Tag: Housing Deficit

-

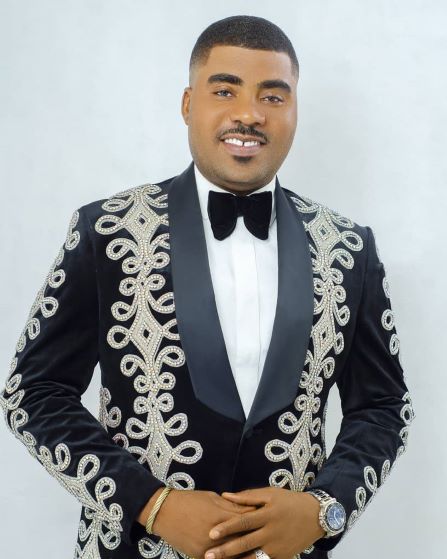

Government only cannot address the housing deficit in Nigeria – Michael Adeyemi

A real estate entrepreneur, builder, Michael Adeyemi has noted that the rapid growth in urbanisation and population in Nigeria, has ensured that the real estate sector will keep experiencing a major growth in Nigeria’s economy.He added that the current housing problem in major cities of Nigeria cannot be left in the hands of government only to solve.While granting interview to news men, Adeyemi the CEO of Realtormax posited that Government alone cannot address the housing deficit in the country.He posited that due to SDG 11, there is a need for the private sector and government to collaborate in creating and developing sustainable cities accross major parts of the country to curb housing deficit.Adeyemi called on individuals and investors to key into real estate sector, saying that everyone has a role to play.According to him, the population of Nigeria is massive for the federal or state government alone to handle in terms of providing affordable homes for everybody.He said that the private sector needs to come in to bridge the gap between government and the people in a bid to creating sustainable cities and affordable homes.Continuing, the Chief Executive Officer of Realtormax Nigeria Limited, said that everybody should be entitled to own a house as a citizen of the country.He noted that low income earners and high income earners should be given an opportunity to buy a landed property and build on them.Stressing that a system where people can be paying in bit at their own convenience should be introduced in order for everyone to be accommodated.Similarly, Adeyemi added that the real estate sector has the capacity to reduced unemployment in the country, adding that from, engineering graduates having access to job opportunities, to sales executive, accounting and finance, quantity surveyors , town planners , architects etc the job opportunities and openings in this sector are endless to name a few.The Realtormax boss, added that his organisation are doing massive recruitment to engage about 10,000 Nigerians in the real estate sector currently, saying they are set to create employment opportunities for those who are willing to be gainfully engaged and as such reduce unemployment.He also emphasized that what the real estate sector brings to the economy is enormous hence, it has become a sector to be given crucial attention and investment. -

Police force facing gross housing deficit – IGP

The Inspector General of Police (IGP) Mr Usman Baba, says the Nigeria Police Force is facing gross housing deficit as less than 10 per cent of its personnel have proper accommodation.

He said this on Thursday in Abuja at the Quarter Four 2021 Public Private Partnership Units Consultative (3PUCF) meeting organised by the Infrastructure Concession Regulatory Commission (ICRC).

The 3PUCF forum was initiated by the ICRC to provide a stakeholder engagement platform that would enhance knowledge and experience sharing among key PPP personnel in MDAs.

The IGP was represented by Deputy Inspector General (DIG) on Logistics and Supply, Mr Zanna Ibrahim.

The IGP said a good living condition was important for optimal service delivery as housing was considered a fundamental physiological human need and the foundation on which to develop higher human motivation.

“It will surprise you to know that with a workforce of over 350,000 in staff strength, the NPF has less than 10 per cent of its personnel quartered in befitting barracks accommodation.

“The state of disrepair and integrity failure in our barracks need no emphasis and we are really in dire need of befitting accommodation to enable us tackle the art and act of policing the nation optimally.

“Suffice to add that there is an ongoing initiative to recruit 10,000 constables for the next six years annually, thereby increasing the housing needs for police officers and men,” he said.

Baba also said that the force was resolute in following due process based on extant laws in the pursuit of infrastructural development through PPP.

The IGP said that decay in police infrastructure, negative maintenance culture, years of neglect due to poor budgetary allocation, destruction of police infrastructure resulting from ENDSARS protests, banditry, Boko-Haram/IPOB activities and some others were still being grappled with.

