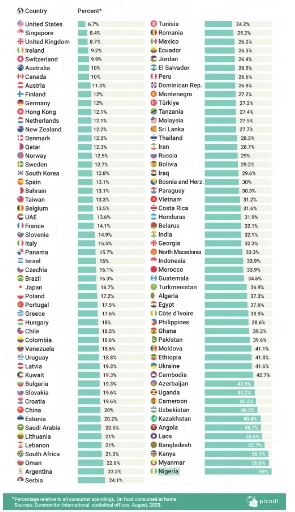

A recent analysis of global consumer spending patterns across countries has revealed that Nigerians allocate a substantial portion of their earnings to food, surpassing many other nations in grocery spending.

Despite gaining the status of a lower-middle income economy in 2014, Africa’s biggest economy with an estimated gross domestic product (GDP) of $441 billion and gross national income per capita of $2,085 in November 2022, Nigeria has over 100 million people facing food insecurity.

According to data compiled by Picodi, an international e-commerce organization, Nigeria tops the chart in terms of grocery spending among those surveyed, as the average Nigerian household spends about 59 per cent of its income on food, the highest in the world.

The ranking places Nigeria at the 105th position out of 105 countries. Other countries with high consumer spending dedicated to food and non-alcoholic beverages are Myanmar (56.6%), Kenya (56.1%) and Bangladesh (52.7%).\

On average, a Nigerian dedicates $62 per month to purchase essential groceries, translating to roughly ₦48,186, the report noted. TheNewsGuru.com (TNG) notes that this is about N18, 000 higher than the current minimum wage.

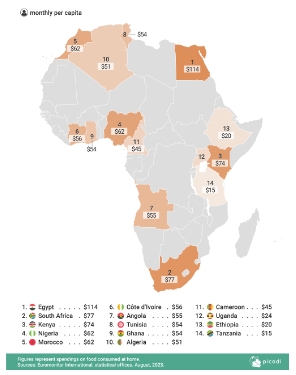

When juxtaposed with grocery spending patterns in other African countries, Egypt leads the pack with the highest grocery spending, where individuals allocate approximately $114 per month to cover their grocery expenses.

South Africa follows closely behind, with an average monthly grocery spending of $77, while Kenya claims the third spot, with an expenditure of approximately $74 on groceries every month.

Conversely, on the lower end of the spectrum, we find countries where grocery spending is notably lower. For instance, in Uganda, monthly grocery expenses average around $24.

Ethiopia trails closely with an average monthly expenditure of approximately $20 on groceries, and Tanzania registers the lowest grocery spending, with individuals setting aside a mere $15 per month for this essential aspect of their budgets.

In Nigeria, where grocery spending significantly contributes to overall consumer expenditure, the data casts a spotlight on the impacts of subsidy removal and the associated challenges stemming from transportation costs.

The statistics are not merely abstract numbers but translate into tangible economic realities for individuals and households in Nigeria when it comes to securing their daily sustenance.

Molecular biologist Ayan Fegem, expressed concern, stating that the cost of living has significantly escalated, and transportation expenses have soared.

Fegem said there was a need for more transparency regarding the distribution of palliatives to individual states for equitable sharing.

She queried: “Cost of living has become very high. Transportation has also become very high. What’s going on with the palliatives given to each state? What is the sharing methodology?”

Nigeria’s annual inflation rate surged to 24.08 per cent in July from the 22.79 er cent recorded in the previous month, according to the National Bureau of Statistics (NBS).

The NBS attributed the surge in food inflation on a year-on-year basis to price increases in categories such as oil and fat, bread and cereals, fish, potatoes, yams, fruits, meat, vegetables, milk, cheese, and eggs.

Although, the rising prices of food commodities have been a consistent concern across Nigeria in recent years, the situation has taken a turn for the worse, exacerbated by government policies, most notably the removal of the subsidy on petrol.

On May 29th, during President Tinubu’s inauguration, the decision to remove the petrol subsidy was announced.

This policy change has had far-reaching consequences, leading to hardships for many Nigerians and a subsequent uptick in the prices of essential goods and services.

In addition to subsidy removal, the Central Bank of Nigeria (CBN) introduced measures to unify all segments of the foreign exchange (FX) market.

President Tinubu responded to the escalating food prices by declaring a State of Emergency on food insecurity in July, signalling a commitment to address the challenges posed by rising food costs.

Furthermore, he directed that all matters related to food and water availability and affordability be brought under the purview of the National Security Council as essential livelihood items.

While agriculture contributes 22 per cent of the total GDP and employs over 80 per cent of the population, smallholder farmers who are responsible for 90 per cent of food production in Nigeria lack the resources to improve their productivity because they operate in an ecosystem characterized by low productivity, high post-harvest losses, low-value addition, fragmented markets, and inefficient value chain logistics.