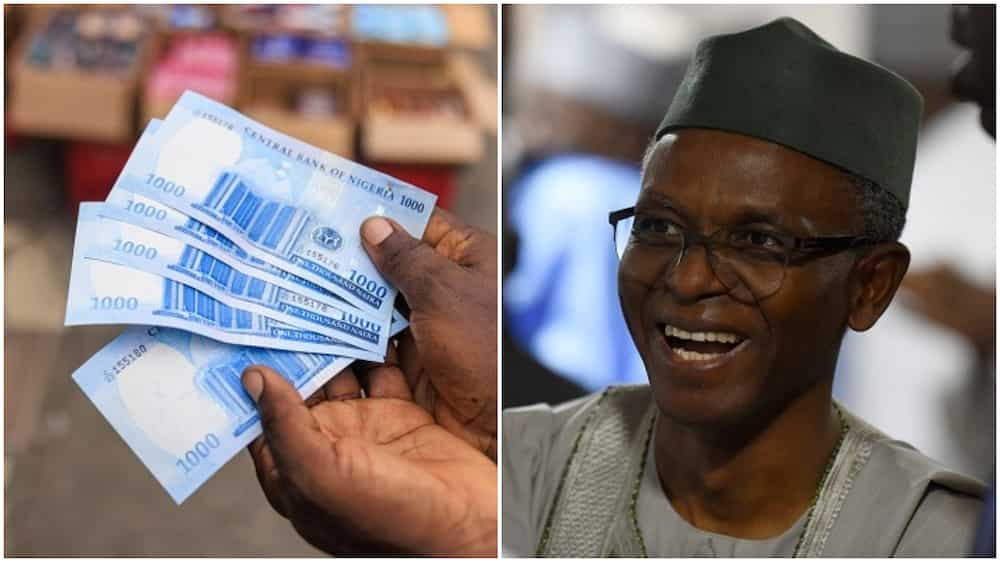

A former Director of Currency Operations at the Central Bank of Nigeria (CBN), Mr Ahmed Umar, on Tuesday told a FCT High Court that the minutes of the meeting of CBN management on Naira redesign was not sent to him.

Umar said this while testifying as the prosecution first witness (PW 1) in the alleged naira swap case filed against Godwin Emefiele , the suspended Central Bank of Nigeria (CBN) governor.

In the four-count charge filed against him, the EFCC alleged that Emefiele disobeyed the direction of law with intent to cause injury to the public during his implementation of the naira swap policy of the administration of former President Muhammadu Buhari.

He is standing trial before Justice Maryann Anenih.

Umar said that he signed the memorandum for the redesign of the naira in 2022.

When asked to comment on an Oct. 26, 2023, Meeting of the Committee of Governors (CoGs) of the CBN, he said:”the minutes of the meeting was only circulated among members of the CoG”.

Led in evidence by EFCC counsel, Mr Rotimi Oyedepo, SAN, Umar said that the management of the apex bank directed his department (Currency Operations) to “come up with a memo on the redesign of the naira notes in Aug. 22, 2022”.

Umar stated that upon completion of the task, a memo was submitted to the CoG and subsequently listed for consideration.

The witness added that the CoG which comprises of the CBN governor as chairman and four deputy governors as members, on Oct. 26, 2022, held a meeting via zoom to deliberate on the memo his department submitted.

He disclosed that he had joined the meeting only “to make my presentation and exited ” afterwards.

Umar further disclosed that after the meeting the Corporate Affairs Department conveyed anticipatory approval of the CoG pending ratification by the Board of Directors (BoD).

The BoD he said is made up of 12 members, comprising the CBN boss as chairman, four deputy governors, Permanent Secretary, Ministry of Finance, Accountant General of the Federation and five external members appointed by the president.

Speaking further, the witness said that “the CoG did not approve items 1 and 3, while item 2 was modified to include the N200 denomination”, he said.

“The proposal for the exercise to take place in 2023 was not accepted by CoG”, he added.

The witness stated that a memo was afterwards prepared for consideration of the BoD and “it was considered on Dec. 15, 2022”.

On the procedure for the issuance of naira notes, the witness stated that the BoD will have to recommend to the president for the design of the forms and devices that shall be contained in the currency.

“After the approval of the president, production of the currency will then begin “, he said.

The witness will continue his evidence on Wednesday.

NAN reports that in count one, Emefiele was accused of approving the printing of 375,520,000 notes at the cost of N11 billion, in count two he was accused of approving the printing of 172 million coloured swapped N500 notes at the cost of N4.4 billion.

Also in count three, the suspended CBN boss was alleged to have approved for printing 137,070, pieces of coloured N200 notes at the cost of N3.4 billion.

In count four he was alleged to have withdrawn the sum of N124, 860, 227, from the Consolidated Revenue Fund of the Federation in a manner not prescribed by the National Assembly.