The removal of fuel subsidies and adoption of a more flexible exchange rate system had been significant policy considerations in Nigeria for many years, with the goal of improving efficiency, reducing fiscal pressures, attracting investments, and promoting economic growth.

The Nigerian government in the past subsidized fuel to cushion the impact of fluctuating global oil prices and maintain social stability.

Similarly, Foreign Exchange (FX) subsidies were implemented to provide favorable exchange rates for specific sectors or to support the importation of essential goods and services.

These subsidies were aimed at maintaining price stability and supporting economic activities in key sectors, yet their sustainability and effectiveness remained subjects of debate and criticism.

Subsidies on fuel were associated with issues such as smuggling, market distortions, corruption, and significant fiscal burdens on the government. Foreign exchange subsidies have also faced challenges due to limited forex reserves and the need for more market-driven exchange rate mechanisms.

In a bold move, President Bola Tinubu swiftly announced the removal of fuel and FX subsidies after his inauguration on May 29th, attracting both applauds and criticisms, almost in equal measures.

TheNewsGuru.com (TNG) reports that the removal of these subsidies is set to have far-reaching implications on Nigeria’s economy and business landscape, and highlights the following likely consequences that will shape the future:

Decrease in Air and Noise Pollution

Following the recent removal of subsidies on Premium Motor Spirit (PMS), the price per litre of this commodity has surged from N195 to N537. This significant increase in cost has brought about a notable shift in the usage of generators running on PMS.

As a result, it is anticipated that there will be a decrease in both air and noise pollution, presenting a positive outlook for the environment and public health, particularly in major cities such as Lagos and Abuja where generator reliance is prevalent.

Decongestion of roads

With the soaring cost of purchasing a litre of PMS, many individuals have found it financially burdensome to continue using private vehicles for their daily commute.

As a result, a significant number of workers are now compelled to prioritize cost over convenience and have made the conscious decision to abandon their personal vehicles and join the ranks of public transportation users.

This shift in behaviour has brought about a tangible reduction in the number of private vehicles on the roads, alleviating the congestion that has long plagued major cities like Lagos and Abuja during peak hours.

By embracing public transport as a more affordable alternative, commuters are not only able to mitigate the impact of the price hike on their budgets but also contribute to a more efficient and streamlined traffic flow, resulting in shorter travel times and improved road safety.

