Hundreds of youths in Delta State took to the streets to protest against a fresh loan request by the State Governor, Ifeanyi Okowa.

The protesters on Monday blocked the ever-busy Effurun/Agbarho section of the East-West Road in Delta State.

The protesters specifically warned commercial banks in the country to desist from granting additional fresh loans to Governor Okowa-led government at the peak of political activities in the State.

The youths under the aegis of concerned stakeholders from several civil society organizations (CSOs) warned that any bank still granting loans to Okowa-led government “is doing so at their own peril”.

They alleged that such loans were being diverted to fund political activities at the detriment of the people of the State.

They condemned the continued “borrowing spree” by the PDP-led government, saying that there was nothing to show for the huge loans and federal allocation that the State has received in the over seven and half years of Governor Okowa’s administration.

The protest is coming on the heels of the recent N120 billion loan request by the State Government which has been approved by the State House of Assembly.

Armed with placards with various inscriptions, which include, “don’t mortgage Delta,” “We say no to N120B loan”, they accused Okowa-led government of mortgaging the future Deltans yet-unborn over the high debt profile of the state.

Addressing journalists at the venue of the protest, National Youth President, Urhobo Progress Union (UPU), Comrade Kelly Umukoro, said Delta State youths reject and condemned the recent loan by the state government.

According to him, “We have seen that the present state government wants to sell us for the future of their children and themselves. You have few months to leave government, and you are borrowing another N120 billion.

“Is it that we are sponsoring Okowa’s ambition to be vice president of Niger with Delta state money? Did we have any meeting as Deltans to say we want to use our treasury to sponsor Gov. Okowa who has not been able to improve the lives of Deltans?

“No infrastructure, for eight years you have been able to do one flyover and you are celebrating it. What does he need this money for? The answer is simple, he needs it to oil his vice presidential ambition.

“As critical stakeholders, we are saying no, never. We are saying our children cannot pay debt that was not used by their fathers. Okowa should have pity on us. Delta owns a State University in Abraka, school fee was increased. Delta state university is like a private university where students pay N250,000.

“With all the ways of getting money, the governor is still interested in taking more loan. As Deltans we are saying any bank that gives loan to Okowa is doing that on their detriment. If they are doing giveaway, they should make it clear.

“We are not going to pay. We are demanding that banks should not give Okowa anymore loan because the money in his coffers, he has not been able to use it judiciously”.

Also speaking, the National President of the Committee for the Defense of Human Rights (CDHR), Prince Kehinde Taiga, lamented the underdevelopment of the state despite the huge borrowing by the present administration.

Taiga wondered why Delta will to borrow despite huge allocations to the state as well as internally generated revenues when there’s nothing to show in the state.

Another protester, Onoriode Emmanuel, expressed dissatisfaction with the level of development in the state, noting that despite the huge loans collected, there are no tangible projects to show.

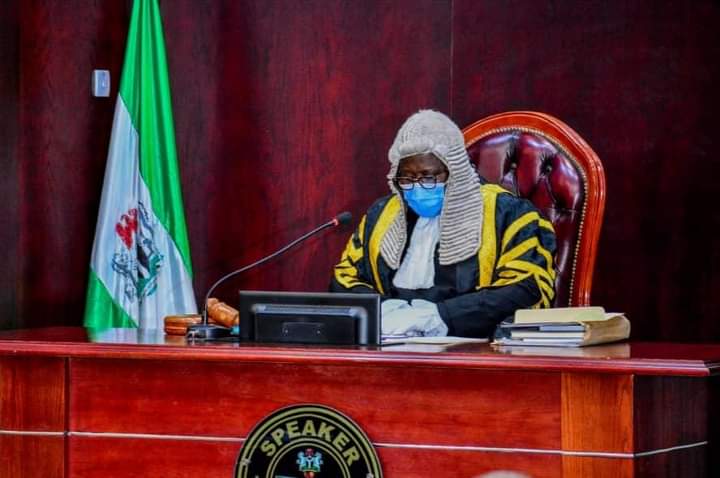

He described the Delta State House of Assembly of being rubber stamp, as they easily approve every loan sought by the state executive.

However, the state government through the commissioner for information, Mr. Charles Aniagwu, said the loan recently approved by the State House Assembly was not a fresh loan.

Aniagwu explained that it was only N20 billion from N120 billion that was approved by the legislature that is a fresh loan, saying the previous loan arranger pulled out of the earlier arrangement.

He added that the loans were tied to specific projects which will engender rapid development in the state.