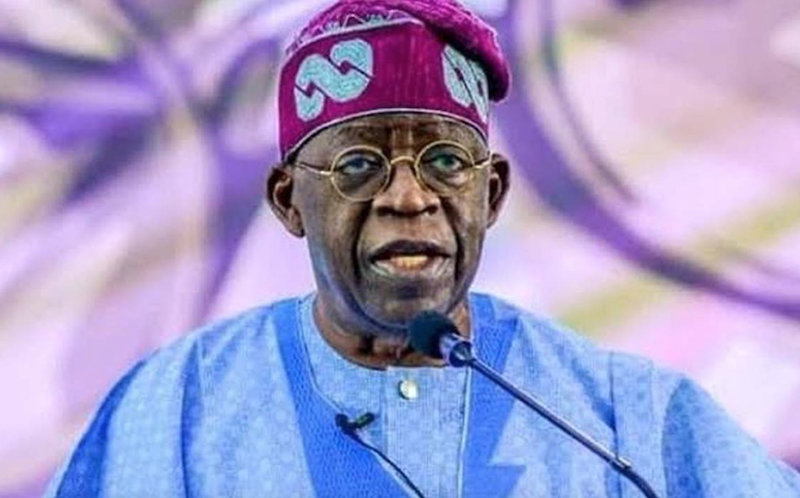

President Bola Tinubu has allayed the fears of the business community, assuring that crucial plans are underway to improve foreign exchange liquidity.

Special Adviser to the President on Media and Publicity, Chief Ajuri Ngelale, in a statement said Tinubu gave the assurance at the 29th Nigerian Economic Summit (NES), held in Abuja on Monday.

Tinubu said his administration would honour every legitimate contract with respect to the nation’s foreign exchange obligations.

The president said he was confident that by working closely with the private sector, financing the 3 trillion U.S. dollars national infrastructure stock could be achieved in 10 years.

He said the construction of mega cities in every geopolitical zone of the size and scale of Lagos must not take six decades because it could be achieved in one decade.

Tinubu emphasised that a fully networked and connected Nigeria by rail, gas, fibre optics and road network could be constructed in less than 20 years with thriving industrial zones in every geopolitical zone before 2030.

”Consistent with our commitment to enshrining fairness and the rule of law in our country, this government will uphold the sanctity of every legitimate contract.

”Specifically, as it relates to the foreign exchange obligations of the government.

“All forward contracts that the government has entered into will be honoured and a framework has been put in place to ensure that these obligations are met in due course.

”My government is not blind to the challenges which several of you are facing in the financial markets.

“I can allay these concerns by revealing that we have a good line of sight into the additional foreign exchange liquidity that is required to restore market confidence,” he said.

Tinubu who assured the business community of a fairer and safer playing field for all, said his administration is strengthening the machinery and architecture of governance.

According to him, his administration is establishing a public and civil service culture and structure that is performance and result-oriented.

”We shall govern ethically, with accountability and transparency; implementing sound and effective policies to accomplish our eight priorities,” he said.

Tinubu outlined the eight priority items of his administration as ending poverty, achieving food security, economic growth and job creation.

Others are: access to capital across all segments of society and the economy, inclusivity, security, fairness and rule of law and anti-corruption.

Tinubu stated that he was committed to delivering improved livelihoods and positive economic outcomes which Nigerians could tangibly feel and experience.

He said that he recognised the institutional frailties of past years and the pragmatic approach to achieving his bold agenda through a path that fully accounts for present-day challenges

”With the effects of an unsustainable fiscal deficit and hidden subsidies, these factors distorted the money supply and created an unfair playing field for an elite crop of unpatriotic forces.

“But that is no more. These changes have been tackled head-on.

“My government has introduced several measures to resuscitate the economy; including the N500 billion intervention to support small businesses and the agricultural sector.

”By January 2024, the new student loan programme and consumer credit schemes will have come into effect,” he said.

The president further called on the private sector to support his vision for a greater Nigeria.

”I would like to charge you, the captains of Industry here present, to commit and redouble your commitment to our vision of a renewed and more prosperous Nigeria, a better Nigeria for all.

”For us to successfully deliver our promise to Nigerians, we recognise that it is imperative that we foster a highly collaborative relationship with the private sector.

”We must work together. I have proven capacity in this regard, as we remember the role of public-private partnership in the transformation of Lagos State under my leadership.

“We will replicate that across Nigeria with your unwavering support.

”Today, I urge you, as Nigeria’s foremost private sector think tank and policy advocacy group, to go much further than you have done before.

”Bring your ideas, bring your leadership, bring your capital, bring the collective will of your large conglomerates and business networks.

”Let us build a future of renewed hope. My government is prepared. Are you also prepared?”, he asked rhetorically.

The annual Nigerian Economic Summit is organised by the Nigerian Economic Summit Group in collaboration with the Federal Ministry of Budget and National Planning.