By Andy Ezeani

There is a palpable excitement in official quarters and beyond, over the recent resurgence of the Naira. Justifiably so.

The national currency, strong and virile at its inception in January 1973 and for a long time, has been passing through a most harrowing experience in recent times. A currency is, of course, as strong or weak, as its mother economy. Expectedly therefore, the Naira has been reflecting travails and the uncertain profile of the Nigerian economy.

Over time, as the Nigerian economy passed through a stretch of managerial abuse, haemorrhaging and bastardization, the Naira has wobbled in gait. It has yielded ground to both the CFA [Communaute Finaniere Africaine], franc, the common currency of the French-speaking West African countries and the Ghanian Cedi, currencies in the West African sub-region, that hitherto deferred to the Nigerian currency. Any sign of a bounce by the Naira, even if momentary, will surely elicit some rave. That may well be where things are at the moment. Or perhaps better.

As at May 2023, when Muhammadu Buhari passed the mantle of the presidency over to Bola Tinubu, the Naira was exchanging on the average at N460 to one United States dollar, on the official platform. At the Parallel market, the dollar was being sold in the region of N775 to a dollar.

At the close of last week, The Naira had gained traction and the value had strengthened to N1,150 to the dollar at the parallel market. It was actually N1,142 at the official rate. The contraction of the difference between the official rate and the parallel market is a major desire of the government and its monetary policy managers. Is the convergence of the two rates a normal response to stimuli or is it artificially induced? The truth, as in virtually all cases, may be found somewhere in between. That, however, is not the focus here.

The bounce in the value of the Naira late last week was remarkable. The momentum has been building up gradually, though, albeit tentatively. For a currency that was alarmingly heading toward N2000 to one dollar less than two months ago, the Naira must have taken the equivalent of an energy drink.

Whatever it was, the bounce back of the Naira was eye-catching enough to get Goldman Sachs, the global financial services firm to forecast that the Nigerian currency may likely exchange at less than N1000 to a dollar in the course of 2024. The basis of the forecast is, of course, open to interrogation, but that is the view of Goldman Sachs.

The Goldman Sachs projection and the movement of the Naira in the desired direction, were, understandably, music to the ears of the government. Indeed, many Nigerians will welcome the prospect of a stronger Naira with great relief. From investors and business people to consumers of sundry products and services, a stronger Naira in relation to the dollar, will always be a boon, different….

The Naira may be Nigeria’s currency, but in reality, the US dollar has, over time, become the currency of reckoning in business transactions in the country. That may seem rather precarious to many other countries, but Nigeria is not a stranger to living dangerously. It actually embraces policies that many other independent countries will find incongruent with their sovereignty.

The gaining of ground over time by the dollar in daily economic activities in Nigeria naturally meant the weakening of the Naira in reckoning in various business circles. With the government itself calibrating its major economic transactions in dollars, such as petroleum sales and pricing, even for local consumption, it was only a matter of time before many other businesses followed the lead.

Subsequently, airlines, property and real estates, insurance business, Customs and port charges and even educational institutions all began to transact businesses in dollars, within Nigeria.

As should be expected, the dollar also became the convenient and preferred currency by politicians for vote buying and bribing officials during elections. What the Naira could not do, the dollar was often called in to do. The slide in the value of the Naira was bound to get steeper.

