The Abia State Government has announced the approval of $125 million Islamic Bank (IsDB) Loan financing facility by the Federal Executive Council at its meeting of Wednesday, Aug. 13.

Mr Ukoha Njoku, the Chief Press Secretary to Gov. Alex Otti, disclosed this in a statement issued to newsmen in Umuahia on Thursday.

Ukoha added that the facility would be used for the state Integrated Infrastructure Development Project.

“This approval marks a major milestone in a project that has undergone extensive consultations and procedural steps.

“The fund is a critical component of the overall co-financing arrangement for the state’s ambitious infrastructure development drive. The project’s total cost is $263.80 million,” Ukoha stated.

He added that $100 million would be sourced from the African Development Bank (AfDB).

According to him, $15 million will be obtained from the Canada–Africa Development Bank; while $23.80 million counterpart fund would come from the State Government.

Ukoha described the IsDB facility as particularly significant “because its financing agreement must be signed for the project to proceed, given the integrated nature of the co-financing structure.

He stated: “The AfDB and Canada–Africa Development Bank financing agreements have already been concluded, with the AfDB loan agreement signed earlier this year.

“Under the project, the IsDB financing will support the construction of approximately 126 kilometres of road network in Aba and 35.57 kilometres in Umuahia.”

He explained that the road projects would include a link road between the two cities, as well as critical erosion control works within the project sites.

He stated that when completed, the projects would reduce travel time in Abia’s busiest urban corridors and create over 3,000 jobs for local residents.

He further added that the project would reduce greenhouse gas emissions, improve access to social services; and attract private sector investments.

Ukoha added that the project, owned by Abia Government, would be executed through the State Ministry of Works, under the supervision of the State Steering Committee.

He noted that the steering committee would provide policy direction for the State Project Implementation Unit and all the stakeholders in the project.

He further explained that the IsDB-financed components, covering civil works and consultancy services, would follow the bank’s procurement guidelines, with disbursements made directly to contractors and consultants.

”This milestone follows sustained engagement and intergovernmental coordination. This approval is also a direct complement to the visionary infrastructural development agenda of the administration,” he added.

Ukoha stated that since assuming office, Otti had made Abia road network’s modernisation, revitalisation of urban centres, and integration of sustainable development principles a cornerstone of his administration.

“The IsDB facility will strengthen these ongoing efforts, accelerating the pace of road reconstruction in Aba and Umuahia.

“It will also address critical erosion challenges, and lay the groundwork for an integrated transportation network that supports commerce, improves quality of life, and enhances Abia’s competitiveness,” he added.

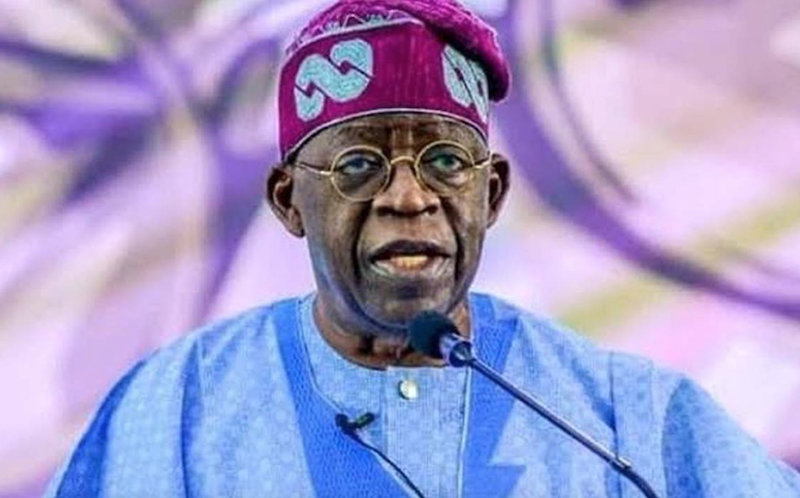

Ukoha quoted Otti to have expressed appreciation to President Bola Tinubu for his trust and pragmatic leadership and the National Assembly for approving the borrowing plan.

He added that the governor also thanked the Minister of Finance and Coordinating Minister of the Economy, Mr Wale Edun, for his leadership in concluding the financing process.

The statement further quoted the governor as thanking the Secretary to the Government of the Federation, Attorney General of the Federation, the Vice President IsDB, Dr Mansur Muhktar and all other stakeholders that contributed to making the request for the facility successful.

He also stated that Otti remarked that the project would complement his administration’s ongoing infrastructural development initiatives.

“He believed that such initiatives are aimed at modernising Abia’s transportation network, revitalising urban centres, and positioning the state as a hub for sustainable economic growth,” the statement added.