He, however, said that irrespective of those, the force was seeking better collaboration with critical stakeholders toward revamping, improving and sustaining a better security architecture for the nation.

Mr Micheal Ohiani, the Acting Director-General, ICRC, said that as at Oct. 31, the organisation had issued 14 Outline Business Case (OBC) compliance certificates and three Full Business Case (FBC) compliance certificates.

“This brings the total compliance certificates granted since inception of ICRC to 113 OBC and 44 FBC.”

He said that the commission had started to charge fees for its regulatory activities, including the review of OBC and FBC and other documents.

He also said that the organisation had facilitated World Bank sponsored trainings for 60 people from different organisations, with the aim of global certification for members.

According to Ohiani, with Nigeria’s population and market, the goal is to be the PPP experts in Africa.

The News Agency of Nigeria (NAN) reports that ICRC was established to regulate PPP activities in Nigeria towards addressing physical infrastructure deficit which hampers economic development.

-

Fashola insists no housing deficit crisis in Nigeria

The Minister of Works and Housing, Babatunde Fashola on Thursday refuted a widespread statistic claiming that Nigeria has a 17 million housing deficit, pointing out that no such deficit exists anywhere in the world.

The minister made the comment during a ministerial briefing organized by the Presidential Communication Team at the State House in Abuja.

The statistic is purported to have been generated by the National Bureau of Statistics for the date ending August 2012 and has been quoted in documents published by consulting firm PWC.

According to Fashola, an official census must be conducted to give a definitive response to Nigeria’s housing deficit situation.

He said Nigeria is a country with significant number of empty houses particularly in the urban areas and cannot be said hold such a figure.

He noted that the Federal Government has, since 2015, investigated the source of the statistics and has consulted with the World bank, African Development Bank and the NBS but is yet to ascertain the source of the said data.

Meanwhile, the Minister reiterated the need to run a maintenance economy.

He said there was a plan to approach President Muhammadu Buhari to submit the proposition that an executive order be raised to compel action, because there is currently no specific amount of budget for maintenance.

Fashola argued that running a maintenance economy, as evident in the rehabilitation of about 24 Federal secretariats, would engender the creation of more jobs in the country.

-

The Imperatives Of SDGs: Prognoses And Remedies For Housing Deficit In Nigeria, By Debo Oladimeji

By Debo Oladimeji

This report aims to look at the problems in the housing sector in Nigeria and the solutions. It is in my opinion that we should take a cue from declarations by the United Nations on Housing and such other development initiatives like the Sustainable Development Goals 1,3,6,11, and the rest that set targets for minimum development requirements within a given period to solve the problem of housing deficit in Nigeria.

Nigeria’s population is currently put at about 194 million people, while the United Nations estimates that the figure will rise to 400 million by 2050. By that estimate, Nigeria will be the most populous country in the world after China and India. However, available data put Nigeria’s housing deficit at 22 million. Aware of the consequences of the fast-growing population in the housing sector, various governments had put measures in place to address the housing challenge. The measures and policies included-enactment of the Land Use Act of 1978, Mortgage Institutions Act, 1989, Federal Housing Authority (FHA) Act, 1990, National Urban Development Policy, 1997, Housing and Urban Development Policy, 2002, among others. In spite of the numerous policies on housing, not much has been achieved.

One of the problems in the housing sector is that of affordability by Nigerians. Most of the houses for let are beyond the reach of average citizens.

The high number of unoccupied houses in Abuja and Lagos is gradually becoming a cause for concern, especially as many residents cannot afford the rent.

Inaccessibility of land has been a major hindrance to Nigerians having their own houses. In some places in Abuja and Lagos, the cost of buying a land is much more than building a house. Many Nigerians cannot afford to build houses due to their meagre earnings.

The cost of construction in Nigeria is high. A bag of cement was sold for N150.00 in 1987. A bag of cement was sold for N2,300 before the government intervened in 2011 and the price dropped to N1,950.

Today a bag of cement is sold for N3,600. The prices for other building materials had equally doubled if not tripled making it difficult for many people to build a house of their own.

Lack of a well define cooperative society is another factor responsible for the housing crisis in Nigeria. Here in Nigeria we are more into agric cooperative. We don’t have a structure for cooperative housing yet.

