For Nigerians, 2023 would become one of the most remarkable years in recent memory in terms of defining moments and major events; some cheery while some are not very pleasant.

This is just as there were major global events that highlighted 2023. We look at some of them:

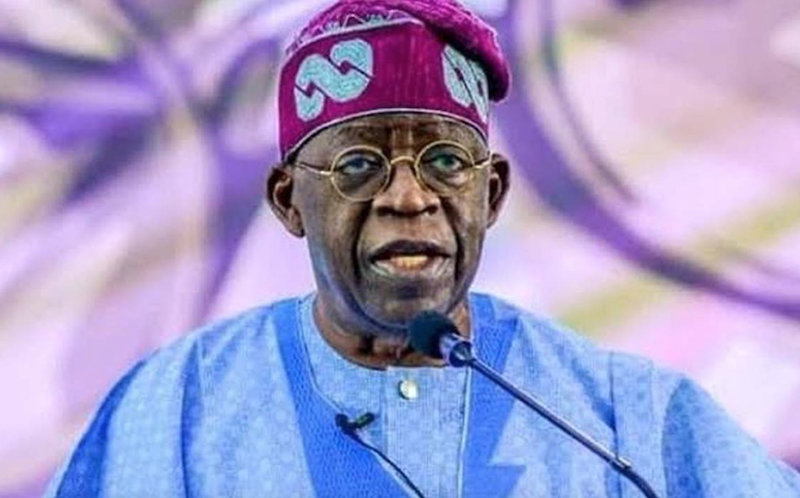

The 2023 General Elections

Nothing highlighted Nigeria’s defining moments in 2023 like the 2023 General Elections.

Following interesting events that preceded the election itself, many believe that it would go down as the most anticipated election cycle since democracy returned in 1999.

Perhaps the fact that it was the first time since 1999 that three major frontrunners contested to become the president of the country added to the anticipation.

The election lived up to its build up, as Asiwaju Bola Tinubu (All Progressives Party), Alhaji Atiku Abubakar (Peoples Democratic Party) and Mr Peter Obi (Labour Party) won in 12 states each.

President Bola Tinubu was declared the winner with 8,794,726 votes; Abubakar came second with 6,984,520 votes; while Obi scored 6,101,533 votes to come third.

One political analyst said the 2023 election was the most consequential in the history of Nigeria since 1999.

As expected post-presidential election litigation went up to the Supreme Court which affirmed Tinubu’s victory.

Naira redesign

Although a spill over from 2022 when the Central Bank of Nigeria (CBN) announced the introduction of redesigned N200, N500 and N1,000 banknotes, it was in 2023 that its impact was most felt.

The policy was greeted with public anger and expressions of frustration as the new notes were unavailable while the apex bank mopped up the old ones.

There also were political undercurrents in the implementation of the policy, leading to the Supreme Court issuing an interim order for the policy to be halted.

Many economists and financial experts termed the naira redesign policy as the worst economic policy ever implemented in Nigeria since the Structural Adjustment Programme (SAP), introduced in 1986.

Japa: Mass emigration of Nigerians

Before 2023, Nigeria experienced mass relocation of professionals and students, often young, who used the study and work permit routes to migrate abroad in search of better lives.

While they travel to Canada, the United States and other Western countries, the UK was the most common choice, especially for those using the study route.

However, in May 2023, the UK government said from January 2024 international students would not be permitted to bring family members with them.

Sensing that the purpose is defeated with that policy, 2023 witnessed possibly the highest relocation of Nigerians to the UK through that specific study route that enables them to take their family members along.

The migration pattern, now referred to as “japa”, has left the country grappling with the shortage of certain professionals in the health, financial services, education, telecom/ICT sectors, etc.

A report by Phillips Consulting Limited, quoted by a newspaper, said japa has, among other negatives, led to a “reduced skilled workforce, decreased tax revenue”.

Osimhen, Oshoala: African football king, queen

Following his exploit with his Seria A club Napoli in the 2022-23 season, Nigeria’s striker Victor Osimhen was named African Footballer of the Year at a ceremony in Marrakech on Dec. 11, 2023.

Osimhen scored 26 goals to help Napoli to a surprise triumph in Serie A last season and was the leading goal scorer in Italy’s top division.

He beat Egypt’s Liverpool forward Mohammed Salah and Morocco’s Paris St Germain right-back Achraf Hakimi to the award, making him the first Nigerian winner since Nwankwo Kanu in 1999.

In the women’s category, Asisat Oshoala won the top prize for a record sixth time.

Hilda Baci’s Guinness World Record

In June 2023, the Guinness World Records (GWR) confirmed that Hilda Effiong Bassey, better known as Hilda Baci, officially broke the record for the longest cooking marathon (individual), with a time of 93 hours 11 minutes.

The 26-year-old chef began on Thursday, May 11 and continued through to Monday, May 15, cooking over 100 pots of food during her four-day kitchen stint.

Hilda attempted to set a record of 100 hours, however, almost seven hours were deducted from her final total because she mistakenly took extra minutes for one of her rest breaks early on in the attempt.

Her record was short-lived though, as Alan Fisher, an Irish chef who runs a restaurant in Japan, dethroned her in November.

GWR said Fisher cooked for 119 hours and 57 minutes, more than 24 hours longer than the previous record held by Baci.

The year also witnessed the death of a sitting governor, as Rotimi Akeredolu of Ondo State succumbed to death after a long battle with cancer.

Rotimi became the 4th governor to die in office in Nigeria after Shehu Kangiwa (Old Sokoto), Patrick Yakowa (Kaduna State) and Mamman Ali (Yobe).

On the international scene, 2023 witnessed the historic coronation ceremony of King Charles III, a ritual that completed his ascension to the throne as the King of England. This followed the death of Queen Elizabeth II.

Women’s football also came of age in 2023, with the staging of the FIFA Women’s World Cup co-hosted by Australia and New Zealand.

The Falcons of Nigeria did Africa proud after fighting gallantly against eventual finalists, England, and losing in a penalty shootout.

The competition shattered all previous records in terms of sponsorship, viewership, stadium attendance, involvement and players’ remuneration.

Artificial Intelligence, which has the potential to change human interaction forever, became mainstream in the year.

Unfortunately, the ugliest event of 2023 – the war between Israel and Hamas in the Gaza Strip – is still ongoing.

Gaza’s Hamas-run government estimates that at least 20,915 people have been killed and 54,918 wounded in Israeli attacks since October 7 when hundreds of Hamas gunmen entered Israel, killing around 1,200 people and taking about 240 hostages.

The year 2023 also saw a proliferation of military coups and attempted coups in Africa, especially in the West African sub-region.

There were deadly earthquakes and wildfires, the most devastating being in Turkey, Syria and Morocco.

And who would forget that unsolicited kiss from Spanish football chief Luis Rubiales on the lips of captain Jenni Hermoso which all but ruined their team’s victory celebration? Kayode Adebiyi, NAN