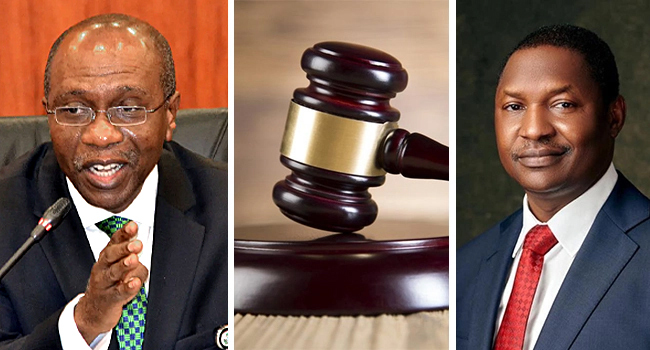

From indications, some state governments are set to initiate contempt proceedings against the Attorney-General of the Federation and Minister of Justice, Abubakar Malami, SAN, and Governor of the Central Bank of Nigeria, Godwin Emefiele, over their refusal to implement the Supreme Court judgment on the naira redesign policy of the Federal Government.

It was gathered on Friday that the Federal Government was served with the enrolled order and Certified True Copy of last week’s Supreme Court judgment, which also ordered that the old N1,000, N500 and N200 should be in circulation alongside the new notes till December 31, 2023.

TheNewsGuru.com (TNG) reports gathered that the non-service of the enrolled order and the CTC of the judgment was responsible for the failure of the Federal Government to direct Emefiele to roll out the old notes already withdrawn from circulation.

The silence of the President, Major General Muhammadu Buhari (retd.), on the judgment of the apex court had fuelled the rejection of the remaining old N1,000 and N500 as legal tender. On Monday, some banks commenced paying customers the old notes in partial compliance with the Supreme Court judgment, but by Wednesday the banks stopped disbursing the old notes as the CBN insisted that it had not given any directive to that effect.

TheNewsGuru.com (TNG) learned that the enrolled order and the CTC of the judgment were served on the AGF on Friday afternoon.

Counsel for Kaduna, Kogi and Zamfara states, which dragged the Federal Government before the Supreme Court on the matter, Abdulhakeem Mustapha (SAN), told one of our correspondents in a telephone interview that Malami was served with the enrolled order and the CTC of the judgment on Friday afternoon, adding that he expected immediate compliance with the judgment as the non-service of the documents had given the government and the CBN an escape route.

Mustapha said, “The Attorney-General of the Federation has been served now and we will take it up from there; if there is no compliance now, we will commence committal proceedings against the attorney-general and the CBN governor. When the Supreme Court talks, the constitution makes it compulsory for all government representatives and everybody to comply with its order. It’s not discretional, you have to obey, it is the last and the final and that is why we have separation of power.

“The presence of separation of power is for checks and balances; when the Supreme Court talks, it must be complied with by all persons.”

The lawyer had earlier told one of our correspondents, “We are waiting for the enrolled order of the court. We are yet to procure it. As soon as we have it, we will take the next step. When the Supreme Court talks, all organs of government comply and if they don’t comply, the rules are clear. We are going to activate the necessary legal steps within the ambit of the law. But we need to get the enrolled order and serve the defendants. That’s where we are.

“Anytime from now, we will be able to get the enrolled order and the Certified True Copy of the judgement, then we will take it up from there. But I can assure you, our clients are monitoring the situation and we will take appropriate steps at the right time.”

Asked what the next step would be if there was still no compliance after serving the AGF the enrolled order and the CTC, Mustapha said, “Courts deal with live issues and not speculations. When we get to the bridge, we will cross it.”

When contacted, the AGF’s media aide, Dr Umar Gwandu, could not be reached as his phone indicated that it was switched off.

State governors, senior lawyers and other stakeholders had since the judgment was delivered been calling on Buhari to direct the CBN governor to direct commercial banks to start giving out the old notes alongside the new ones in order to ease the scarcity of the naira that has crippled the economy.