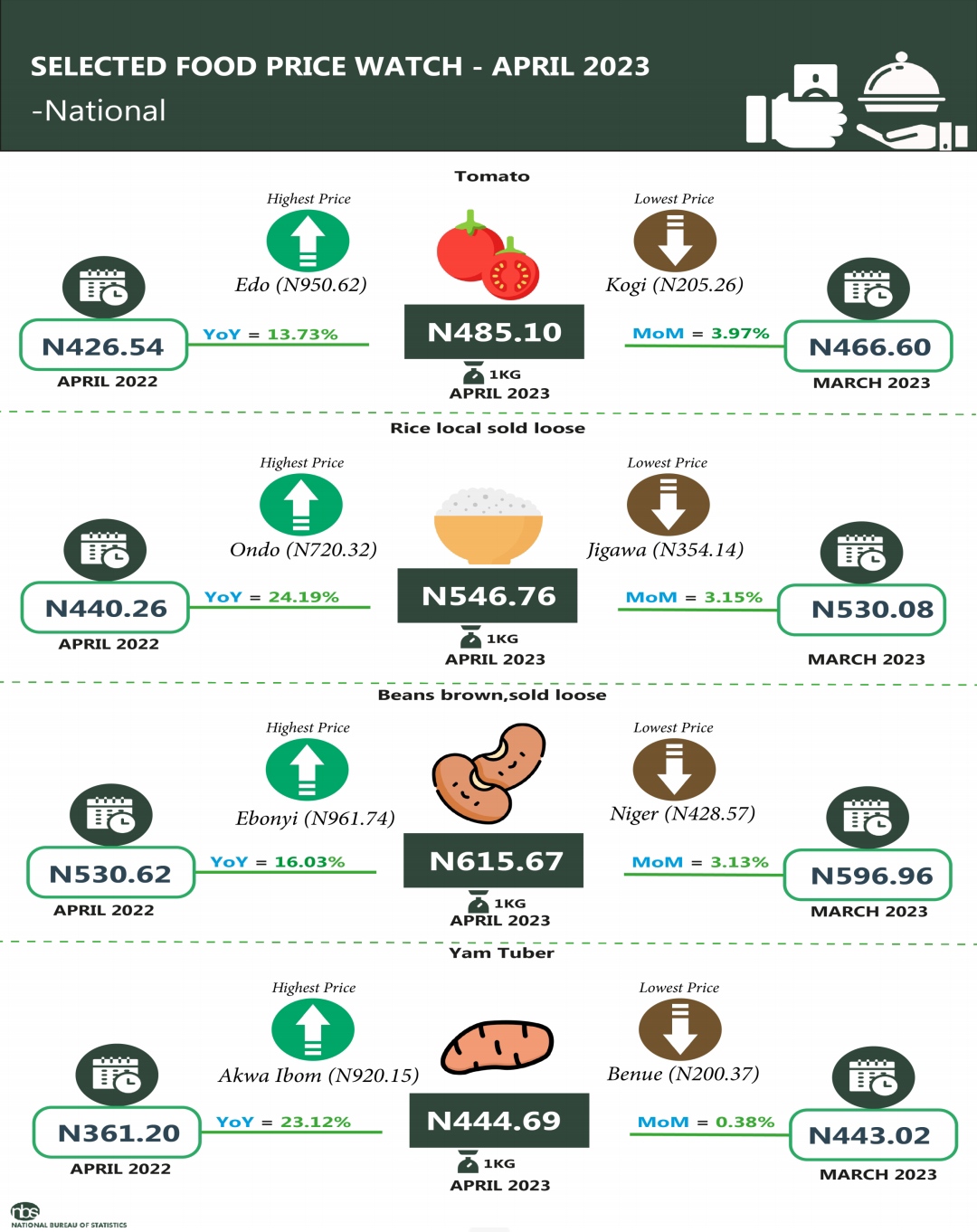

Increase in the price of commodities

The removal of fuel and FX subsidies accompanied by the subsequent increase in fuel prices, has a direct impact on the prices of commodities. The heightened importation and transportation costs, increased production expenses, and currency devaluation all play significant roles in driving inflationary pressures. As producers and suppliers adjust their pricing strategies to account for these added expenses, consumers ultimately bear the brunt of these adjustments through higher prices for goods and services.

High exchange rate volatility

Floating the naira may lead to high exchange rate volatility due to various factors such as market forces, speculation, external events, market sentiment, and limited central bank intervention. These factors contribute to frequent fluctuations in the value of the currency against other currencies, causing uncertainty and risks for businesses. Exchange rate volatility can impact import and export costs, investment decisions, and overall economic stability.

Increase in export competitiveness

When the currency is allowed to fluctuate based on market forces, it can result in a depreciation of the currency’s value. A weaker currency makes exports more affordable and competitive in foreign markets. This can potentially boost export volumes and revenues, benefiting businesses engaged in international trade. The increased competitiveness can help stimulate economic growth and improve the country’s balance of trade.

Increase in capital flows and foreign investment

By adopting a floating exchange rate system, Nigeria will be able to create a more flexible and market-driven exchange rate environment. This increased flexibility can attract foreign investors seeking opportunities.

The ability to freely convert currencies and potentially benefit from exchange rate fluctuations can make the country more appealing for foreign investment. This influx of capital can contribute to economic growth, job creation, and the development of various sectors, reflecting confidence in the country’s economic prospects and policies.

Speaking from Paris, France, President Bola Tinubu highlighted the importance of the removal of fuel subsidy and streamlining the exchange rate to attracting Foreign Direct Investment (FDI) to the country.

Tinubu extended an invitation to prospective investors, urging them to seize the abundance of opportunities that await them in the vibrant Nigerian market and underlined the government’s unyielding commitment to fostering a propitious business environment that caters to the needs and aspirations of both local entrepreneurs and global investors alike.

Increase in debt servicing

the devaluation of the naira increases the cost of servicing foreign currency debt, leading to higher repayment burdens, and affecting the financial stability and ability to meet debt obligations.

Decrease in wealth valuation

The devaluation of the naira can result in a decrease in wealth valuation, particularly for individuals and entities holding assets dominated in foreign currencies. As a result, individuals and entities may experience a reduction in their net worth and financial standing.

This decrease in wealth valuation can also have various implications, including potential changes in investment decisions, asset allocation strategies, and overall financial stability.

In summary, while some challenges may arise, the removal of fuel and FX subsidies is expected to improve fiscal stability and pave the way for a stronger and more resilient economy.