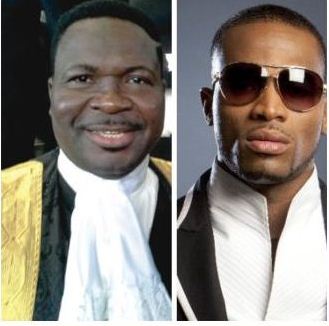

Human Rights Activist, Chief Mike Ozekhome SAN, has described as unwarranted, illegal and unconstitutional, the three days detention of Nigerian singer, Oladapo Daniel Oyebanji, aka D’banj, by the Independent Corrupt Practices and other Related Offences Commission, ICPC.

The singer’s lawyer (Ozekhome) noted that the ICPC investigated and found nothing incriminating against him, hence released on administrative bail to him.

It would be recalled that the anti-graft agency detained D’Banj on Tuesday, 6th November 2022 after he surrendered himself at the ICPC’s headquarters in Abuja.

“D’Banj ‘s unnecessary detention for 3 whole days after cooperating with the ICPC by voluntarily cutting short his full engagements in South Africa, came to us as a big surprise. This is because he was neither a fugitive fleeing from justice nor a Defendant already undergoing a trial and jumping bail.

D’Banj hereby emphatically denies and maintains his innocence in any involvement in the alleged diversion of the sum of N900m N-Power empowerment scheme

“One would have expected that having voluntarily submitted himself and answered the ICPC ‘s call from South Africa to enable him clear his good name and solid reputation, by helping in its investigation, Dbanj ought to have been immediately released on administrative bail.

“Unfortunately, we witnessed the usual, now infamous media trial for which the anti-corruption agencies are now known, through a clandestine release to the public, skewed details concerning his invitation, arrest and illegal detention, with no scintila of evidence found against him after three days of interrogation.

“The ICPC ought to have first carried out a thorough investigation before issuing a pre-emptive damaging press release which,by its very screaming heading, had literally pronounced Dbanj guilty and culpable of fanthom, unproven and unprovable allegations even before investigation had commenced,” Ozekhome said.

How not to fight corruption

He added: “This is how not to fight corruption-a sad and unworkable template of media trial and the “name-and-shame” mantra. This invariably delivers the innocent into the hands mob hysteria and internet space-lynching, thus painting even the innocent such as Dbanj, guilty of a false allegation, with the paintbrush of shame, odium and obloquy, even before the investigation has commenced and been concluded.

Let everyone learn to respect the presumption of innocence of all citizens, until proven guilty, as enshrined in section 36 of the Nigerian Constitution

“It amounts to works from the answer to the question. It amounts to first detaining an innocent citizen, painting him black, and then fishing for non-existent evidence to nail him.

“D’Banj hereby emphatically denies and maintains his innocence in any involvement in the alleged diversion of the sum of N900m N-Power empowerment scheme meant for beneficiaries or any amount for that matter. Nothing incriminating has been found against Dbanj by the ICPC after the whopping days of deep and uninterrupted investigation.”

Make public account details of D’Banj and minister involved in the arrest

“This is calling on the ICPC to thoroughly investigate this matter by inviting the minister who allegedly called in the ICPC, with all those alleged collaborators, and make public their account details, including Dbanj’s account details which are already in its possession.

“Where the ICPC finds the evident witch-hunting and name-dopping of Dbanj, the least expected of this distinguished agency is to tender a public apology to Dbanj. It is so cheap and very easy to hurriedly demonize and accuse an innocent person, especially where his accusers leverage on his celebrity status to attempt tearing him to pieces and fling him under a powerful government moving train.

“This attitude must stop. The 1946 immortal words of Martin Niemoller, a German theologian and Lutheran Pastor, which he uttered after World War 11, in which he had opposed Hitler’s despotic Nazi regime, are quite instructive here. Kindly read and digest them. Let everyone learn to respect the presumption of innocence of all citizens, until proven guilty, as enshrined in section 36 of the Nigerian Constitution,” Ozekhome asserted.