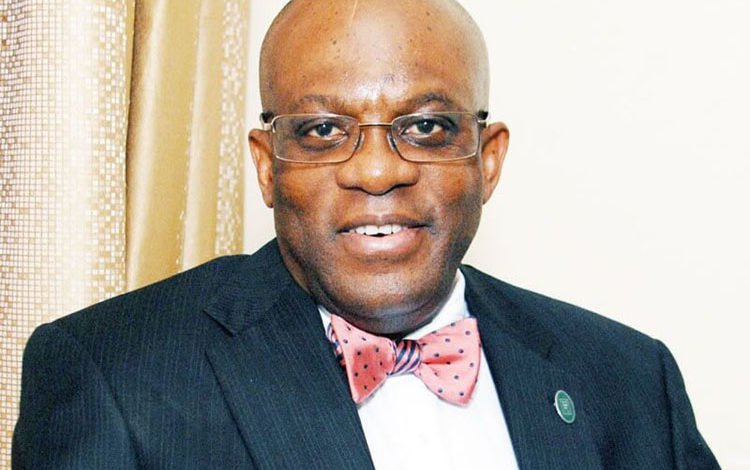

A Federal High Court in Lagos has adjourned till December 18, for the arraignment of the President of the Nigerian Bar Association (NBA), Mr Paul Usoro (SAN), for an alleged N1.4billion fraud.

Justice Muslim Hassan fixed the date to enable the Economic and Financial Crimes Commission (EFCC) serve Usoro with the charge sheet for the alleged offences.

Usoro, who appeared in court in person with a retinue of senior lawyers, had urged the judge through his lead counsel, Chief Wole Olanipekun SAN, to direct the EFCC to serve him in court.

But this was resisted by EFCC counsel, Mr Rotimi Oyedepo.

The anti-graft agency, in a charge marked FHC/418c/18, alleged that Usoro, from Akwa Ibom, converted and laundered the money in connivance with his state Governor, Udom Emmanuel.

The charge sheet, signed by EFCC Counsel, Mr Rotimi Oyedepo, did not list Emmanuel as a defendant.

The EFCC indicated that he is “currently constitutionally immuned against criminal prosecution”.

It did, however, mention four other defendants.

They are: Nsikan Nkan, described as Commissioner for Finance, Akwa Ibom State; Mfon Udomah, described as the Accountant-General of Akwa Ibom State; Uwemedimo Nwoko, described as the Akwa Ibom State Attorney-General and Commissioner for Justice; and Margaret Ukpe, all of whom are said to be at large.

The commission alleged that Usoro, in connivance with the others mentioned, conspired to commit the offence “sometime in 2015 within the jurisdiction of this honourable court”.

The anti-graft agency claimed that the N1.4bn belonged to the Akwa Ibom State Government.

According to Oyedepo, the offences were contrary to Section 18 (a) of the Money Laundering (Prohibition) Act, 2011 and punishable under Section 15(3) of the same Act.