As I was in the process of releasing this piece into the mass media,the news broke that President Tinubu has on Wednesday 12 July ,put forward a request to the House of Representatives, HoR for five hundred (N500b) billion naira as extra funds for the provision of succor for the masses undergoing what Mr President referred to as pains similar to child birth pang experienced by women who are mothers.

The sum which is to be specifically deployed in the provision of succor to the masses distressed due to the immediate consequences of the withdrawal of subsidies on both petrol and the naira policies being implemented by the incumbent administration.

The funds is expected to be sourced from the 2022 supplementary appropriation act which has a provision of N819.5 billion naira for palliatives envisaged by the predecessor administration.

It was quite a pleasant co-incidence to me because,a critical question that l had posed in the later part of this piece before the request for the approval for the allocation is: where would president Tinubu find the funds to provide the much needed cushion for his temporarily painful but ultimately economically revolutionarily positive policies?

Having searched and not been able to identify other more viable alternatives in the horizon,my answer to the question is that taking the option of the International Monetary Funds,IMF loan may hold a better promise for our beleaguered country.

That is because although Nigeria is currently distressed financially,it has the resources and potentials to thrive as a prosperous and successful country which are yet to be tapped or harnessed.

But with the self imposed reforms-removal of petrol subsidy and removal of multiple exchange rates if the naira with foreign currencies which President Bola Ahmed Tinubu’s government has voluntarily embarked upon in less than 45 days of being on the saddle of leadership,Nigeria is eminently qualified to seek and obtain the IMF loan.

Having basically fulfilled all the loan conditionalities made by the IMF as far back as 1986 under the watch of then military president Gen.Ibrahim Babangida, IBB,through the sweeping reforms introduced by president Tinubu via his Tinubunomics initiative since 29 May this year, the question that comes to mind would be: is Nigeria taking the IMF loan ?

Everyone knows that our country is in dire need of revenue, and its external debt burden that is hovering around fifty trillion (N50) naira added to its local debt that brings its indebtedness to an estimated N80 trillion has been acknowledged as unsustainable.

And given the paucity of revenue inflow that has been compounded by an epidemic and pernicious crude oil theft (Nigeria’s main source of revenue) that has assumed an alarming dimension,the country may not have any other option than to go the way of its neighbor Ghana which recently sought and received three ($3b) billion dollars from the International Monetary Fund,IMF.

The option of IMF loan recommends itself because it is becoming increasingly difficult for Nigeria to service her external debt due to the fact that the cost of servicing it practically consumes most of the revenue accruing into the coffers of the federal government to the extent that our country’s debt to equity ratio is in the negative territory and the world bank reckons that our debt servicing obligations matched against our national income is at about 96%.

In fact,by some estimates in some quarters ,our debt payment obligations,all things remaining the same,would outstrip our revenue inflow in less than one year time.

Consequently,in recent times there has been very little or nothing left to apply in providing infrastructure or even somethings as little as basic remedies or palliatives for the hardship triggered by the removal of subsidy on the pump price of petrol and multiple naira exchange rates in the last one month of president Bola Ahmed Tinubu’s sweeping economic reforms.

For instance,the economy is in such a dire strait that it is the four hundred (N400m) that used to be pushed into the black hole otherwise known as petrol subsidy on a daily basis that is being targeted as the funds for the new administration to kick start the much anticipated palliatives to ameliorate the hardships currently being faced by Nigerian masses.

It may be recalled that the outgone administration of President Mohammadu Buhari had programmed for petrol subsidy regime to be over at the of last June beyond which there was no financial provision in the 2023.

And the Nigerian National Petroleum Corporation Ltd,NNPCL had claimed that the federal government was owing it a princely sum of N2.8 trillion naira after netting off the income from crude oil sales from the cost of petrol imports.

That is despite the fact that N3.5 trillion provision was made in 2023 budget for petrol subsidy up till June which is just half of the year after N6 trillion was appropriated as subsidy for petrol in 2022.

