There is no disputation that Naira abuse or more specifically the act of spraying money at social events has become an acceptable norm or cultural practice in Nigeria. Nigerians have a cultural affinity for lavish social gatherings. Many people regard these occasions as a means of displaying social status and wealth. Spraying Naira notes, and other currency notes, at events progressively appear to be the ultimate way to flaunt your social standing. Even burials that are supposed to be sober moments have been turned into considerable fanfare. This has created a new industry of mint note trading and events management. All of these constitute the social infrastructure of Naira abuse. A new dimension of the social infrastructure of Naira abuse is the arrival to the scene of the nouveau rich. Society has labelled them with all sorts of nomenclature: Yahoo Boys, Yahoo Plus, and 419.

Nigeria has since recognized the dangers of Naira abuse but that is not the focus of this piece. The government has made rules and laws to check it and provided enlightenment campaigns to educate people. The Central Bank of Nigeria( CBN) gave Naira abuse as one of the reasons why it is pushing for digital-based financial transactions. Naira abuse, like its ancestor-mother social epidemic of corruption, has remained stubborn and refused to go away.

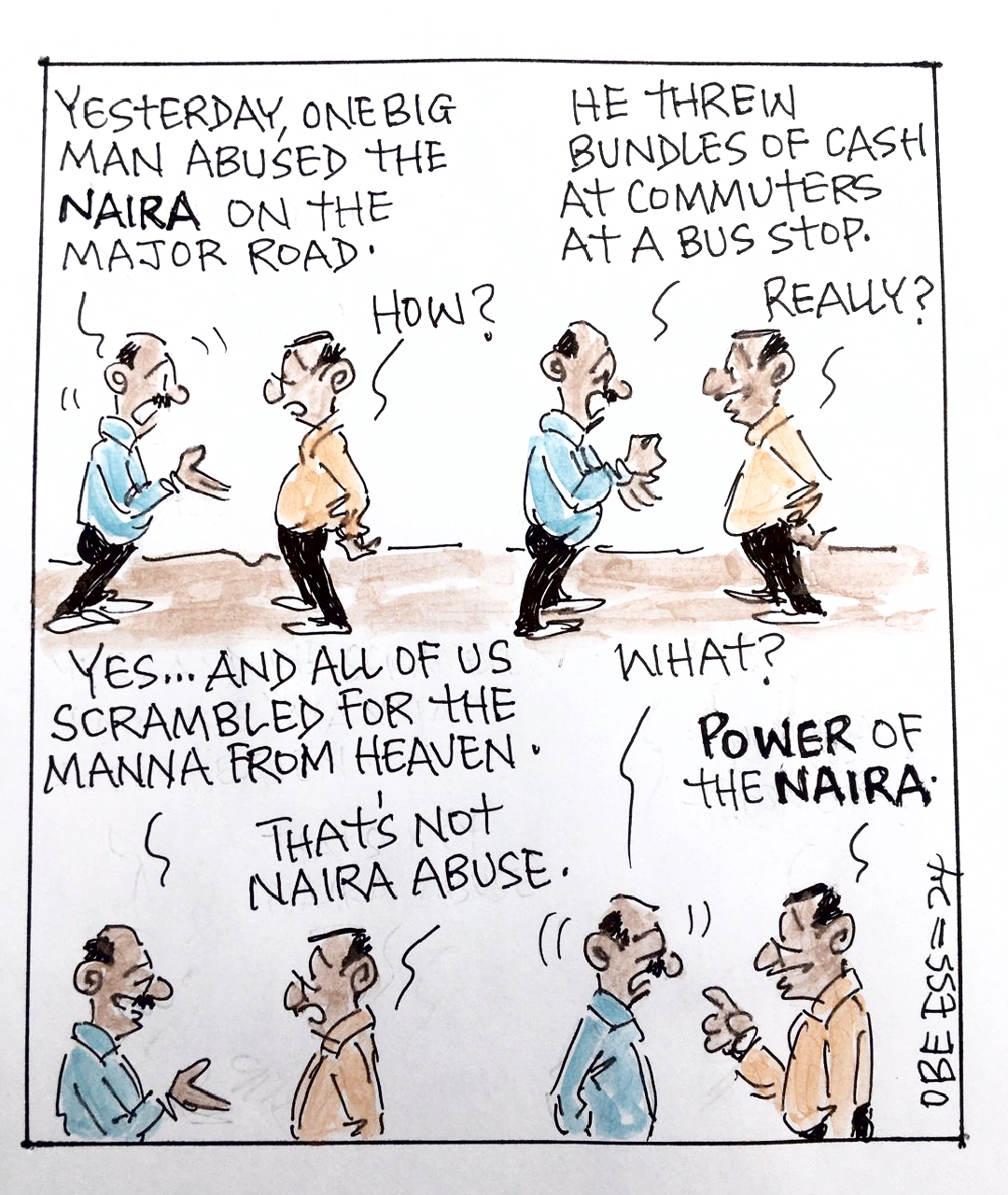

There is ambiguity about what constitutes Naira abuse. The Central Bank of Nigeria Act of 2007 in Section 21 of the CBN Act 2007 clearly defines Naira abuse and prescribes various punishments to deter citizens from abusing the Naira. They include – spraying banknotes at events; writing on banknotes; stapling banknotes; tearing banknotes; dancing or stamping on Naira; defacing the bank notes with substances or ink, oil; selling currency banknotes; mutilation of the Naira note; money bouquets. However, law enforcement has been lax. It is commonly believed that the laws against Naira abuse are either symbolic or desuetude because no one is held accountable, everyone gets away with it, and things have normalised.