We also have the problem of poor infrastructural facilities. In most villages and cities the basic amenities like good roads, potable water, health facilities, etc are either lacking or not functional. It is no longer news that in Nigeria, every home and corporate organisation is like a government, providing all the basic facilities it needs to function optimally.

Inconsistency in government policy is another concern. The on-going National Housing Programme is a new housing policy conceived by the present administration with the aim of providing affordable houses for Nigerians.

However, the Federal Government is yet to settle those people who paid for the Federal Government low cost housing schemes since 1994.

Another area that lacked government’s attention over the years is on adequate data of the housing population. Lack of adequate data for planning was discovered during the covid-19 lockdown. That impeded the government’s effort in distributing economic stimulus, which comes in form of food packs during the pandemic.

We also have the problem of omoonile (land grabbers). The problem people have with buying land has to do with the nature of Land Use Act in Nigeria. In 1978 when the Land Use Act was promulgated, it was illegal to sell or buy land. So where does omoonile come in? Both the buyers and the sellers are doing illegal thing, because, according to the Land Use Act, selling of land should be the business of the government.

Many Nigerians are having issues with supply of prepaid meters, which will make the people enjoy right billing of electricity. Another issue is that of transformers. Most communities are now finding it difficult to replace their old transformers with new ones.

There is also the problem of forced evictions by the government. Recently the civil servants living in 1004 and other Federal Government Estates in Lagos were evicted from their houses. The 1004 Estate was sold to the high and the mighty in the society after the civil servants were evicted from their houses.

There was also the case of the residents of Maroko that were chased out of their houses by the military government and their land was forcefully taken over. The place that the government claimed that was a slum then is today a cynosure of all eyes. Since the people of Maroko were evicted from their houses most of them have been living in slums.

They don’t have access to social distancing and potable water to flatten the curve of covid-19 pandemic. This is against the spirit of the Sustainable Development Goals, SDGs.

In Nigeria today, there is really not a mortgage finance industry. Where they exist, their effect has been minimally felt with the few mortgage institutions undertaking almost purely commercial banking activities.

This unfortunate situation has been aggravated by the fact that financial institutions operating in Nigeria do not have access to long-term funds.

Most estimates suggest that only around 20 per cent participate in informal banking sector, with the remaining 80 per cent dealing almost entirely in cash. With this in mind, much of the population is ineligible for loans of any kind, as it is impossible for financial institutions to confirm creditworthiness due to a lack of history.

If Nigeria must solve its housing deficit issues, it must look at the issues holistically and develop concrete plans that will address basic needs that will promote equal growth in all its urban locations.

To start with and most critical of all in remedying the situation is the need for the government to fund a proper census that would address the various types of accommodation currently available nationwide. The results should then be harmonized with the current population census with a proper stratification of the various age groups and their numbers.

The Land Use Decree should be reviewed to make it in consonance with the times. Land titling should be made affordable like it is the practice in the developed economies. Nigerians paying 15 percent of the cost of land is very disheartening.

Addressing the housing deficit must go hand-in-hand with the promotion of the use of local building materials and technology. There is need to continually bring to the fore, trends, technologies, systems, and policy issues that impact on the building industry’s intervention and responses to everyday living.

With Over 3,000 Housing Estates in Abuja, deficit still reaches nearly two million.

Consequently, many people have to seek more affordable accommodation in the outskirts of the city. The solution to the vacant houses is for the government to provide more affordable houses for the people. Housing being one of the basic needs of man, government should not see investments in this sector from the profit motive only. Governments should view the returns more from the positive social impact of developments.

There is need for a robust savings schemes through cooperative society to ensure inclusive growth and development in the housing sector. We must save for the raining day and the system in saving and credit is that whatever you have saved would be given to you double the amount.

Other solutions are: Research and Development in association with local manufacturers. There is also the need for the government to fast-track the development of infrastructure in the satellite towns to check the high cost of accommodation in Nigeria.

Policy inconsistency is unhealthy for the growth of any country’s housing sector. The Federal Government should adopt strategies that developed nations had used to optimally provide accommodation for their citizens.Also crucial is the need for an urgent passage of several bills in the housing sector that have been lying dormant in the National Assembly for years.

It is also the time the government take to the advice of the United Nations (UN). Due to the housing deficit in Nigeria, a UN Special Rapporteur on the Rights to Adequate Housing, Leilana Farha advised the Nigerian Government to start taxing vacant houses in the country.