Governors Nasir El-Rufai of Kaduna State, Yahaya Bello of Kogi State, Bello Matawalle of Zamfara State and Rotimi Akeredolu of Ondo State, among others, had condemned the silence of the President and Emefiele on the judgment.

In the judgment delivered by Justice Agim, the seven-member panel of the apex court held that Buhari breached the constitution in the manner he issued directives for the redesigning of the naira.

On the disobedience of the Supreme Court’s earlier order on the new notes, Justice Agim said Buhari’s broadcast of February 16, 2023 that only the N200 note should remain legal tender made the country’s democracy look like a mere pretension.

Justice Agim stated, “Let me consider the issue of the President’s disobedience of the 8-2-2023 interim order that the new and old versions of naira notes continue to circulate as legal tender until the determination of the pending application for interlocutory injunction. It is not in dispute that the 1st defendant refused to obey the said order.

“The President’s 16-2-2023 national broadcast reproduced here in pages 27-31 demonstrates this disobedience. In disobedience of the order, he directed that only the old N200 naira notes be re-circulated. Interestingly, there is nothing to show the implementation of even that directive. I agree with the 9th plaintiff that the 1st defendant is not entitled to be heard by this court when it has effused to respect the authority of this court and the authority of law from which the authority of the President and the government of Nigeria derives.

“The rule of law upon which our democratic governance is founded becomes illusory if the President of the country or any authority or person refuses to obey the orders of courts. The disobedience of orders of courts by the President in a constitutional democracy as ours is a sign of the failure of the constitution and that democratic governance has become a mere pretension and is now replaced by autocracy or dictatorship.”

The court also dismissed the preliminary objections by the AGF as well as those of Bayelsa and Edo states, and stated that it had jurisdiction to entertain the suit.

CASH DRY-UP IN LAGOS, OGUN BANKS

Meanwhile, it was gathered on Friday that cash had dried up in most banks in Lagos and Ogun states due to what senior bankers described as the inability of the CBN to supply them with new naira notes.

A branch manager of a Tier-1 bank told Saturday PUNCH that his branch last received cash last week Tuesday, adding that bankers were also frustrated about the currency crisis affecting the nation.

The Lagos-based branch manager said, “There have been no supplies of new naira notes to my branch and other neighbouring branches this week. The last supply we got was N5m last week Monday and another N5m the following day. Members of our bullion van team have been on standby throughout this week awaiting signals to come to the CBN to pick cash, but there has been no signal. The N10m we got last week didn’t last up to Wednesday.

“Following the Supreme Court judgment, we were initially paying out the old N1,000 and N500 notes deposited with us and which had not been deposited with the CBN to desperate customers, but we had to stop when the customers came back to complain that people were not accepting the old notes from them.”

Another senior banker corroborated this, adding that his first generation bank had not been supplied new naira notes to disburse to customers.

He said, “Even me as a banker, I can only boast of N100 as I am speaking to you. We have not been supplied with cash this week. The Nigeria Inter-Bank Settlement System Instant Payment platform is not working; the digital payment systems are overwhelmed. When you see crowds at our branches now, we are not giving them cash, what we are doing is to deal with complaints arising from digital payments.

“I think it is deliberate not to supply naira notes to the banks because the government and the CBN don’t want politicians to mop them up. Politicians are desperately looking for cash to pay their agents now. I know of a candidate for the Lagos State House of Assembly, who has launched a passionate appeal to his friends to raise money to pay his party agents, who were not paid after the presidential and National Assembly elections and threatened not to take part in the governorship and state House of Asse

An operations manager in one of the commercial banks said his branch had been unable to dispense cash to customers because it did not have any. She explained that her branch had not received any cash from the headquarters in the last one month, and that the most recent any of the nearby branches received cash was two weeks ago.

“The cash scarcity is getting worse. Even as a bank worker, I don’t have cash to spend. We have not been receiving money from the headquarters and so we have nothing to give to customers,” she added.

