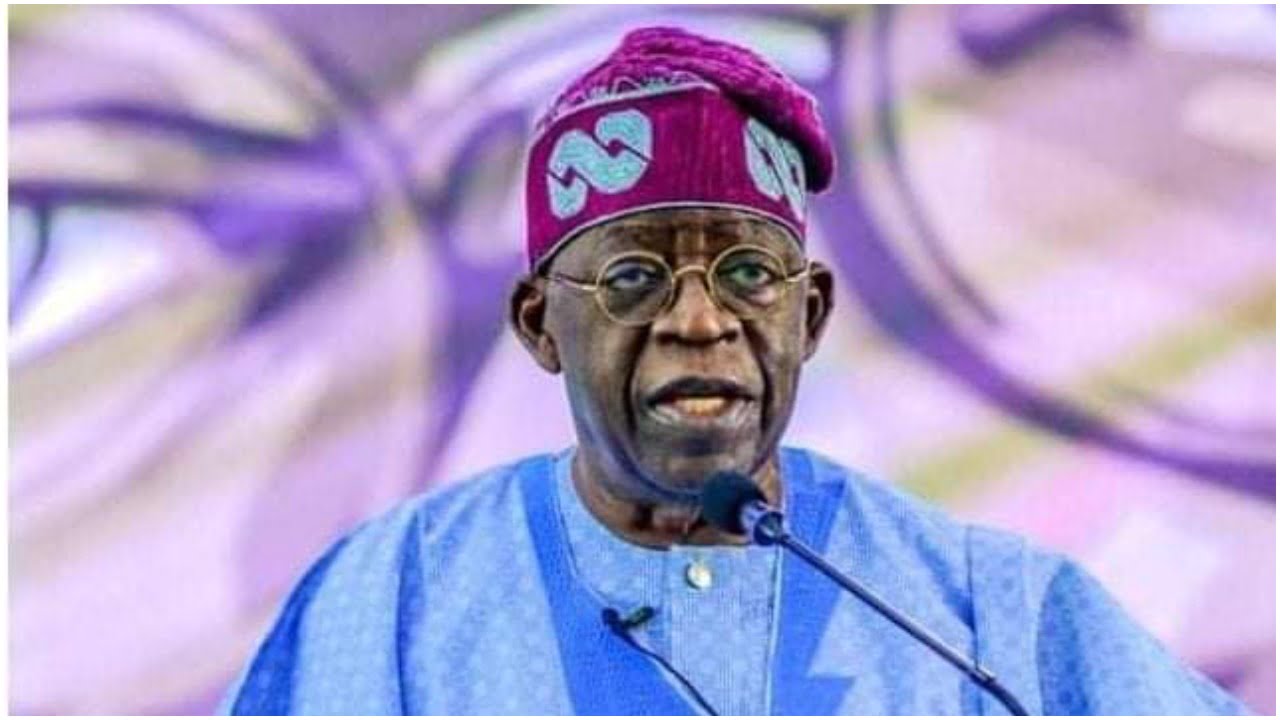

An international news agency headquartered in New York City, Bloomberg Business News revealed that 15 days of President Bola Tinubu, has pulled the right levers for markets.

The agency in its report yesterday disclosed that foreign investors have embraced those decisions, sending Nigeria’s dollar debt surging on Monday.

Recall that Tinubu in his inauguration speech on May 29, announced that the country’s gasoline subsidy was “gone” which many Nigerians described as bold move that had set off riots when previous leaders attempted it.

“Overall, President Tinubu has shown that he’s willing to take on two of the most important factors investors are focusing on, which is fuel subsidies and FX reform, in a very short space of time,” said Thys Louw, a portfolio manager at Ninety One in London.

“Reform momentum in Nigeria has picked up considerably, although from a low level and sustaining this will be important given poor economic conditions Tinubu inherited.”

In two major moves, Tinubu suspended central bank Governor Godwin Emefiele on Friday, and on Monday a senior adviser said it’d be a matter of months before he unified its exchange rates, a key demand of investors and multilateral institutions like the World Bank.

Bloomberg opined that Emefiele is widely considered the chief architect of a set of unorthodox policies including propping up the naira, allowing a complex regime of multiple exchange rates, and lending tens of billions to the government of Tinubu’s predecessor that have been blamed for crippling Africa’s largest economy.

Nigeria’s international bonds due in 2029 jumped the most among emerging-market peers on Monday, a public holiday in Nigeria. Those notes jumped as much as 3 cents before closing around 88 cents on the dollar, the highest since January, according to data compiled by Bloomberg.

The extra yield investors demand to hold the nation’s debt over US Treasuries fell 38 basis points to 7.19 perctange points, according to a JPMorgan index.

The changes at the central bank “could spell the end of unorthodox and often conflicting and confusing monetary policies that held back economic growth and destroyed local and foreign investor confidence,” Ayodeji Dawodu, head of Africa sovereign and corporate credit research at BancTrust & Co. in London, said by phone.

Under Emefiele, the central bank offered the US dollar through several windows at tightly controlled rates, with little liquidity, to businesses and individuals. This forced many to the black market, where the dollar traded more freely but at about a 60% premium to the official rate.

Wale Edun, an influential member of Tinubu’s advisory board, told Bloomberg by phone on Monday that the unification of exchange rates was “imminent.”

“I would say it would have to be done within a quarter as rather than within a year,” he said. “ I think you’re talking, think quarters rather than years, that’s where I would put it.”

Emefiele was widely seen as acting in lockstep with the administration of Tinubu’s predecessor, Muhammadu Buhari. That government was perceived to be more statist and socialist in its approach, said Yemi Kale, chief economist for Nigeria at KPMG LLP and the nation’s former statistician general. “The markets will respond positively to an administration it believes to be more market oriented,” Kale said.

In his inaugural address Tinubu criticized the central bank and vowed to unify the multiple exchange rates in order to “direct funds away from arbitrage into meaningful investment in the plants, equipment and jobs that power the real economy.”

The current naira exchange rate of 471.92 to the dollar, a record low, likely needs to be adjusted to about 700-750 naira, closer to the current black-market rate, JPMorgan analysts said in an note on May 31.

A naira at that level, combined with Tinubu’s decision to remove a costly gasoline subsidy, “means the government does not have to borrow as much, just to pay interest on debt,” Charlie Robertson, head of strategy at FIM Partners, said in a series of posts on Twitter.

The naira has closed lower for three consecutive days, its longest streak of losses since May 12.