Tag: Naira

-

Naira appreciates by 1.5% against dollar

The Naira experienced a slight appreciation at the official market, trading at N1,431.49 to a Dollar on Friday.

Data from the official trading platform of the FMDQ revealed that the Naira strengthened by N21.79 or 1.5 per cent, compared to the previous day’s rate of N1,453.28 against the Dollar.

However, the total turnover decreased to $199.71 million on Friday, down from $288.47 million recorded on Thursday.

Meanwhile, at the Investor’s and Exporters’ (I&E) window, the Naira traded between N1,468 and N1,301 against the Dollar.

Recall that the Central Bank of Nigeria (CBN) had earlier announced the completion of clearance of the valid foreign exchange backlog, signaling a positive development in the forex market

On the impact of forex intervention, researchers at Cordros Securities said, “The recent overhaul and increased intervention in the FX market have bolstered confidence and facilitated Foreign Portfolio Investors (FPIs) inflows into the forex market.”

They also highlighted renewed interest from foreign portfolio investors in the fixed-income market, as stop rates on the long-end bills rose above 20.0 per cent.

-

Naira appreciation: We’ll unleash more economic measures – Tinubu

President Bola Tinubu, says his administration will unleash a number of measures to revive the economy, based on the recent appreciation of the Naira.

Tinubu said that this was in line with the current appreciation in the value of the Naira, due to various steps taken to curb activities of illegal money speculators.

Chief Ajuri Ngelale, Special Adviser to the President on Media and Publicity, made this known to statehouse Correspondents on Friday in Abuja.

“Nigerians at large have witnessed the seismic shifts that have taken place within the nation’s foreign exchange market over the course of the last several days and the strengthening of the Nigerian Naira against the United States dollar.

“This is a time to deepen our efforts to dig in and to work harder, which is why President Tinubu has approved a series of interventions to ensure that we see a mass strengthening of the Nigerian Naira against all other global currencies.”