That brings subsidy in 30 months to a mind boggling N9.5 trillion which the HoRs is determined to investigate its disbursement.

That is on top of Nigeria producing crude oil below the 1.8 million barrels a day quota from OPEC and its income from the sale of the commodity which constitutes about 79% of its foreign exchange earnings (gas is 11%) and as such earning a paltry income in the neighborhood of $5b which converted to maitama os Lewa than N30 trillion annually , (world bank estimated that about $5.6b would be saved owing to subsidy removal from petrol and naira) which is about half of the over $10 billion that it used to earn annually in not too distant past ,finding funds to sustain government would be like trying to squeeze water out of stone.

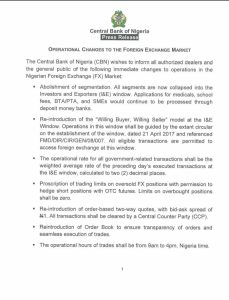

And even the dollar proceeds hitherto applied in defending the naira by the Central Bank of Nigeria,CBN via weekly interventions in the foreign exchange market through the sale of dollars to a vast array of bureau de change outfits that were mainly owned by government officials and fronted for by surrogates located in popular hotels,airports and strategic street corners,the bonanza is not available anymore as NNPC ltd had been mandated to use the dollar income to import petrol into Nigeria and sell at subsidized rate,and which has been returning a net deficit for the federation.

The weekly dollar bazaar which was done ostensibly to shore up the naira/ FX rate is no more available for the twin reasons of crude oil proceeds being exclusively managed by NNPCL that collects and uses the funds to import refined petroleum products into our country and which it subsidizes before it is retailed to motorists.

And it is a largesse that has ended with

President Tinubu’s bombshell decision pronouncement in his inauguration speech on 29 May: “Petrol subsidy is gone “.

As observed earlier,NNPCL in the wake of the petrol subsidy removal had claimed that our country is owing it N2.8 trillion in payment areas for subsidizing pump price of petrol which it had been carrying out on behalf of the Federal Government of Nigeria,FGN.

What the narrative above indicates is that our crude oil revenue was not even enough to support the cost of subsidizing petrol pump price because the FGN was still owing NNPCL N2.8 trillion.

That explains why the FGN has been borrowing to pay civil servants emoluments and meet other governmental responsibilities.

In the light of the grim fiscal and socioeconomic situations described above ,even as President Tinubu’s team that l have,for lack of a better nomenclature branded Tinubunomics evangelists are able to come up with strategies to ease the burden of galloping inflation taking a heavy toll on the masses, the initiatives would need to be cash backed.

Whence cometh the funds,Nigerians would wonder?

Definitely not the paltry $800m that the world bank offered Nigeria to help cushion the harsh effect of subsidy removal just before ex president Buhari’s tenure ended,neither is it the new $500m that has been offered to president Tinubu’s new regime by the world bank,perhaps as a demonstration of its support for the far reaching reforms so far introduced.

Clearly ,both world bank funds to be availed or already disbursed to Nigeria,even when combined are inadequate as they would not even scratch the surface of our country’s need.

So,an IMF loan beckons.

Although,President Tinubu appear to have answered the question: when cometh the funds, clearly,N500 billion can only be a stop gap measure in light of the urgency required to do something to ease the pain on the masses sooner than later.

The request for the funds is all the more very much needed to bridge the gap as the process of obtaining the IMF loan,can be relatively long.

Strikingly,Nigeria had attempted to take the IMF loan under the watch of former military president,Gen Ibrahim Babangida who incidentally had toppled then head of state,Gen.Mohammadu Buhari.

And the country was under a similar yoke because the Nigerian economy was at that time literally comatose following about two years of draconian policies of then head of state Gen.Buhari wherein essential commodities such as rice,sugar, milk etc were so scarce that an agency known as Nigerian National Supply Company Ltd,NNSL was set up to purchase and ration the items to Nigerians under very stressful atmosphere reminiscent of the situation in iron clad countries like Republic of North Korea.

