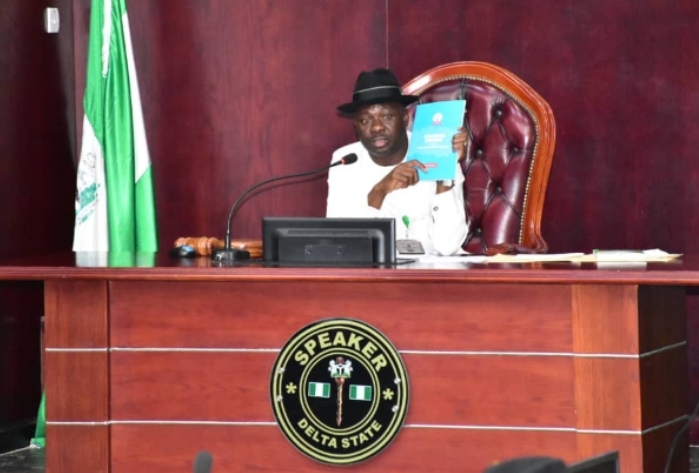

It said further analysis of the disbursements to the states showed that Delta state received the highest allocation of N102.79 billion in the second quarter of 2023, followed by Akwa Ibom’s N70.01 billion, Rivers N69.73 billion, Lagos N60.64 billion and Bayelsa N56.34 billion.

It said the total disbursements to these five states (N359.5 billion), or 35.9 per cent of the total FAAC allocations, was more than the total allocations to the next 15 states (N349.3 billion).

It said the cumulative allocation to the five states was also more than the share of allocation to 19 other states put together, adding that the bottom 10 states received 17.3 per cent of the revenue shared in the second quarter of 2023.

According to the report, Nasarawa, Ebonyi, Ekiti, Gombe and Taraba states received the lowest allocations of N16.71 billion, N16.84 billion, N16.95 billion, N17.22 billion and N17.45 billion respectively.

It said four of the five states with the highest allocations, except Lagos, received a significant share of 13 per cent derivation revenue allocated to oil-producing states.

It said the total disbursements to these five states (N359.5 billion), or 35.9 per cent of the total FAAC allocations, was more than the total allocations to the next 15 states (N349.3 billion), while the cumulative allocation to the five states was also more than the share of allocation to 19 other states.

It added that the bottom 10 states received 17.3 per cent of the revenue shared in the second quarter of 2023.

It stated that the bulk of the revenues to the federation account came from remittances from the three main revenue-generating agencies.

It listed them as the Nigeria Upstream Petroleum Regulatory Commission, the Federal Inland Revenue Service (FIRS) and the Nigeria Customs Service (NCS).

These revenues, it explained that they came through earnings from the different revenue streams, including oil and gas royalties, petroleum profit tax, company income tax, value added tax and import and excise duties.

“Also, revenue remittances of about N1.84 trillion in Q2 2023 came from mineral and non-mineral sources, comprising of N809 billion, or 44 per cent from mineral revenue (mostly oil and gas) and N1.03 trillion, or 56 per cent from non-mineral sources.

The report further revealed a huge gap between revenue disbursements from the oil and gas and solid minerals sectors, pointing out that this was a reflection of the perennial underperformance of the latter over the years.

“In terms of debt service obligations and the impacts on states’ net allocations, the report showed that Lagos topped the list of 36 states with a total deduction of N9.03 billion in the second quarter of 2023, followed by Delta (N6.76 billion), Ogun (N6.10 billion), Kaduna (N5.63 billion), Osun (N5.60 billion and Imo (N5.51 billion).

“Jigawa, Anambra, Nassarawa, Kebbi and Enugu States had the lowest deductions of N1.16 billion, N1.29 billion, N1.45 billion, N1.51 billion and N1.88 billion respectively.

“The nine oil-producing states, according to the report, namely Abia, Akwa Ibom, Anambra, Bayelsa, Delta, Edo, Imo, Ondo and Rivers states received allocations relative to their share of the oil and gas as well as other minerals extracted from their domains,” it said.

It projected that with efficient, prudent management and utilisation of the savings of N3.6Trillion from subsidy payment in the first six months of 2023, Nigeria’s balance of payments would be boosted as demand which was served entirely by product importation would be curtailed.

It said the drop in demand would inadvertently, trigger a corresponding reduction in the dollar volume needed to pay for premium motor spirit (PMS), which constituted the largest single import product by value,” he said.

The report welcomed with high expectations, the unification and the floating of the exchange rate policy recently introduced to strengthen and stabilise the economy.

“With the average exchange rate of N713.69 to US$1, which is about 55 per cent higher than the rate of N460.52 to the dollar recorded during Q2 will significantly raise the value of export earnings remitted to the Federation Account by more than 50 per cent.

“Also earnings from the new exchange rate through exports will also increase the value of foreign capital inflows, including investments, loans and grants,” it recommended.

Also, the report urged the Central Bank of Nigeria to prioritise policies to stabilise the exchange rate to facilitate the effective implementation of the deregulation policy and stabilise foreign exchange-dependent inflows into the Federation Account.