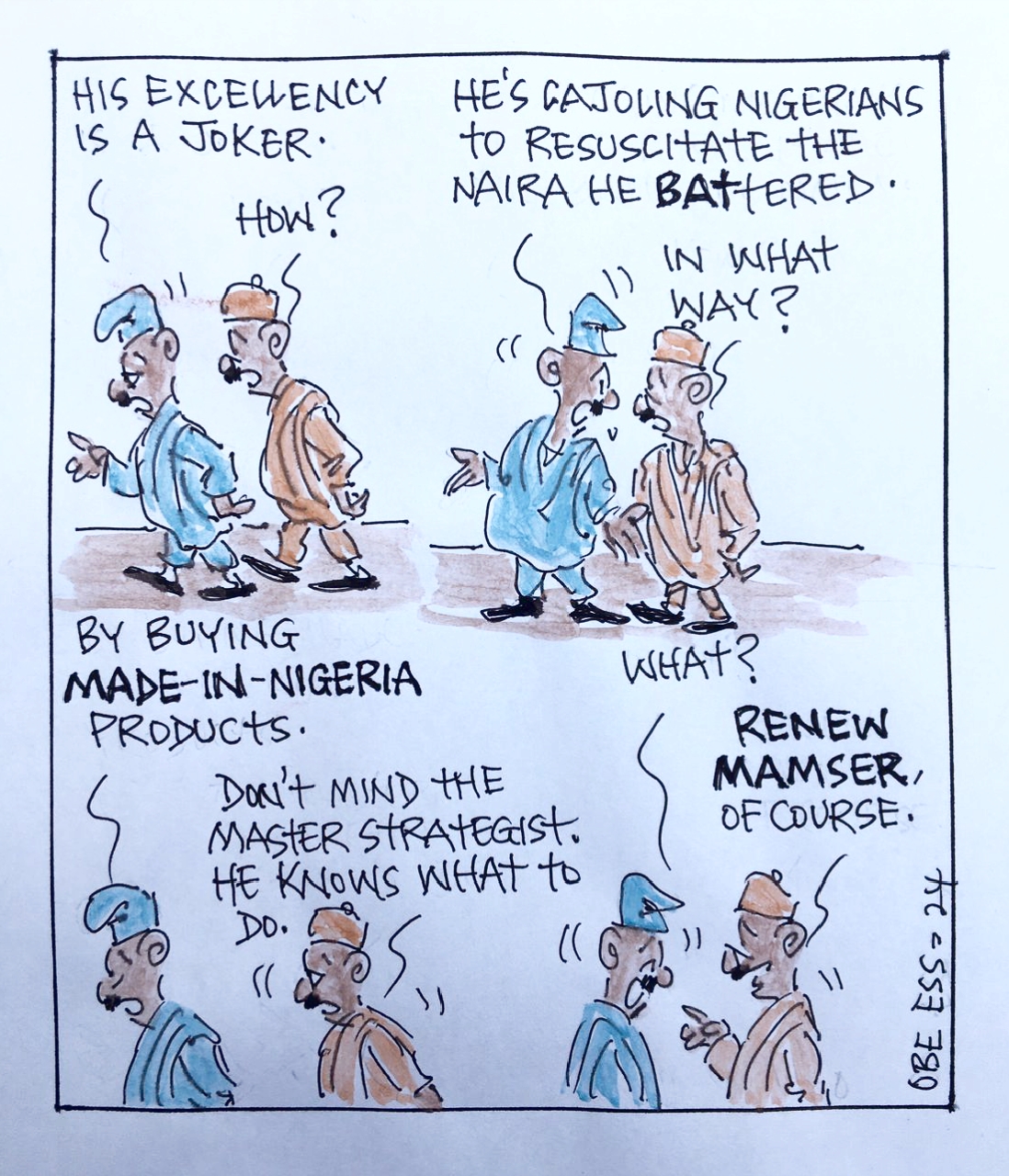

Ajuri said the President appealed to Nigerians to use this period to imbibe the culture of patronising and purchasing Nigeria products across all value chains.

“There is an intention that we must have on this issue that we want a strong currency, we want the spending power of our people to go up.

“We want every Naira and Kobo we earn to be more valuable not just here but when we travel abroad, the way to achieve that is by doing just this.”

Ajuri said the President demanded every Nigerian to join in this effort of turning the tide against unscrupulous citizens working to undermine the economy.

He urged Nigerians to blow the whistle on any activity that is drawing the economy to the brink, in order to save the country and cut cost of governance.

Ngelale said the President would ensure that micro small and medium scale enterprises in the country have what they needed to get through this difficult period.

He said the President has approved the Presidential Conditional Grant Scheme, in which over one million Nigerian businesses would be empowered.

”This is money they will not have to pay back of up to 50,000 Naira per Nano enterprise, with over one million Nano enterprises being selected and granted these funds within each and every local government area of the federation.

”In addition to that, over 150 billion naira has been dispersed from the Bank of Industry and made up on single digit interest rate loans of up to N2 million to small and medium scale enterprises across all local government areas of the federation.”

He said the construction and manufacturing sectors of the economy that employed more than 1,000 Nigerians would also be given a facility to encourage them and boost employment.

”The President has approved over N75 billion to be dispersed to 75 large scale manufacturers across all states of the federation. These are going to be manufacturers who employ over 1,000 Nigerians in each of their facilities and industries.

”We are going to ensure that they have the support that they need at the large scale, so that Nigerian families who rely on these large scale businesses are protected.

”We want to see our large scale industries, not just refuse to fire people but to actively increase and expand their hiring at this difficult time.”

He said that it was in this light of strengthening the system for better service delivery, that the President approved a new remuneration for the judicial arm of government.

”This is very important in the sense that we can dramatically reduce the impact that corruption has always played in the judiciary, which has an impact on not just the ability of Nigerians to get effective justice in the country.

”But also to ensure that businesses who we are now asking around the world to invest in Nigeria have a judicial system that they can trust with respect to any litigation that can arise from business practice.”

He said the appreciable value of the Naira would also impact positively on the proposals of the minimum wage review coming up in April.

”What we do not want is a situation in which the minimum wage continues to be what it has always been in the history of our country, which is a moving goalpost.