In my column of June 27 titled: “A Comparative Analysis Of Tinubunomics Reforms And I.M.F Conditionalities For Loan”, and also wifely published in traditional and online media platforms,l reflected on issues pertaining to our country’s contemplation on taking the IMF loan nearly forty (40) years ago,before it settled for a home grown Structural Adjustments Program, SAP, which it mismanaged with disastrous consequences.

To put things in perspective,below is a snippet: “As it may be recalled,Nigeria had also suffered the dilemma of financial insolvency in the mid 1980s (during the regime of Gen Ibrahim Babangida,IBB (1985-1993) similar to the situation currently being faced by Ghana which just took the IMF loan .

“That was what prompted the country to seek a bailout loan from the l.M.F and some reforms were demanded as pre conditions for granting the loan.

“Some of the conditionalities were very stringent and they were such that the nation balked at taking the loan facility.

“New York Times reporter , Edward A. Gargan, in his article titled : “ Nigerian Leader Wary On I.M.F Loan” published on October 8, 1985, which is nearly 38 years ago so stated the following about Nigeria and the I.M.F loan:

“As a condition for granting the loan,the I.M.F. has called for Nigeria to devalue its currency, the naira, and end the practice of subsidizing petroleum products for consumers. At the official rate of exchange, the naira is equivalent to $1.08, but on the black market here in Lagos money changers are selling nairas for as much as four to the dollar.

“Smuggling Is Rampant.

The tremendous disparity between the official and unofficial exchange rate has led to rampant smuggling and has sharply curtailed Nigeria’s ability to sell manufactured goods abroad”, he noted.

“Moreover, gasoline in Nigeria remains the cheapest in Africa – less than $1 a gallon at the official rate and about 25 cents a gallon at black market rates. Today, General Babangida refused to say whether oil subsidies would be lifted, and virtually ruled out any sharp devaluation of the nation’s currency.”, the reporter concluded.

“Is it not stunning that the damning socioeconomic atmosphere currently prevailing in Nigeria is exactly the situation that was existing nearly four decades ago and for which the l.M.F demanded that Nigerian leaders should make some tough decisions to reform as a critical pre condition for granting her a bailout loan under the watch of military president Gen. lbrahim Babangida?”, l had observed .

The reality is that it is not only gut wrenching that as a nation,we have remained on the same path of ‘Debt Avenue’ and seeking a bailout nearly forty (40) years after lBB considered it following the ouster of then Gen. Mohammadu Buhari as head of state via a palace coup detat in 1985,but it is equally damning and pathetic that today, an IMF rescue may be contemplated once again after the reign of President Buhari who was elected president in 2015 and he succeeded in bringing Nigerian economy to its knees and thus earned the country the unenviable reputation of being the world’s poverty capital which he has handed over to President Tinubu on 29 May .

Although ,this feeling is without concrete evidence,but one gets the sense that it may be as a precursor to seeking the lMF loan that President Tinubu has been rolling out revolutionizing economic reform policies tagged Tinubunomics that is unshackling our country and making it investment friendly.

By the way,there is currently an equivalent of Tinubunomics in the United States of America,USA known as Bidenomics which as the name indicates encapsulates president Joe Biden’s economic policies including the ground breaking infrastructure act that has reflated the economy and boosted employment amongst others through the ongoing massive infrastructure refurbishment in the USA.

As evidence ,the Consumer Price Index, CPI in the world’s largest and wealthiest economy has dropped from 9.1 points to 3 from June last year to June this year.

And the drop in inflation by six (6) points between 2022 and June 2023 is owed to the Infrastructure Investments Act or Jobs Act which saw a humongous sum of $1.2 trillion being appropriated for investment in infrastructure.

The the monumental investment dubbed once-in-a-generation stake in infrastructure is encapsulated in Bidenomics driven by the Build Back Better Agenda of president Biden.

