The Nigerian Education Loan Fund (NELFUND) says it has disbursed a total of N1.17 billion to 20,000 students in five of the public tertiary institutions that applied for the loan.

The Managing Director of NELFUND, Akintunde Sawyerr, disclosed this at a news conference in Abuja on Wednesday.

Sawyerr, who said that, one more institution would be added to the beneficiaries before the end of the day, noted that NELFUND would keep increasing the number based on applications.

According to him, the fund is working on reviewing another 100 institutions whose application had been received

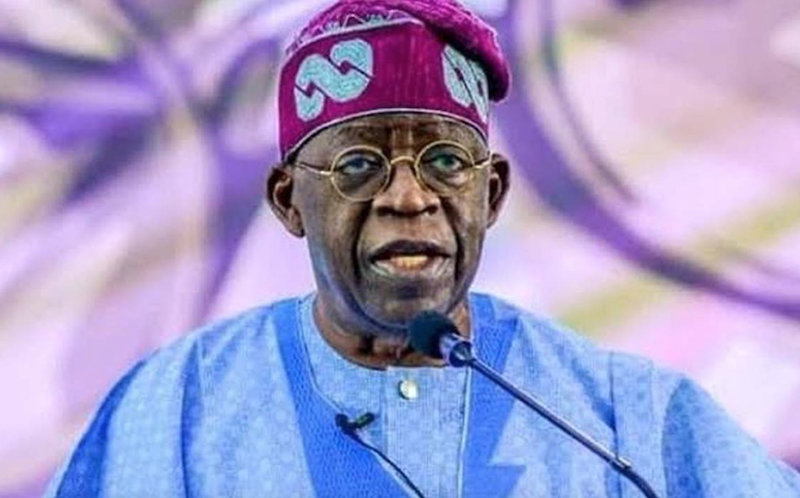

“I am delighted to share that, following President Bola Tinubu’s directive, NELFUND has been able to disburse students’ institutional fees amounting to N1,172,388,340.00 for 20,000 students (100 per cent paid) in the institutions across the country.

“These institutions were carefully selected based on their academic calendar.

“Disbursement to other institutions will be made at the beginning of their sessions, to ensure a transparent and equitable distribution of resources,’’ he said.

Sawyerr said an additional disbursement of N850 million would leave NELFUND to various institutions due to receive the loans.

He also disclosed that a total of 260,000 students had been approved for payment of upkeep loans and their institutions’ charges

He said that the upkeep loan and institution charges for each student is N250,000 per annum. However, a student could apply less than the approved amount.

According to him, not every student that takes the institution loan wanted the upkeep loan, which would be paid in tranches base on students’ need.

When asked if the loans could be given to Post Graduate students, Sawyerr said the mandate of the fund focuses on undergraduate students with the least opportunities,

“Our focus is on the undergraduate students. It is a fund that enables those who have the least opportunities to get education.

“While we acknowledge that there are students who will want to pursue their postgraduate studies, for now, our target is undergraduate students,” he said.

![See 36 State universities to first benefit from FG student’s loan [FULL LIST]](https://thenewsguru.ng/wp-content/uploads/2022/08/Screenshot-2022-08-18-at-6.23.43-PM.png)