”If we do not get a firm grip on the value of our currency and it continues to be a volatile, devaluing asset, then whatever we do with the national minimum wage is going to essentially become a moot point.

”We are focused on ensuring that we arrive at a new minimum wage that states can afford, and that we’ll deal with all of the needs of Nigerian families across the country.

”We also want to ensure that what we peg it at is something that is sustainable over a number of years, based on the long term, you know, stability that we want to bring to the Nigerian Naira with interventions we’re presently making.”

-

Weak Naira: Patronise locally made products, Presidency begs Nigerians

The presidency believes patronage of made-in-Nigeria products is key to strengthening the naira and wants citizens to buy goods produced in the country to make that happen.

The Special Adviser on Media and Publicity to the President, Ajuri Ngelale, disclosed this in a press briefing with the State House Correspondents on Friday.

“One, His Excellency, President Bola Ahmed Tinubu wants to communicate very clearly to our people, that there has never been a more important time in our history to actively agree together,” he said.

“That we will patronize and purchase made-in-Nigeria products across all value chains across all sectors.”

He said this is one of the decisions taken by President Tinubu to ensure the continued strengthening of the Nigerian naira against other global currencies.

The President’s media aide also highlighted government interventions such as the presidential conditional grant scheme providing 1 million nano enterprises with non-repayable grants up to N50,000 and N75 billion to 75 large manufacturers employing over 1,000 Nigerians each as some of the efforts the government is making to improve the lives of Nigeria.

He said the President is doing everything he can to ensure that he steps in to ease the burden on families while also ensuring that he holds the public sector and the federal government of Nigeria accountable for prudent spending.

This he noted, is demonstrated by ensuring a drastic cut down on travel expenditures, ensuring that with the temporary ban that is being put in place from April 1 on all but unnecessary foreign travel, which will save over N5 billion per quarter.

On minimum wage, Ngelale said the President wants to bring sustainable strength to the currency before putting a new minimum wage for the workers.

He said the discussions for the minimum wage are ongoing, but what the government does not want “is a situation in which the minimum wage continues to be what it has always been in the history of our country, which is a moving goalpost.”

See the full statement below:

I’m certain that everyone seated here and indeed Nigerians at large have witnessed the seismic shifts that have taken place within the nation’s foreign exchange market over the course of the last several days and the strengthening of the Nigerian Naira against the United States dollar.

impact on not just the ability of Nigerians to you know, get effective justice in the country, but also to ensure that businesses who we are now asking around the world to invest in Nigeria have a judicial system that they can trust with respect to any litigation that could arise from business practice in the country.

The effects are huge and the President is taking a multi sectoral and comprehensive approach to ensuring that we bring prudence to government expenditure at a time when we are restructuring the economy of the Federation in such a way that sectors that are employing our people that are empowering our people are those sectors that will be able to more easily access lending both commercially and from public sector sources.

So the momentum of the Nigerian Naira and it’s strengthening. Nigerians should expect that to continue. Yes, we understand that there’s still going to be volatility to some extent, but we are seeing a lessening impact of that volatility and as we move forward with the interventions Mr. President is making in the foreign exchange market and will continue to make we will see increasing stability.

And the last point we want to emphasize is that President Bola Ahmed Tinubu while he’s dealing decisively with the issue of the spending power of every Naira and Kobo that Nigerians are earning today.

He is also ensuring that we bring a sustainable strength to the currency so that when we talk about a new minimum wage, because many of our people have asked, you know government officials about when the new minimum wage is coming in, those negotiations are ongoing. But what we do not want is a situation in which the minimum wage continues to be what it has always been in the history of our country, which is a moving goalpost.

If we do not get a firm grip on the value of our currency and it continues to be a volatile, devaluing asset, then whatever we do with the national minimum wage is going to essentially become a moot point, nullity. And so we are focused on ensuring that yes, we arrive at a new minimum wage that states can afford, and that will deal with all of the needs of Nigerian families across the country.

But we also want to ensure that what we peg it at is something that is sustainable over a number of years based on the long term, you know, stability that we want to bring to the Nigerian Naira with the interventions we’re presently making.

And this is the point that His Excellency Mr. President wants to emphatically make today.

