The President Bola Tinubu’s Administration priotises Medium and Small Scale Enterprises (MSMEs) because, beyond being the lifeline of the citizens, they are the pillars upon which the nation’s economy stands.

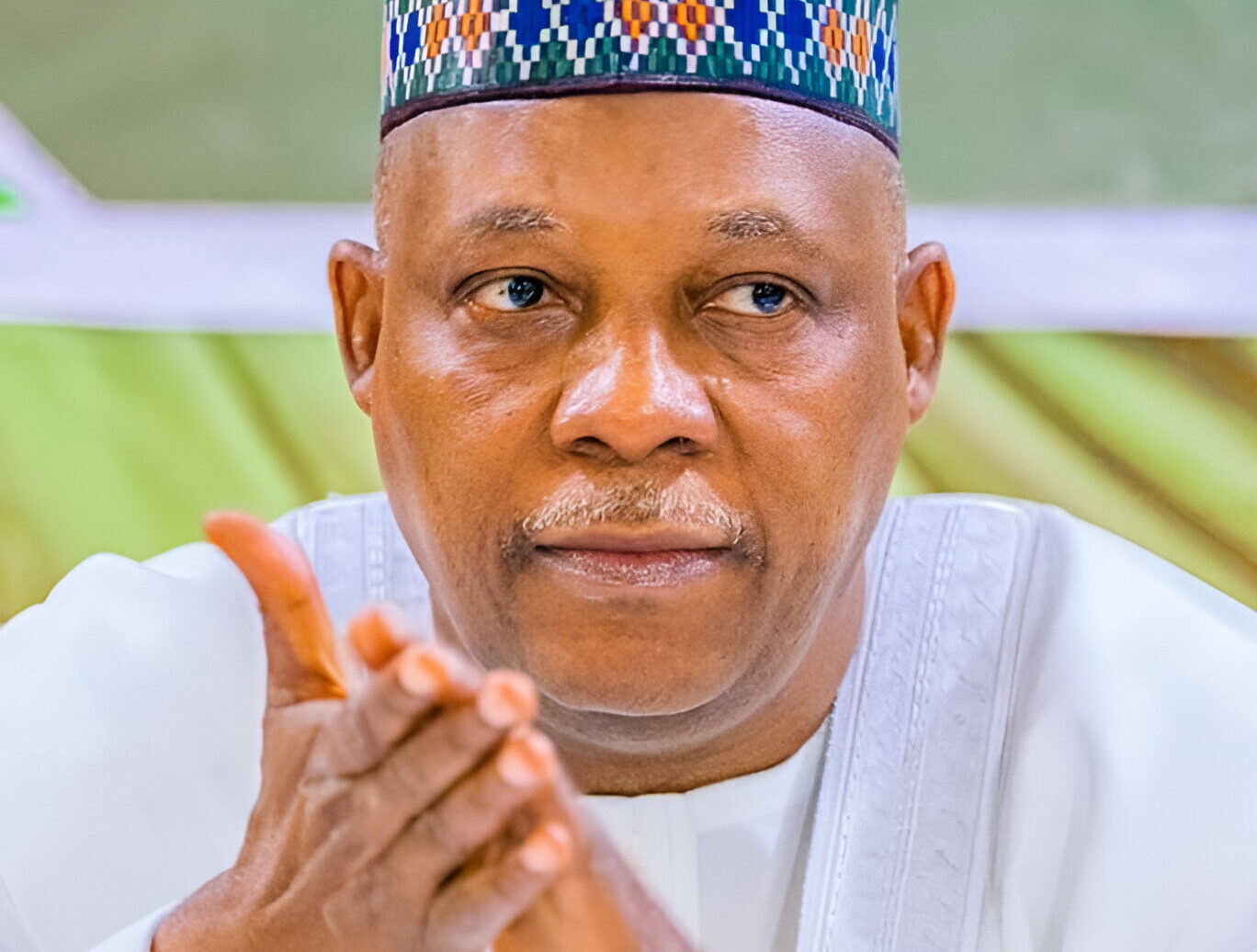

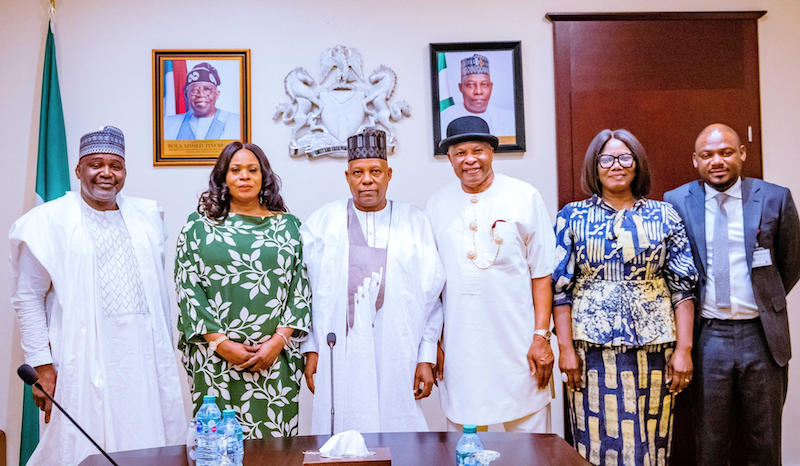

Vice-President Kashim Shettima, disclosed this on Tuesday at the inauguration of the Federal Government’s state-of-the-art Information, Communication and Technology (ICT) Hub for MSMEs in Calabar, Cross River.

Shettima also inaugurated the newly refurbished State Library Complex housing the hub and two newly acquired Bombardier CRJ1000 regional jets (100-seat capacity each) for use by the state-owned airline – Cally Air.

The Vice-President noted that no nation in the world can prosper beyond what its small businesses promises.

He stressed that, at the core of Tinubu’s Renewed Hope Agenda, is a commitment to create an environment where MSMEs not only survive, but thrive.

“When His Excellency, President Bola Tinubu, took charge, he did not only guarantee access to capital, he pledged to support every venture that dares to redefine the future of work, skills, and industries.

“We are here in pursuit of our promise to build an ecosystem that eases the struggles of our entrepreneurs, provides the infrastructure that fuels creativity, and unleashes the innovative spirit of our people,” he declared.

“The world today is shaped by the wave of digital technology, and so the commissioning of a state-of-the-art Information, Communication and Technology Hub for MSMEs in this beautiful state could not have come at a better time.

“This is our eighth Expanded National MSME Clinics, and like those before it, the hub we commission today is our investment in tomorrow.

“We are living in a digital century where technology is no longer a luxury but a lifeline,” he said.

Shettima added that the clinic was part of efforts by the Tinubu’ administration to bring the Federal Government’s support directly to the doorstep of businesses across the country.

“The MSME Clinics, such as the one we launch today, are designed to bring the Federal Government’s support directly to your doorstep.

“Here, entrepreneurs can interact with the Corporate Affairs Commission, NAFDAC, the Bank of Industry, SMEDAN, and other critical agencies. Here, challenges are met with solutions, not promises deferred,” he said.

Shettima announced the disbursement of N250,000 unconditional grant, each to outstanding business owners in Cross River, as part of ongoing efforts to support MSMEs across the country.