These monies can be ploughed back into the construction of decent and affordable homes for Nigerians to buy. The government should also tackle the issue of corruption head-on.

Where evictions become inevitable, it should be carried out in consultation with the affected communities with provision of an alternative relocation.

-

Fashola speaks on 20m housing deficit, other sectoral challenges

…says 10 percent equity contribution to NHF has removed

Minister for Works, Housing and Power Babatunde Fashola (SAN), Tuesday dismissed insinuations that Nigeria has five million housing deficit.

He conceded that Nigeria has housing challenges, but added that housing challenges are universal phenomenal.

The minister told reporters in Ilorin, the Kwara state capital at the end of a capacity building workshop for Federal Controllers of lands and housing in the country.

The theme of the training is “learning and development for greater stature.”

Mr. Fashola revealed that the ministry had removed the mandatory 10 percent equity contribution before accessing loan from the National Housing Funds (NHF).

He said: “First of all I don’t believe that 20 million housing deficit number. Nobody has owned up to it. It is a number of no origin, I say so. So the person who did that data should come up and take ownership of it.

“But that is not to say that there is no housing challenge. We have it, every country in the world has it. Its level and degree is a function of so many things. It is perhaps, more pronounced in the urban centres as it is in the rural areas. But even in the urban centres there are still empty houses even where there is a problem of shelter.

“What we are doing is to try and complete ongoing projects that we met. We have started our own national housing programme. The idea is to design a product that Nigerians accept and can afford. One of the reasons why we have a number of empty buildings and houses is that some of these buildings are acceptable or are not affordable or both.

So we are trying to create a model that will be acceptable for the people. “Some of the other thing we are doing is to grant funding for people who contribute to the National Housing Fund (NHF) by way of mortgage. That is happening. We are improving access by reducing the amount you have to contribute. Those who wanted to borrow up to five million naira for example, their equity contribution was about 10 percent.

“We know that some people will not have N500,000 to contribute and deposit, we have removed that. They can borrow and what they should have contributed is now capitalized into what they will pay.

“That opens the door of access. You are not denied because you did not have the fund to self-contribute. We have also reduced the amount of which you are borrowing five million Naira and above from 15 percent down to about 10 percent.”

On consents and title documentation, the minister said that “we are also dealing with backlogs of title documenting and transactions, such consent to transact land. This is also a barrier to access. If you cannot finish the documentation, you might probably not get the funding. If you don’t have the title you might also be denied access to funding.

“So we have those backlogs of consent and certificate of occupancy (C of Os). As at April 19th this year, we signed 2,400 certificates of occupancy, we issued 1,214 consents to transact business on land.

These are things, some of which have been pending since the 1990s. We are attacking housing challenge in many fronts.”

On the power to revoke the licenses of DISCOs, he said: “The power to regulate DISCOs rests with the Nigerian Electricity Regulatory Commission (NERC) not in the ministry. It is a power vested by law, so the ministry cannot interfere with that power. It is a statutory power. The ministry is only saddled with policy directive which I have given in documents, letters and all of that. Don’t forget that before the privatization, the ministry had well over 50,000 staff. The staff strength of the ministry is now 779.

-

Dogara advocates private sector participation to tackle housing deficit in Nigeria

…frowns at violation of NHF Act, housing policies

…says New Housing Laws to cover self-employed Nigerians

Speaker of the House of Representatives, Hon. Yakubu Dogara has called for increased private sector participation in order to address the national housing deficit and pledged the commitment of the House towards enacting the required legislation.

Speaking at a public hearing by the House Committee on Housing on a motion and four bills related to the National Housing Fund and the Federal Mortgage Bank of Nigeria, Dogara stated that citizens’ welfare should be of utmost importance to any government and shelter should, therefore, be considered a foremost priority.

“The government of the Federal Republic of Nigeria has a duty and responsibility to carter for the welfare of its people. Housing or shelter is one of the most important and fundamental needs of man. The very concept of human dignity requires that a man should have a roof over his head. This is why the Fundamental Objectives and Directive Principles of State Policy of the 1999 Constitution of Nigeria provides, inter alia, that the “state shall direct its policy towards ensuring that suitable and adequate shelter, suitable and adequate food, reasonable national minimum wage, old-age care and pensions, and unemployment and sickness benefits are provided for all citizens”

He further revealed that the proposed amendments would make housing laws more encompassing and introduce the necessary changes, as existing schemes have not been very successful.