There is stability coming to the currency, we’re getting closer to it, and when the new minimum wage comes into effect it is going to be one that will be sustained over a long period of time by a stable Nigerian Naira based on the interventions being made under his leadership.

-

Naira appreciates to N1,400/$ as CBN continue to plug leakages

The Naira recorded a significant gain at the official market represents an appreciation of N68 or 4.5 per cent, from the N1,560/$1 recorded on Tuesday.

13.5 per cent or N190 gain was also recorded at the parallel market.

Findings show that there is a significant drop in the stocking of dollars by speculators following waning demand by prospective buyers amid CBN clampdowns.

It would be recalled that the Central Bank of Nigeria has released series of circulars warning currency speculators and racketeers to desist from exploiting the loopholes.

Moreso, the CBN also put measures in place to block the loopholes and plug leakages.

Also, the recent clampdowns on the activities of illegal BDC operators in Lagos, Abuja and Kano by the operatives of the Economic and Financial Crimes Commission have helped to reduce the volatility of the naira.

A Bureau De Change Operator at Wuse 2, Abuja, Ibrahim Yahu, said on Wednesday that the greenback was bought at the rate of N1400/$1 and sold at N1500/$, allowing operators to make a spread of N100/$1.

He said, “The highest I can buy from you is N1400/$ but we are selling at N1500/$.

He noted that some persons bought at the rate N1,300/$ during the daily trading activity.

-

Colonel, couple nabbed for printing fake currencies, selling to BDC operators

The Nigerian police arrested a syndicate which specializes in printing fake Nigerian and Cameroonian currencies and also recovered fake N9 million and 300 million CFA notes from them in Lagos State.

The police held four suspected members of the syndicate include a couple:Mr Oludare Olamilekan, 50; his wife Oluwayemisi, 46; Ilelabayo Johnson, 62, who identified himself as a retired Colonel and Adeniyi Quadri, 35.

The suspects who were paraded before journalists yesterday, at the Zone 2 Command Onikan, Lagos, by the Assistant Inspector- General of Police , AIG Olatoye Durosinmi, were discovered to have been distributing the fake currencies to Bureau De Change operators both in Nigeria and Cameroun and through POS services in Nigeria..

AIG Durosinmi disclosed that the arrests were made following intelligence report about the hideout of one of the suspects, Quadri, who allegedly printed and supplied the fake currencies to other members of the syndicate.

Consequently, he said the Zonal Monitoring Unit, headed by DSP. Adeyemi Akeem was derailed to carry out discrete investigation.

According to him: The team swung into action and on February 3, 2024,the hideout of one Adeniyi Quadri of 11 Alof street, Lagos Island, was invaded where he was arrested and a printing machine he uses in printing security threads on all sorts of counterfeited currencies, with a cash sum of Three Hundred Million CFA and Nine Million Naira, all suspected to be counterfeit, were recovered in his possession.

“Adeniyi Quadri confessed to have been in the business of currency counterfeiting for over three years , he also named his cohort who he supplies for circulation.

“His confession led to the arrest of Oludare Oluwayemisi and Oludare Olamilekan who are couple and partners in the crime.

” The arrested couple also confessed to the crime which led to the arrest of one Ilelabayo Johnson , an ex-Military personnel who resides at 3 Ilelabayo close, Isoto via Ajasa Compound, Lagos State.

“During his arrest, his house and premises were searched and some suspected counterfeit local and foreign currencies were recovered in his possession.

”All the arrested suspects confessed to various roles in the process of committing this offence. Efforts have been intensified to apprehend other fleeing members”, he stated.

During interrogation, Quadri, revealed that he was paid N10,000 to print N1 million fake N1,000 notes.

He said “I am paid N10,000 to print 1000 pieces of fake N1,000 note. Already, I have printed about N9 million before my arrest.. I was paid N50,000 to do the job.

-

Naira grossly undervalued – Cardoso

The Governor of the Central Bank of Nigeria (CBN), Mr Yemi Cardoso says the Naira is grossly undervalued.

Cardoso said this on Tuesday in Abuja, while presenting a communiqué from the 293rd meeting of the apex bank’s Monetary Policy Committee (MPC).