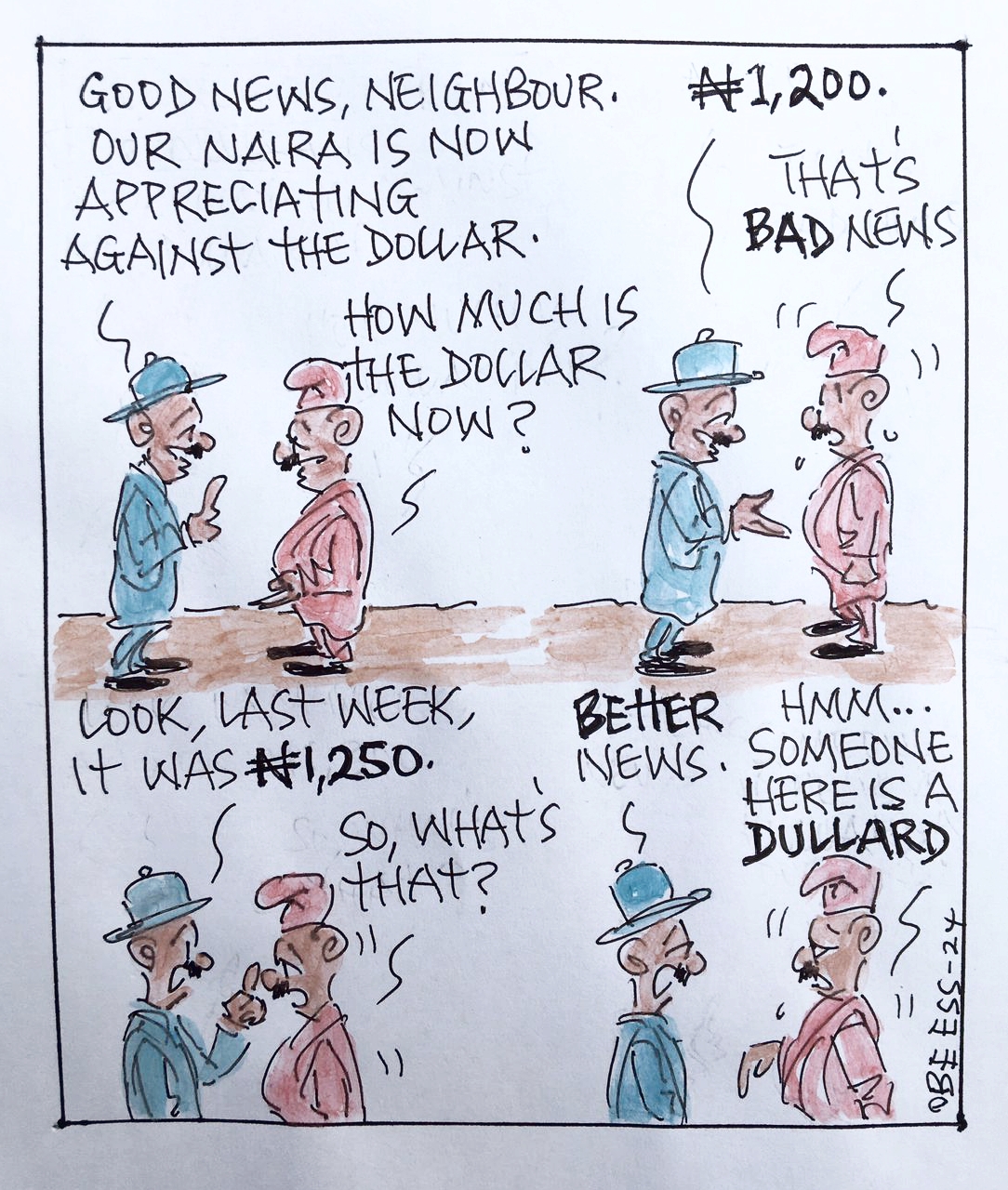

The recent reversal of fortune, with the dollar weakening and the Naira gaining strength should, indeed, be a heartening development for Nigeria. But then, to what extent can it truly be said that the Naira is on a recovery curve? Is the report of the recovery of the Naira not exaggerated? It will be helpful in the analysis of the heralded recovery, to put facts in perspective, without taking away any credit from the current effort of the managers of the Nigerian economy.

The contention by the Tinubu government soon after coming to office, that its predecessor, the Muhammadu Buhari government had been propping up the Naira, is interestingly, at the root of the travails of the currency in the last few months. It remains a critical question, whether the floating of the Naira as the Tinubu team did, even against all the known challenges of that option, is a mark of astuteness or monetary adventurism, in a fragile economy? Time will tell.

The urge in the Tinubu government to declare victory on the currency exchange front, with the recent weaking of the dollar and the gains by the Naira appears premature. While it may be attractive politically, to hail the resurgence of the Naira, it make rational sense to be cautious. Exchange rate regimes are not flimsy regimes. The government may need to do more to make the gains of the local currency sustainable over time.

Much more importantly, for any gains in the value of the Naira to be useful, beyond mere optics and political upmanship, prices of commodities and services which had earlier reacted sharply to the overbearing influence of strong dollar, must be made to respond proportionally to the new order.

It is difficult however, to see how Nigerians can derive any worthwhile relief in the near future, from the strengthening of the Naira, as long as various composite economic policies of the government, with deleterious effects, remain at play.

Whatever gains a strong Naira may promise, will definitely be cancelled out by the impact of the new astronomical hike in electricity tariff, which when combined with the excruciating price of petrol leaves many individuals and economic enterprises prostrate. Manufacturers Association Nigeria cried out over the weekend that adverse economic environment is driving many more of its members out of business. The situation goes beyond what improvement in the value of the Naira can address.

Even at this, having a good perspective of the backdrop of the new gain in the value of the Naira is helpful in situating any assessment of the progress of the currency. That is to say, what is the present yardstick for measuring the recovery of the Naira? Is the newly hailed value of the currency being measured with the exchange rate at May 2023 [ N 638 to one dollar] or as at 2022 [N237.9 to a dollar] or for 2020 [N359.2 to one dollar] or when? Floating the Naira and watching it hug the sky, only to turn round to roll out the drums because the same Naira has come down to the roof top, is at best, disingenuous. The Naira is yet to arrive.

It must be conceded though, that there is positive movement in sight. The Tinubu government contended that the exchange rate under Buhari was not sustainable. It promptly replaced that regime with a new one that first triggered off economic chaos, but is now showing movement on an encouraging curve. The government just have to ensure that what is being held up at the moment as the new and more appropriate value of the Naira is sustainable too. Curiously, till date, the issue of the productivity level of the economy is not even being discussed.