The Nigerian stock market continued its upward trajectory, with a gain of N396 billion on Tuesday.

Market capitalisation rose by N396 billion or 0.47 per cent, closing at N83.789 trillion when compared to the previous day’s N83.393 trillion.

Similarly, the All-Share Index (ASI) climbed by 624.96 points or 0.47 per cent to reach 132,451.73 as against 131,826.77 recorded on Monday.

The positive trend was driven by strong buying interest in medium and large-capitalised stocks, like: Dangote Sugar, The Initiates Plc, Sovereign Trust Insurance, Enamelware, University Press and 31 other stocks.

Also, the market breadth closed positive with 36 gainers and 34 losers.

Dangote Sugar led the gainers’ chart, rising by 10 per cent, settling at N56.10 while The Initiates Plc increased by 9.97 per cent, ending the session at N12.13 per share.

Sovereign Trust Insurance gained by 9.84 per cent, finishing at N1.34 and Enamelware rose by 9.83 per cent, closing at N22.35 per share.

Similarly, University Press soared by 9.82 per cent, settling at N6.15 per share.

On the flip side, Ellah Lakes fell by 10 per cent, closing at N9.90 while Legend Internet also shed by 10 per cent, finishing at N5.31 per share.

FTN Cocoa Processors dropped by 9.91 per cent, ending the session at N6.09 and Meyer lost by 9.79 per cent, settling at N17.05 per share.

Also, Thomas Wyatt Nigeria Plc declined by 9.73 per cent, closing at N3.06 per share.

A total of 771.65 million shares worth N26.78 were traded across 32,734 transactions.

This is in contrast with 706.04 million shares worth N21.56 billion that were traded in 30,750 transactions earlier on Monday.

Transactions in the shares of Access Corporation topped the activity chart with 102.88 million shares worth N2.77 billion.

Ellah Lakes followed with 56.73 million shares valued at N586.4 million while United Bank for Africa sold 48.28 million shares worth N2.28 billion.

Guaranty Trust Holding Company transacted 32.75 million shares valued at N3.18 billion and WAPCO traded 30.5 million shares worth N3.87 billion.

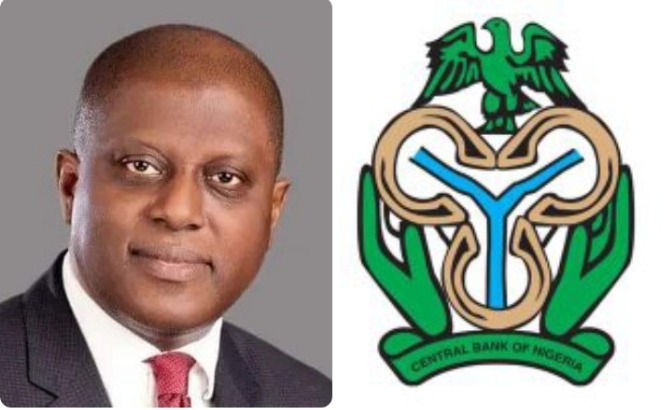

The Monetary Policy Committee (MPC) of the Central Bank of Nigeria (CBN) held rates steady after its two-day meeting.

The MPC retained the Monetary Policy Rate (MPR) at 27.50 per cent, also the asymmetric corridor around the MPR at +500bps/-100bps.

It retained the Cash Reserve Ratio (CRR) for deposit money banks at 50 per cent, the CRR for merchant banks at 16 per cent, and the liquidity ratio at 30 per cent.