He said that the foreign exchange market had not been functioning effectively and had been distortionary in outcome, thereby creating a serious challenge for the Naira.

“We are presently investigating some of the manipulations that have been taking place.

“For distortions that came up due to bad behaviour, those involved will be made to face the full wrath of the law ” he said.

The CBN governor said that the apex bank was clearing the backlog of genuine forex claims, adding that the country’s foreign reserves now stood at 34 billion dollars

“Just today, we paid another 400 million dollars to those that have been so identified,” he said.

He said that it was important that the foreign exchange market had a good amount of liquidity and minimal distortion.

“In recent times we have been able to attract liquidity into the system.

“We have attracted up to two billion dollars as a result of the tools that we have used to calibrate interest rate.

“We are collaborating with law enforcement agencies to ensure that we can understand better what is going on in the market.

“We are moving to a very aggressive regulatory environment where we will have zero tolerance for sharp practices,” he said.

“He said that players in the market would have to abide by all CBN regulations as those who refuse would face the consequences.

According to him, a very thorough exercise is going on to identify what went on in the past and what needs to be done.

Cardoso said that the CBN was moving away from interventions programmes and development finance initiatives like the Anchor Borrowers Programme, as they were time-consuming and counter productive.

“Everybody’s concern js about price stability, and we should put everything we have into ensuring price stability.

“The interventions took away a lot of time for things we do not have the expertise to do, and it created a lot of distortions in the economy through inflow of money supply.

“The interventions that took place in the recent past were estimated in excess of N10 trillion. It did a lot of damage to the economy, ” he said.

He, however, said that the apex bank was taking concrete steps to recover loans that were given out through such interventions.

NAN reports that Tuesday’s MPC meeting was to first under Cardoso as CBN governor.

Earlier, Cardoso had announced an aggressive tightening of the rates, as the committee increased the benchmark interest rate, the Monetary Policy Rate (MPR) by 400 basis points from 18.75 per cent to 22.75 per cent.

The committee also raised the Cash Reserve Ratio (CRR) from 32.5 per cent to 45 per cent, and adjusted the Asymmetric Corridor from +100/-300 basis point to +100/-700 basis point around the MPR.

It, however, retained the Liquidity Ratio at 30 per cent.

-

Foreign Exchange: Naira gains weight twice in one week

The Naira has gained weight significantly against the US Dollar for the second consecutive time in the period of just one week at the foreign exchange market.

Figures from FMDQ indicate that the Naira appreciated N1542.58 per US dollar on Wednesday from 1,551.24 on Tuesday.

This shows a significant improvement of N8.63 or 0.6 per cent gain compared to the N1,551.24 recorded at the close of trading on Tuesday.

Accordingly, the Naira has gained N36.66 since Monday, when it traded for N1,574.62 per US dollar at the official forex market.

This is as the US dollar supply surged on Tuesday by 76.62 per cent, according to FMDQ data.

Furthermore, at the parallel market, the Naira dropped to N1,860 per US dollar on Wednesday from N1,740.00 on Tuesday.

The margin shows clearly that the margin between the official and parallel forex markets’ exchange rates has widened.

The development comes barely 24 hours after a clampdown on illegal Bureau De Change operators by officers of the Economic and Financial Crime Commission, EFCC, in Wuse Zone 4.

It would be recalled that in the past weeks, the Central Bank of Nigeria has introduced several policies to checkmate the continued fluctuations of the Naira in the FX market.

The latest policies by CBN were the new guidelines issued to stop the payout of Personal Travel Allowance, PTA, and Business Travel Allowance, BTA, in cash.

-

Forex: FG to raise $10bn for increased liquidity, Naira stability

The Federal Government has expressed determination to raise at least 10 billion dollars to increase foreign exchange liquidity to stabilise the Naira and grow the economy.

President Bola Tinubu made this known at the inauguration of the Public Wealth Management Conference organised by the Ministry of Finance Incorporated (MOFI) on Tuesday in Abuja.

The theme of the conference was, “Championing Nigeria’s Economic Prosperity.”