And if Bidenomics has worked in the USA as is currently evident,there is every good reason to believe that its equivalent Tinubunomics would equally have a positive outcome in Nigeria if diligently pursued.

In Nigeria Tinubunomics policies range from the repeal of burdensome and archaic economic policies that had shackled our country thus putting long suffering Nigerians literarily in economic manacles via the erstwhile funds guzzling petrol subsidy,operation of multiple naira exchange rate with dollar which is another type of subsidy and the subsidy on electricity production and distribution arising from the fact that the activity was on the Exclusive List,meaning that hitherto ,only the federal government could provide electricity service.

It is situation which the signing into law of Electricity Act 2023 by President Tinubu has changed for the better basically because the policy has thrown open the investment space in electricity services to the private sector for participation.

Apart from the earlier referenced Electricity Act 2023 and the Freedom of Data Act that would unleash the potentials of information technology which has been elevated to the level of Artificial Intelligence,AI being leveraged in the advanced society to enhance all spheres of life,there is also the passage of four (4) Executive Orders that have reversed some anti business laws such as new tariffs on vehicles imported into Nigeria and 5% Value Added Tax,VAT on telecoms services as well as similar sundry taxes that were stifling businesses.

It may be recalled that the aforementioned laws that are unfriendly to business had gotten hastily passed by the immediate past regime before its exit on 29 May.

The four (4) executive orders that are business friendly appear to be in response to the organized private sector which has cried out to President Tinubu for forbearance.

And as if it to cap the myriads of policy decisions that has so far been taken by President Tinubu aimed at pulling our country out of the abyss of debt and the hole of despondency into which more citizens of our country numbering up to 130 million of 200 million have descended, the president has also set up a tax advisory council with PwC team lead for West Africa ,Taiwo Oyedele as chairman.

The mandate of the council comprising of other eminent tax experts is to seek ways and means of optimally harnessing in win-win manner the untapped tax resources in our country presently not captured by the existing system.That is with a view to enabling the administration carry out the onerous task of pulling out our country from the economic doldrums in which it is currently wallowing as a consequence of eight (8) years of monumental sociopolitical and economic mismanagement by the predecessor government.

It is a consequence of the unmitigated disastrous socioeconomic and political leadership of our country by the outgone regime that Nigerian masses are being characterized as multi dimensionally poor people.

It is even as an additional four million,one hundred thousand (4.1m) are adjudged by the world bank as having joined the ranks of the indigent,since the withdrawal of subsidies on petrol and the naira exchange rate unification on 29 May when President Tinubu mounted the throne of leadership in Aso Rock Villa .

With the threat of an additional seven million (7m) joining in the inglorious poverty club,which is a figure that the world bank is projecting would likely be the aftermath of the removal of subsidies on petrol and naira by this year end,if palliatives are not rolled out to cushion the harsh effects of the policies aimed at preventing our country from falling into a looming debt trap,it is not an understatement to emphasize that there is an urgent need to make haste in providing buffers.

That is probably what justifies and is driving the request for N500 billion from the supplementary appropriation act 2022 currently before HoRs, but which the Nigerian Labor Congress, NLC is kicking against because it believes it is inadequate to support the 300% salary increase that it is demanding.

After breaking the somewhat forty (40) years jinx of operating an economy that has been bearing the debilitating burden of petrol and naira subsidy which the multilateral and international financial institutions,World Bank,IMF and even investment bank JP Morgan as well as other multilateral financial organizations have been demanding that Nigeria should remove to free up the economy via major policy reforms as far back as president Buhari’s first coming as military dictator (1984-85),it would not surprise me if the aforementioned global financial agencies are already wooing Nigeria with loan offers.

That would be more so because the ongoing reforms have been voluntary as opposed to being imposed.

That being the case ,despite Nigeria’s estimated N50 trillion external loan exposure,she may be able to obtain international loans on favorable terms simply because the country with its humongous potentials(population in excess of 200m and the largest in Africa) with a significant and reasonable purchasing power as well as virile middle class comprising of 60% youth demographics that are very creative, Nigeria is currently the toast of the investors globe wide.