“The National Housing Funds (NHF) scheme was designed to assist public servants own homes while saving a percentage of their income. The private sector employees were also captured under the Act. Similarly, the government – through mortgage institutions – is expected to provide loans to real estate developers to build low-cost houses for the people. Unfortunately, both programmes have not yielded the desired results as Houses are still not within the reach of the generality of Nigerians. Indeed, the provisions of the National Housing Fund Act and Federal Mortgage Bank of Nigeria Act are observed more in breach by most stakeholders mandated to perform one responsibility or the other under the laws. The proposed amendments capture virtually everybody including self-employed persons.”

He pledged the commitment of the House to working with stakeholders towards the provision of safe and affordable housing.

“Let me assure you of the determination of the House to collaborate with all stakeholders in ensuring supply of safe and affordable homes and provision of viable legislative frameworks that will lead to private sector participation and ownership in order to reduce these deficits. The Bills being considered today will have far-reaching effects on many institutions and stakeholders and these stakeholders should pay attention to the issues and offer workable solutions.”

Stakeholders in the housing sector include The Central Bank of Nigeria, The Pension Commission, Pension Fund Administrators, Commercial and Merchant Banks, the Federal Mortgage Bank, the Organised private sector, the Nigerian Labour Congress, the National Insurance Commission of Nigeria, Employers of Labour both private and public, NSITF, among others.

The motion and bills considered during the public hearing are; A motion on the need to ensure full compliance with the National Housing Fund Act for effective housing delivery in Nigeria (HR.59/2017); A Bill for an Act to repeal the National Housing Fund Act Cap. N45, Laws of the Federation of Nigeria, 2004 and Re-enact a National Housing Fund and for related matters (HB.1077); A Bill for an Act to repeal the National Housing Fund Act Cap. N45, Laws of the Federation of Nigeria, 2004 and Establish the National Housing Trust Fund Act, and for related matters (HB.891); A Bill for an Act to Repeal the Federal Mortgage Bank of Nigeria Act, Cap. F16 Laws of the Federation of Nigeria, 2004 to make comprehensive provisions for the re-establishment of the Federal Mortgage Bank of Nigeria and its Board of Directors and for related matters (HB.911); and A Bill for an Act to establish the Institute of Mortgage Brokers and Lenders of Nigeria to regulate the activities and ensure professionalism in the system and for related matters (HB.465).

-

Nigeria operates housing deficit of over 17 million units – Adeosun

The Minister of Finance, Mrs. Kemi Adeosun has said Nigeria currently operatives an estimated housing deficit of 17 million units with an estimated increase of 900,000 annually.

Adeosun said this in a meeting representatives from International Finance Institutions at the World Bank Spring Meetings to take forwards discussions on Nigeria’s agenda to deliver affordable housing.

Speaking at the meeting, the Adeosun said: “Delivering affordable housing is critical to the delivery of our reform agenda and is one of the key pillars for implementation we have been discussing in Washington this week.

“Nigeria has an estimated housing deficit of 17 million units, and with an estimated increase of 900,000 annually. Some of the reasons for this are clear.

“Interest rates are high for both developers and home buyers, and the tenure of debt remains too short. As a result, we have to find a way to accelerate the provision of affordable homes. That is why we have established the Family Homes Fund.

“We have requested N100 billion in the 2017 budget and for the subsequent three years as part of the Medium Term Expenditure Framework (MTEF), this is seed funding from the government, but this is not solely a public sector scheme, it will be a partnership with the private sector and we are looking to mobilise additional resources from domestic and external sources.

“The Fund will enable us to deliver discounted mortgages for home owners, while also enabling access to attractive funding mechanisms for developers. We are piloting in 6 states and the results of those pilots will guide long term programme implementation.”

TheNewsGuru.com reports that the Minister is conducting a series of meetings on the implementation of some of the critical projects in the Economic Recovery and Growth Plan including meetings on Housing, Water, Power and Food Security.

“Many of these projects are already well advanced and we have had a series of productive meetings in Washington with development partners to advance those projects and hopefully accelerate implementation so we can meet the ambitious but achievable goals we have set ourselves.”