The social phenomena of Naira abuse, especially the spraying of money, have become an epidemic in Nigeria. Lately , it is of significant concern. We have exported this to many parts of the world, and social media is replete with evidence of this in weddings and other social events attended by Nigerians in different parts of the world.

Malcolm Gladwell’s book, “The Tipping Point: How Little Things Can Make a Big Difference” explores the idea that social phenomena, like trends and epidemics, often reach a tipping point where they suddenly become widespread. He identifies three key factors that contribute to this tipping point: the Law of the Few (the idea that a small number of people have a disproportionate influence), the Stickiness Factor (how messages or ideas stick in the minds of people), and the Power of Context (how the environment influences behaviour).

Through engaging anecdotes and research, Gladwell illustrates how understanding these factors can help individuals and organizations create or manipulate trends and epidemics. The book emphasizes the importance of paying attention to small details and understanding the social dynamics behind spreading ideas and behaviours. The fundamental concepts of the book about Naira Abuse are twofold. First, the cultural context or external environment provides the soil for bad or good behaviour to grow and spread. Second, key people with remarkable personalities can cause or stop social epidemics because of their social profile or social network.

There is a link between the recommendation of Malcolm Gladwell and the arrest and prosecution of Idris Okuneye better known as Bobrisky, a cross-dresser and social influencer, for Naira abuse, and the arrest and ongoing prosecution of Cubana Chief priest Pascal Okechukwu in connection with Naira abuse. Why selectively arrest the duo when everybody is involved in some form of Naira abuse either by trampling, spraying ,mutilation or rumpling ? Truth is that it is nearly impossible for any law enforcement organisation to find and apprehend every perpetrator. Resources exist in limited supply . It is simple wisdom to begin with people who have disproportionate influence. This is perhaps what EFCC has done. First common ground is that both of them enjoy considerable social media influence whether for positive or negative reasons depending on your own value system. These two cases, though similar, are following different paths. Bobrisky, in court, pleaded guilty and has since been handed six months imprisonment. Cubana Chief Priest did not plead guilty, so his case will go to full trial, putting the law to the test. This court case will assist us in providing answers to some critical questions: what are the societal ramifications of Naira spraying, and how can Naira misuse be proven? Is there need to amend the existing law and make it more relevant to the challenge? Will this fresh wave of enforcement stop the epidemic of Naira abuse ? Regardless of how the legal proceedings turn out, they have highlighted how important it is to take the triplet societal plague of poor social behaviour, Naira abuse, and their ancestor-mother corruption very seriously.

I have identified six pillars to control or stop Naira abuse: Fight corruption because it is an enabler for abuse of the Naira. The incestuous relationship between corruption, illicit financial transactions and Naira abuse is well established . Second,the government should deepen knowledge and change people’s orientation by embarking on mass enlightenment, people must understand clearly what constitutes Naira abuse and what the punishment is for such offence . Third, address cultural issues relating to Naira abuse through community engagement. People gifting money to celebrants at occasions is no crime but the manner of gifting is the issue. Fourth, government should renew the push for digital transactions. Fifth, government must strengthen the structures of law enforcement. It is not just police and EFCC matter . The judiciary must upend its knowledge on the subject matter . Sixth, government must be impartial and objectively enforce the law to change cultural norms and public behaviour that defaces the Naira. This may entail revisiting and improving the law.

CBN , Police and the EFCC should study different models of changing public behaviour in the past and draw up a model and strategy to deal with the issue of Naira abuse, especially since it has become embedded in some cultures. Good examples abound abroad and in Nigeria. The British government employed various strategies to change public behaviour regarding spitting and other personal vices. Spitting in public places was prohibited by local bylaws or municipal regulations but it is social persuasion that gave the result . These laws serve as deterrents and can result in fines or other penalties for offenders. They launched public awareness campaigns, collaborated with community stakeholders, and monitored and enforced the law. However, most of all, they leveraged social norms and peer pressure to influence behaviour and encourage individuals to conform to accepted standards of behaviour by highlighting the societal consensus against spitting and certain destructive behaviours and showcasing positive role models who embody desirable conduct. Today, the practice of spitting publicly, urinating on the road corners, and other public nuisances are controlled to the barest minimum.

In Nigeria, good examples of efforts to change public behaviour can be seen around us. Most were successful to a greater degree. The government should revisit some of these campaigns and learn from them.

A model that seems to be working in Akwa Ibom State is the State Ethical and Attitudinal Reorientation initiative . Before 1999, the Akwa Ibom people experienced a severe social epidemic, “The Pervasive and prevalent House help Syndrome,” which gained widespread notoriety and led to the dubbed moniker “Ekaette” for nearly every female domestic helper. The administration of Obong Attah took up the task of reorienting the Akwa Ibom people’s mindset. He established the Ethical and Attitudinal Reorientation Commission (EARCOM) in Akwa Ibom and gave them the responsibility of raising public awareness about the importance of “minoring” vices and “majoring” in moral principles.

The struggle has persisted throughout the regimes, and Pastor Umo Eno’s present administration appears to be taking it to newer, more profound heights by hiring assistants for each ward and unit and charging them to carry out the Commission’s work of value reorientation in remote areas. As bait, he is using the incentivization and social support model, drawing on the country’s current food and hunger crisis to reach out with the message of value reorientation. Today, a negligible number of Akwa Ibom daughters are house helps , and the majority are highflyers in the professions and business.

The success story of Akwa Ibom is a model that the federal government can replicate. Changing public behaviour requires a multifaceted approach that combines legislation, education, community engagement, social support and enforcement efforts. By addressing the underlying factors contributing to undesirable behaviours and promoting positive alternatives, governments can effectively shape public attitudes and foster a more socially responsible society.