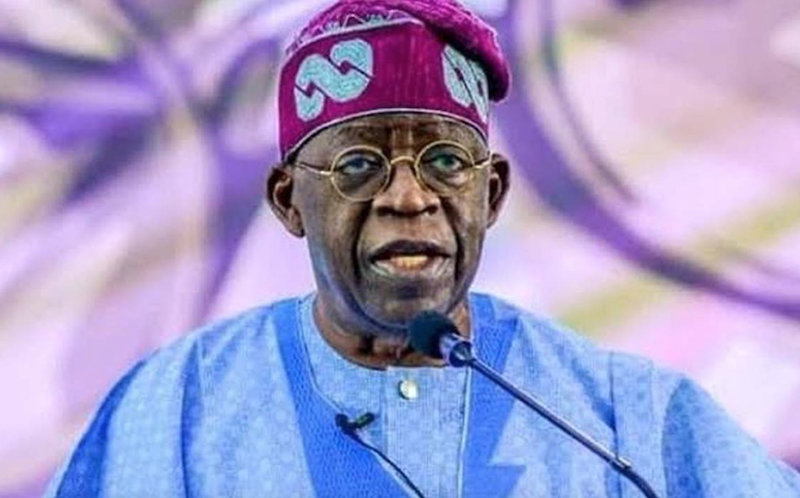

President Bola Tinubu has disclosed that Diaspora Home Remittances through official channels stood at $20.93 billion in 2024, which is four times the value of Nigeria’s Foreign Direct Investment (FDI).

President Tinubu said this at the National Diaspora Day (NDD) celebrations and National Merit Award 2025, organised by Nigerians in the Diaspora Commission (NiDCOM) on Friday in Abuja.

The theme of the celebration was “Optimising Formidable Diaspora Potentials for National Development and Growth”.

The President was represented by Sen. George Akume, Secretary to the Government of the Federation.

He lauded the creation of NiDCOM flagship programmes like NDD celebrations, National Diaspora Merit Award, Nigeria Diaspora Investment Summit, Diaspora Mortgage Scheme and Diaspora Data Mapping project.

According to him, it has become a practice to fellowship with Nigerians in the diaspora at the presidential diaspora town-hall meetings during the presidential official trips outside the country.

“It is gratifying to note that we have celebrated the achievements of our diaspora annually on July 25th, many of whom are our Ambassadors at large uplifting the image of Nigeria in their host countries.

“Nigerians in the diaspora are also actively investing in our healthcare, agriculture, education, Information and Communication Technology (ICT), housing and real estate, sports, transportation, oil and gas and other sectors.

“This is commendable and in our enlightened self-interest as only Nigerians, both at home and abroad, can develop Nigeria,’’ he said.

He also said that the NDD celebration has taken a new dimension owing to the inclusion of the national Diaspora merit award by NiDCOM since 2023.

Speaking earlier, Mrs Abike Dabiri-Erewa, Chairman/CEO of NiDCOM, said the NDD was set aside to recognise and acknowledge the over 20 million Nigerians in the diaspora who are contributing immensely to national development.

“Our Diaspora are known for hard work, resilience, patriotism, and they are highly productive. They are also barrier breakers and pacesetters in their different fields of endeavour.

“It, therefore, behoves on us to celebrate our very best, not minding that a few do fall below standard.

“Since its establishment over six years ago, NiDCOM has had so much to celebrate; this is because the legacy team has sustained the passion and consistency that saw to the establishment of the commission,” she said.

Dabiri-Erewa said that the commission had successfully hosted NDD merit awards where notable individuals and association who have contributed to the development of the country and their host countries were recognised and honoured.

“Badagry door of return festival is celebrated in October yearly; to commemorate the Nigerian descendants from the slave trade era and the significance of the ancient city of Badagry during that period,’’ she said.

Ms Sharon Dimanche, Chief of Mission International Organisation for Migration (IOM) Nigeria, commended NiDCOM for the organisation and success stories in the past years.

Dimanche said that it underscored the unique role of Nigerian diaspora as a catalyst for inclusive and sustainable development.

According to her that the Nigerian diaspora has consistently demonstrated resilience, innovation, and patriotism.

“According to the World Bank, in 2024, global official remittances was 905 billion dollars, with Sub-Saharan Africa receiving 56 billion dollars.

“Of this, Nigeria recorded a significant inflow of 20.93 billion dollars, an 8.9 per cent increase from the previous year as reported by the Central Bank of Nigeria.

“These remittances serve as a vital economic buffer, supporting households, education, healthcare and livelihoods across the country,” she said.

She, however, said that the diaspora’s impact transcended remittances,

“Nigerian professionals in health, technology, education, arts, finance and public administration are transforming institutions globally while maintaining deep ties to their homeland.

“This transnational connection represents an untapped wealth of knowledge, skills and networks critical to national transformation.

“The youth in the diaspora; innovative, digitally savvy and globally connected hold enormous potential to drive entrepreneurship, civic participation, and technological advancement in Nigeria,” she said.

Nigerians in diaspora reaffirm commitment to national development

Meanwhile, the Nigerians in Diaspora Organisation (NiDO) Worldwide reaffirmed its strong commitment to Nigeria’s progress and national development on Friday in Abuja at the 2025 National Diaspora Day and Merit Awards celebration.

This was said by the Coordinating Chairman of NiDO-Worldwide, Mr Chibuzo Ubochi, in a message to mark the day, themed: “Optimising Formidable Diaspora Potential for National Development and Growth.”

The event, tagged “HYBRID,” is scheduled to hold from July 25 to 26 in Abuja.

“Today, we join millions of Nigerians around the globe in celebrating Diaspora Day 2025, a day to honour the resilience, patriotism, and contributions of Nigerians living abroad.

“This is not just a celebration. It is a reaffirmation of our commitment to nation-building and a reminder that wherever we live, Nigeria lives in us,” Ubochi said.

Ubochi, who also chairs NiDO Europe, advocated for full civic inclusion, including the right of Nigerians in the diaspora to vote.

“This is not just about fairness, it is about completing Nigeria’s democratic promise. We wear Nigeria in our hearts, and we are advocating for equal citizenship through diaspora voting,” he said.

He commended the Federal Government under President Bola Tinubu for recognising the vital role of the diaspora in national development, noting that such acknowledgment gave visibility and honour to the decades of service rendered abroad in the name of Nigeria.

Ubochi also expressed gratitude to the Nigerians in Diaspora Commission (NiDCOM) for its leadership, which he said had elevated the status and global relevance of Nigerians in the diaspora.