Prof. Ishaq Oloyede, Registrar, Joint Admissions and Matriculation Board (JAMB), says the board has generated N20 billion from University and Tertiary Matriculation Examinations (UTME) between 2016 and 2019.

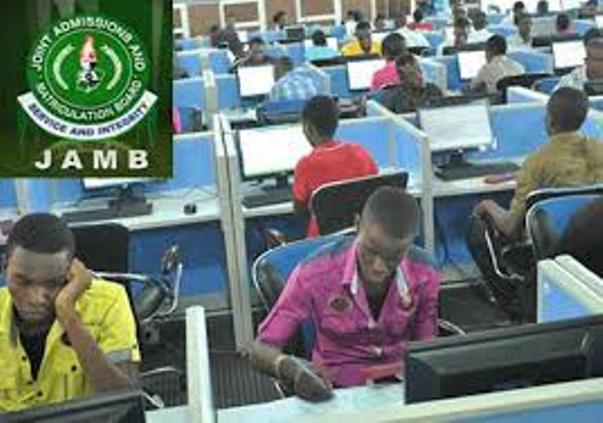

He made the disclosure during a two-day meeting with Computer Based Test (CBT) Centre Operators, State Coordinators of the Board, Financial Institutions and Internet Service Providers on Thursday in Zaria, Kaduna State.

The meeting, which was held at Kongo Conference Hotel, Ahmadu Bello University (ABU), aimed at deliberating on issues affecting the board and way forward.

Oloyede urged CBT centre operators not to worry about their investments while transacting business with the board as long as they were doing their work in accordance with the agreed registration and examination guidelines.

“You have nothing to fear and you should know that, if you put your investments together, it can’t be up to N20bn and we have accrued N20bn in three years as an agency.

“As an aency of government, we have to ensure that small and medium scale businesses thrive and if you multiply 11 staff by 700, you will know better.

“We are also adding value to the economy and job creation out of your employment market and we will continue to support you once you are doing your work well,” he assured.

Oloyede said the board also announced its readiness to deploy drone cameras to all the identified 700 examination centres to check any activity that could jeopardise the efforts of the board from being a transparent agency of government it was known for.

The Registrar directed that: “All CCTV must be wired, all cameras must cover verification areas, coding areas, walk ways, examination hall, server room and entrance and exit in all centres.

“We will use drones to monitor the centres to check registration and examination scandals.”

In the area of prosecution of those caught in the past, he said: “100 candidates caught red-handed are under prosecution – 20 jailed and 80 others are under investigation.

“Last year was for the prosecution of candidates. By the grace of God, it is the urn of CBT centres to be prosecuted. If you do work well, it will reduce the cost of running from one court to the other,” he pleaded.