By Oluwole Oluyemi

“Madame, the wages of sin are not exempted from taxation” – Blanche E. Lane, 15 TCM 1088 (1956), sourced from the UMKC site on 8 April 2017.

During the run-up to the 2015 national elections, the anti-corruption drive was a major campaign tool that probably partly contributed to the success of the current administration at the elections. The expectation from the President Buhari’s administration is high, especially on the anti-corruption campaigns. However, the Economic & Financial Crimes Commission (EFCC) and other prosecuting agencies have still been unable to procure any landmark conviction in Nigeria since 2015.

In the last decade, we have had some alleged cases being thrown out at the Nigerian courts only for the same accused persons to be fully convicted in foreign countries. There is a popular saying that “insanity is doing the same thing over and over, and expecting to have different results”. With the population of lawyers and tax professionals in Nigeria, we shouldn’t be seen as insane in this area, unless the lawyers and tax professionals admit to be collaborators in this great crime against the nation.

I will not make attempt to explain why bribery still continues to be a “national character” in the country despite the fact that most Nigerians are highly religious. I will also not attempt to categorise bribery and other financial crimes into different categories. My focus in this article is to evaluate how we can use our tax laws as a tool for fighting and prosecuting corruption.

Tax evasion and Tax avoidance

So, what is tax evasion? Tax Evasion is defined in a very simple manner by the Canadian Department of National Revenue as “the omission or commission of an act knowingly with intent to deceive so that the tax reported by the taxpayer is less than the tax payable under the law, or a conspiracy to commit such an offence. This may be accomplished by the deliberate omission of revenue, fraudulent claiming of expenses or allowances, and the deliberate misrepresentation, concealment or withholding of material facts.”. Tax evasion schemes may include, but not limited to, the following:

- Non Registration for Taxes or Failure to furnish a return or to keep the required records;

- Making an incorrect return by omitting or understating any income (irrespective of the source or morality of the source), including the non-disclosure of offshore businesses and income;

- Claiming of Fictitious expenses (including false claims on pension schemes) and assets;

- Deliberate claiming of tax credits (e.g. capital allowances) to which claimant know they were not entitled;

- Falsification of tax clearance certificate, tax receipts, withholding tax credit notes, etc.

Tax evasion is different from tax avoidance, which is a legitimate way of arranging one’s financial transactions in a way that will optimise the tax exposure without infringing on the tax laws and regulations. Therefore, tax evasion is a wilful and deliberate violation of the law whereby a person who derives a taxable income either pays no tax or pays less tax than he would otherwise be bound to pay, while tax avoidance is the active means by which the taxpayer seeks to reduce or remove altogether his liability to tax without violating the tax laws and regulations.

Wages of Sin and Taxation Laws: Nigeria versus Other Nations

Tax is based on the taxable income of the individual or body corporate. The Nigerian Personal Income Tax Act (PITA) based the taxation of individuals on the “gross income” of the individual. Section 3 of PITA defines the gross income as….“the aggregate amounts each of which is the income of every taxable person, for the year, from a source inside or outside Nigeria, including, without restricting the generality of the foregoing….”. This definition is similar to what obtains under Section 61 of the United States Internal Revenue Tax Code (USIRTC), which defines gross income as “all income from whatever source derived”.

In the US, before the enactment of the USIRTC, Section 11B of the Income Tax Act of 1913 provided that “the net income of a taxable person shall include gains, profits, and income…….from……..the transaction of any lawful business carried on for gain or profit, or gains or profits and income derived from any source whatever….” See 38 Stat. 167. However, the 1916 Amended Income Tax Act expunged the word ―lawful. Based on this 1916 amendment, it would appear that the US intended to tax income derived from all sources – both legal and illegal sources.

Based on the above referenced Section 3 of PITA, it would appear that any earning, of whatever description, is taxable unless expressly excluded by the law. It is my opinion therefrom, that the tax laws does not make any moral judgment as to the legality or unholy nature of a taxpayer’s source of income. By extending this argument further, therefore, proceeds from prostitution, armed robbery, bribery, “419” and “Yahoo-Plus” are all taxable.

Prosecution of Tax Evasion offenders in Nigeria and the Anti-Corruption Campaign

In Nigeria, most of the prosecutions that we have seen on tax related offences are usually for forgery of tax clearance certificate brought under section 473 of the Criminal Code Act Cap C.28 Laws of the Federation of Nigeria on forgery, and such are not regarded as a tax offence. There is also an un-celebrated case in 2014 where the ICPC was able to secure the conviction of an FIRS official who was bribed to issue a Tax Clearance Certificate to a company without paying the adequate taxes. Based on the information on the ICPC website, both the FIRS official and the Company were convicted. It is not clear if this conviction was secured based on the tax evasion laws. Therefore, it appears that there is no documentation of any criminal prosecution arising from tax evasion in Nigeria.

Likewise, there has also been no reported case of a high profile personality or celebrity who has been prosecuted for tax evasion as is common in developed countries. In such economies, high profile personality or celebrity have been found guilty of tax evasion and have been made to pay back the relevant taxes and penalties, in addition to jail terms to serve as deterrent to others. The list of high profile personalities that have been convicted of tax evasion includes Boris Becker, Martha Stewart, Wesley Snipes, Nicolas Cage and Marc Anthony.

Our tax laws have several monetary penalties and fines, as well as criminal sanctions for tax offenders. Hence, the seeming absence of criminal prosecution of tax offenders is due to the approach of the agencies saddled with prosecuting financial crimes in Nigeria, and not due to lack of relevant laws in the country.