Represented by Vice President Kashim Shettima, Tinubu revealed plans by his administration to create millions of jobs by unlocking the value of Nigeria’s vast public assets.

This, according to him, is to optimise and double the country’s Gross Domestic Product (GDP).

He stressed the need to identify, consolidate and maximise returns on government-owned assets worth trillions of Naira.

“The Federal Government set a goal to raise at least 10 billion dollars in order to increase foreign exchange liquidity, a key ingredient to stabilise the naira and grow the economy.

“At the core of this is ensuring optimal management of the assets and investments of the Federal Government towards unlocking their revenue potential.

“This includes our bold and achievable plan to double the GDP growth rate and significantly increase the GDP base over the next 8 years.”

Tinubu, however, noted that decades of mismanagement and underutilisation have plagued the country’s assets, spread across Nigeria and outside its borders, leading to revenue losses that have hindered economic growth.

The President gave the assurance that “the newly restructured Ministry of Finance Incorporated, which is to act as custodian and active manager of these assets, will now take the centre stage.”

He emphasised transparency and accountability as key principles, believing that improved corporate governance, innovative partnerships and attracting alternative investment capital would significantly increase returns.

“These improved returns will then be directed towards crucial funding for education, healthcare, housing, power, roads and other areas vital to lifting millions out of poverty.

“And stimulating sustainable economic development and job creation for the youths.”

Tinubu said that by efficiently managing public resources, the government aimed to build a more equitable society and unlock the full potential of its citizens.

He called on all stakeholders, including ministries, development financial institutions and the public and private sector players, to partner with MOFI to optimise the strategic assets.

He expressed hope that the collaborative effort would unlock Nigeria’s full potential and create a brighter future for all citizens.

The Minister of Finance and Coordinating Minister of the Economy, Mr Wale Edun, said Tinubu was mindful of the pains of his administration’s reform programmes and was deploying appropriate mechanisms to address the challenges.

He said that 42,000 metric tons of assorted grains were being released with 60,000 metric tons to follow shortly, adding that these are part of measures to arrest inflation and reduce food prices in the coming months across the country.

He urged the management and board of the MOFI to develop a specific line of revenue for the national budget.

This, according to him, is part of its renewed mandate of supporting the Federal Government’s fiscal stability.

The Chairman of the MOFI Board, Dr Shamsudeen Usman, said that the MOFI would play a more active role in the management of assets under its purview.

He urged operators of the assets to see MOFI as partners rather than competitors or regulators, adding that the new management was committed to high level corporate governance.

Usman disclosed that the company had integrated a non-conflict of interest policy to guard against practices that undermine professionalism among members of staff.

The Chief Executive Officer of MOFI, Dr Armstrong Takang, announced the launch of a N100 billion Project Preparation Fund as part of its renewed mandate of ensuring professionalism in the management of public assets.

Takang said that the company would transform the fortunes of public assets and restore investor confidence in both the operations and management of the assets.

-

Naira continues free fall, drops to all time low

Naira has continued its free fall as it fell to an all-time low against the US dollar, at the official and parallel foreign exchange markets, worsening the nation’s FX crisis.

Data from FMDQ showed that the naira depreciated from N1,574.62 per US dollar on Monday to N1,537.96 on Friday last week.

The figure shows that Naira fell to an all time low of N36.66 or 2.3 per cent loss compared to the N1,537.96 recorded at the close of trading on Friday.

Similarly, at the parallel market, the naira dropped to N1,660 per US dollar on Monday from N1,590 on Friday.

Dayyabu Mistila, a Bureau De Change operator, confirmed the development to pressmen on Monday.

The development comes amid a clampdown on illegal Bureau De Change operators by officers of the Economic and Financial Crime Commission, EFCC, and the arrest of 50 in Wuse Zone 4 Abuja on Monday.

Meanwhile, the depreciation of the FX markets came despite the Central Bank of Nigeria’s introduction of new guidelines on Wednesday last week, stopping the payout of Personal Travel Allowance, PTA, and Business Travel Allowance, BTA, in cash.

At the same time, the apex bank stopped international oil companies, IOCs, operating in Nigeria from repatriating 100 per cent of their forex revenue.