But given the horrendous and frightening size of our current debt profile,a significant,if not broad a spectrum of Nigerians may kick against the idea of obtaining more loan.

But to dig the economy out of the hole in which it is currently stuck, would require more funds.

And being that the debt servicing that watchers of our economy (world bank etc had warned about a year ago would outstrip our income) if adequate care was not taken to cut down on our expenditure costs and boost revenue inflow by plugging crude oil leakages to oil thieves, an admonition that was unheeded and has become a reality today,hence the future of our country is currently in jeopardy.

According to statistics from the National Bureau for Statistics,NBS,the total exports from Nigeria for 2022 rose by 41.72 per cent from N18.91 trillion in 2021 to N26.79 trillion as of 2022. But imports rose by 22.77 per cent from N20.84 trillion in 2021 to N25.59 trillion in 2022.

When the value of Nigeria’s total export last year which is N26.79 trillion is basically equal to the import value of N25.59 trillion in the same 2022. That simply implies that our country’s export and import almost netted off each other last year.

When the debt servicing obligation of Nigeria is added,and which the Debt Management Office,DMO puts at N3.36 trillion in 2023, where would this administration find the money to undertake the under-listed huge investments that would facilitate a more people friendly transition from petrol subsidy removal and naira exchange rate unification?

Although ,the administration is yet to disclose its plans, l would like to hazard a guess that the immediate needs for investment to soften the effects of the policy reforms would likely be: procurement of mass transit buses powered by Compressed Natural Gas,CNG, provision of one hundred percent (100%) salary increase to public servants and offer some tax breaks to businesses to enable the extension of similar 100% salary raise for workers in that sector,as well as avail loan to indigent tertiary institutions students as enunciated in the Students Loan Act.

The above listed proposals are some of the lofty measures that are likely to be

undertaken by the administration as a panacea to the inclement fall outs of the socioeconomic reforms so far rolled out by president Tinubu.

The introduction of the palliatives would enable the reforms come into fruition or materialize without too much collateral damage on the masses.

As if there was a synergy of thoughts and meeting of minds of sorts, government has put put forward the request to HoRs for it’s approval for the executive branch to apply N500 billion in the 2022 supplementary appropriation act in mitigating the harsh effect of its reforms,and it is currently receiving the attention of the legislators.

The NLC dissatisfaction with the sun of N500 billion requested,suggests to me that it may be a bridging gap as more funds , probably from the I.M.F may be sourced.

Whatever the case may be,the undeniable reality is that this country right now looks like a firm or business corporation which has just been taken over from a very bad manager and needs working capital to put it back on even keel.

In my reckoning,to make Nigeria work again,it needs working capital,and as financial experts very well know,borrowing from the money or capital markets is obviously more expensive than borrowing from a multilateral agency like the IMF, world bank etc.

The snag may be that our country’s previous experience with lMF might have left an unsavory taste in the mouths of Nigerians.But there is a difference between 1986 and 2023 which is that the IMF would not be imposing any harsh conditionalities on Nigeria because the country has already voluntarily swallowed the bitter pills.

Should president Tinubu decide to pursue the option of IMF loan ,Nigerians would acquiesce with it as long as they would be assured by Tinubunomics champions that the funds would be invested in production -infrastructure etc activities as opposed to consumption items-salary payments ,which has been the pattern in the past eight (8) years.

And the demand by the NLC for more funds to be appropriated for palliatives underscore the belief that lMF loan may be the most viable option at this point in time.

Magnus Onyibe,an entrepreneur, public policy analyst ,author,democracy advocate,development strategist,alumnus of Fletcher School of Law and Diplomacy,Tufts University, Massachusetts,USA and a former commissioner in Delta state government, sent this piece from Los Angeles, California,USA.

To continue with this conversation,please visit www.magnum.ng