This is not a loan. It is a gift to accelerate your journey,” he said

Shettima drew attention to other interventions under the Tinubu administration such as the creation of a N75 billion MSME Intervention Fund being administered by the Bank of Industry (BoI).

He listed the N50 billion Presidential Conditional Grant Scheme to support one million nano businesses across the 774 local government areas of Nigeria with grants of N50,000 each.

He also listed the N75 billion Fund for manufacturers to access up to N1 billion in funding at a 9 per cent interest rate.

The Vice-President hailed Gov. Bassey Otu for his support and leadership in promoting infrastructure in Cross River.

He noted that the commissioning of two Bombardier CRJ1000 aircrafts “to boost air travel, will not only invites the world to the People’s Paradise but also makes it a safe destination for investments”.

Corroborating the Vice-President, the Minister of Information and National Orientation, Mohammed Idris, said Tinubu remained unwavering in his support for small businesses in Nigeria.

He added that Tinubu demonstrated same through policy reforms, special interventions and provision of critical infrastructure across the country.

He commended the passion and determination of the Vice-President for the MSME space by personally encouraging and supporting activities in the sector through the clinics and related interventions.

The minister noted that the efforts will positively transform the space in the near future.

Speaking in the same veins, the Special Adviser to the President on Job Creation and MSME, Mr Temitola Adekunle-Johnson, described the MSME Clinics as a unique initiative of the Federal Government that is transforming ideas of budding and established entrepreneur across different sectors.

He said the vision of establishing shared facilities for MSMEs across the country was prompted by the desire of the Federal Government to intentionally address key challenges confronting small businesses.

Earlier, Ottu said the state government believed in the reforms of the Tinubu administration and is keying into every facet of the reforms.

According to him, the administration is building a formidable economy that will sustain and stand the test of time.

Out pledged the support of the government and people of Cross River for Tinubu’s government and its aspirations.

The governor reeled out what his administration is doing to support growth and development of MSMEs across the state.