Asked if they had a directive to dispense the old notes in compliance with the Supreme Court ruling, she said, “No, there is no communication from our headquarters in that regard. We have some old notes that customers deposited, which we can pay for now, but we don’t have an instruction to disburse them.

“Ordinarily, people expected the banks to start paying the old notes immediately after the Supreme Court ruled on the matter on March 3, but we needed a directive from the CBN through our headquarters to do that. So, the challenge is three-pronged; the CBN did not release the old notes for us to circulate; we don’t have the authorisation to dispense the old notes we have in our vault; and the CBN has refused to supply us new notes. That is what is responsible for the scarcity everywhere.

“The last time my branch received old notes was early February, about a month ago. Our zonal branch received N3m from the headquarters, and under that zone, we have eight branches. By the time that was shared between the eight branches, what got to the branches was insignificant and it didn’t even last a day. Don’t forget that the bankers are also cash-strapped.”

PROTEST IN BAYELSA AGAINST REJECTION OF OLD N1,000 AND N500NOTES

Meanwhile, some residents of Yenagoa, the Bayelsa State capital, on Friday, staged a peaceful protest against the rejection of the old N1,000 and N500 notes by transporters, traders, banks and filling stations.

They complained that the refusal to accept the old notes was disobedience to the Supreme Court judgment, which ordered that the old naira notes should circulate alongside the new ones till December 31, 2023.

The protest took place in the Akenfa suburb of the state capital.

The placard-carrying protesters blocked the Akenfa section of the Mbiama-Yenagoa Road.

The residents’ action caused gridlock and forced commuters to trek long distances, while motorists diverted to other routes.

They called on the Federal Government and Governor Douye Diri to intervene to save residents from suffering.

One of the protesters, Mrs Rebecca Izibeya, said, “Traders and transporters are frustrating people in this town by not collecting the old N500 and N1,000. They have no reason to reject the old naira notes because the Supreme Court said they remain legal tender.”

Another protester, Oyintari Cosmos, said he was fed up with the rejection of the old naira notes since the apex court delivered its verdict.

He said, “From what I know, nobody is supposed to go against the judgment of the Supreme Court. Everybody is supposed to obey the Supreme Court and accept the old N1,000 and N500 notes.

“But surprisingly in Yenagoa, some traders and Keke riders, even some banks, filling stations, eateries and supermarkets are rejecting the old naira notes. It is wrong and unacceptable. I don’t know what is wrong with us Nigerians.”

Motorists and road users plying the Onitsha-Owerri Road were left stranded for many hours on Thursday night as security operatives believed to be naval ratings at the Enamel bus stop rejected old naira notes from tricycle operators.

Tricycle and shuttle bus operators, passengers as well as other motorists have been complaining about being subjected to hardship as a result of gridlock caused by the naval ratings, who mount roadblocks on both ends of the expressway on a daily basis.

They complained that these security operatives, operating under the guise of enforcing a 6am to 6pm curfew imposed by the Anambra State Government, always barricaded more than half of the road with sacks of sand to create a checkpoint, where they extort commercial motorists every night.

The state governor, Prof Chukwuma Soludo, had in July 2022 imposed the curfew on about eight local government areas of the state, including the Ogbaru, as a result of insecurity.

The section where the security men mounted a roadblock on the Onitsha-Owerri Expressway falls under the Ogbaru LGA.

It was gathered that following the development, naval ratings at the checkpoint always collect N200 from each tricycle operator, N500 from shuttle bus drivers and N1,000 from lorry drivers.

When contacted, the state police spokesman, DSP Tochukwu Ikenga, denied knowledge of the activities of the military men.

“You have just drawn my attention to the situation and efforts will be made to ensure that it is stopped. For those who have fallen victims, we urge them to make use of our complaint lines,” Ikenga added.

The Press Secretary to the Governor, Christian Aburime, referred Saturday PUNCH to the Special Adviser on Security to the Governor, AVM Ben Chiobi, who did not respond to calls and messages sent to his mobile telephone.