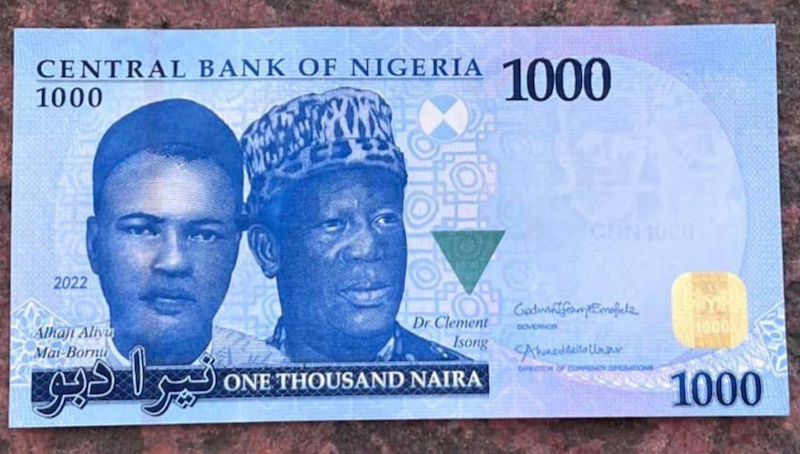

President Muhammadu Buhari has inaugurated the new Naira banknotes, expressing delight that the redesigned currencies were locally produced by the Nigerian Security Printing and Minting (NSPM) Plc.

Speaking at the inauguration of the new banknotes which preceded the Federal Executive Council (FEC) meeting on Wednesday in Abuja, Buhari explained in detail the basis for his approval to the Central Bank of Nigeria (CBN) to redesign the ₦200, ₦500 and ₦1000 banknotes.

According to the president, the new Naira banknotes have been fortified with security features that make them difficult to counterfeit.

He added that the new banknotes would help CBN to design and implement better monetary policy objectives, as well as enrich the collective memory of Nigeria’s heritage.

Buhari commended the CBN Governor, Godwin Emefiele and his Deputies for the initiative.

He equally thanked the Managing Director, Executive Directors and staffers of NSPM PLC “for working tirelessly with the apex bank to make the currency redesign a reality, and for printing the new Naira notes within a comparatively short time.”

According to him, international best practice requires central banks and national authorities to issue new or redesigned currency notes every five to eight years.

Buhari said that it was now almost 20 years since the last major redesign of the country’s local currency was done.

The president said that implied that the Naira was long overdue to wear a new look.

“Buhari said: ‘A cycle of banknote redesign is generally aimed at achieving specific objectives, including but not limited to: improving security of banknotes.

”It is also aimed at mitigating counterfeiting, preserving the collective national heritage, controlling currency in circulation, and reducing the overall cost of currency management.

“As is known, our local laws, specifically the Central Bank of Nigeria Act of 2007, grants the CBN the power to issue and redesign the Naira.

“In line with this power, the bank’s Governor approached me earlier in this year to seek my permission to embark on a currency redesign project.

”I considered all the facts and reasons presented before me by the Central Bank.”

Buhari, therefore, expressed the hope that the new notes would address the urgent need to take control of currency in circulation.

He said that it would also address the menace of hoarding Naira banknotes outside the banking system and curb the shortage of clean and fit banknotes in circulation.

Buhari added that the redesigned notes would also address the increase in counterfeiting of high-denomination Naira banknotes.

”It is on this basis that I gave my approval for the redesign of the ₦200, ₦500 and ₦1000 banknotes.

“While this may not be apparent to many Nigerians, only four out of the 54 African countries print their currencies in their countries, and Nigeria is one.

”Hence, a majority of African countries print their currencies abroad and import them the way we import other goods.

“That is why it is with immense pride that I announce to you that these redesigned currencies are locally produced right here in Nigeria by NSPM Plc,” he said.

In his remarks, Emefiele thanked the president for his unwavering support for the redesign and distribution of the new notes.

According to him, the new notes will control inflation, make policies more effective, ensure financial inclusion and fight corruption.

The CBN governor also said that by international best practice, the redesign of notes should be every five to eight years.

He said,” and the currency in circulation had been in use for 19 years, with spiraling challenges on the economy, especially on security and counterfeiting.”

Emefiele also appreciated the president for his insistence that the initial notes must be designed and produced within the country, further placing confidence in NSPM Plc.

“Mr. President, only a President of your esteemed and incorruptible stature could have done what we are witnessing today,’’ he added.

Emefiele listed more benefits of the redesigned naira notes to include enhanced security, greater durability, attractiveness and promotion of rich cultural heritage.