Section 40 of the FIRS ACT of 2007 (the Act establishing the FIRS) on the failure to deduct or remit taxes also recommends imprisonment for a period not exceeding three years in addition to the payment of the uncollected or unremitted taxes along with a penalty of 10% of the tax withheld or not remitted per annum plus interest at the prevailing CBN rate. The FIRS Act also granted several powers, including the following, to the FIRS:

- In collaboration with the relevant law enforcement agencies, carry out the examination and investigation with a view to enforcing compliance with the provisions of this Act;

- Make, from time to time, a determination of the extent of financial loss and all other such losses by government arising from tax fraud or evasion and such other losses (or revenue forgone) arising from tax waivers and other related matters;

- Adopt measures to identify, trace, freeze, confiscate or seize proceeds derived from tax fraud or evasion;

- Liaise with the office of Attorney General of the Federation, all government security and law enforcement agencies and such other financial supervisory institutions for the enforcement and eradication of tax related offences.

Section 66 of the Companies Income Tax Act (CITA) confers on the FIRS the power to seize and sell defaulting taxpayers’ goods, chattels as well as their premises in extreme cases in order to recover the amount of tax owned by such taxpayers.

Our tax laws, therefore, are strong enough to tax illicit wealth and help our anti-corruption agencies to use these laws as a basis to prosecute people with illicit wealth and other tax evasion offenders up to our Supreme Court. The newly introduced whistleblower guidelines and the Freedom of Information Act will complement this strategy.

The prosecution of crime based on the taxation of illegal proceeds has, however, yielded positive results in the global arena. Based on documented history, we can recall that it was tax evasion and not a conviction of murder, robbery, or some similar crime that led to the conviction of the popular gangster Al Capone in 1931. It was also during a similar court proceeding that a tax court made a popular comment that “Madame, the wages of sin are not exempt from taxation!”. In the case of James v US (1961), the US Supreme Court also held that illegal gain and proceeds from criminal ventures are taxable income, despite a legal obligation to make restitution.

Using Tax Evasion Prosecution as a Tool for Anti-Corruption Campaign: Illustrative Scenarios

Based on the successful prosecution of tax evasion offenders globally, it is noted that tax evasion prosecutions are usually successful if it can be proved beyond a reasonable doubt that the taxpayer owed substantial income tax in addition to that declared in the tax return, and that the person knowingly and willfully attempted to evade the tax, or a substantial part of it, by willfully neglecting to report all of the taxable income which he/she knew he/she had during that year.

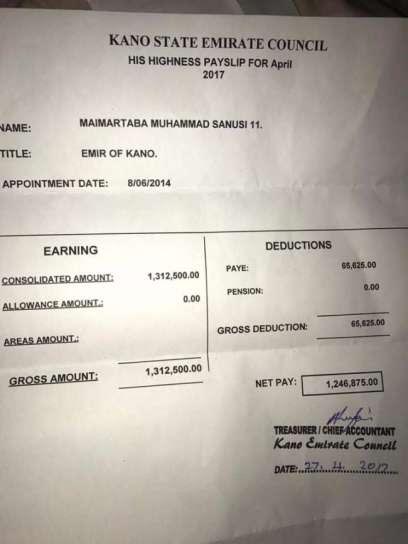

For instance, a person who declares an annual income of NGN5 million but is able to send his/her children to school in the US or UK must obviously be getting funds from an undeclared sources. Such persons are good candidates for tax evasion prosecution as the profile of the person’s expenditure can be used as prove of undeclared taxable income.

Now, let us also look at a hypothetical case of a Madam PJ (a fictional name for this scenario and does not represent a real case). Madam PJ is a senior civil servant (on the level of a Permanent Secretary) with an annual income of N5 million. She has worked for 20 years from the year she graduated from the university. Assuming that she has been on the same salary grade from the year she was employed, her total cumulative salary to date is about N100 million. Assuming, again, that she has not spent any “kobo” from her salaries to date, then her total savings should be about N100 million. Now, lets assume that EFCC suddenly discovered an amount of US$15 million cash in her vault that is secretly kept somewhere in Kaduna. What can EFCC do?

Option 1 (Current situation): EFCC to rush to the courts based on the discovery, to challenge Madam PJ that the US$15 million must have been proceeds of financial crime. Of course, depending on the popularity of Madam PJ, there could be a media frenzy (especially for the first two weeks before another media item comes up). However, the law courts are not moved by emotions or media frenzy. The allegation is to be proved beyond reasonable doubts. Unfortunately, the “burden of prove” (of the allegation) rests on the prosecuting agencies. However, it is sometimes difficult to prove the source or intention of such proceeds. In this instance, therefore, Madam PJ could be cleared for “absence of convincing evidence from the prosecution” and she will then have full and unrestricted access to the illicit US$15 million.

Option 2 (Where we should be): EFCC to provide evidence that the US$15 million proceeds are inflows into Madam PJ’s account and that she has ownership and/or control of the funds (irrespective of the morality of the source of the proceeds). Based on this, EFCC along with the relevant tax agencies, could then reconcile the tax returns that was filed by Madam PJ in the preceding year(s) to confirm if any income relating to the US15 million was declared on the tax forms (whether as gifts or business income) and the relevant taxes paid on the income. If the income was not declared on the tax returns and/or the necessary tax was not paid, then this constitutes a valid ground for the prosecution for tax evasion, which if successfully prosecuted, attracts the payment of the relevant taxes and penalties, along with up to three years imprisonment. As an ex-convict (whether or not the conviction includes imprisonment), madam PJ will no longer be able to hold political offices or be appointed as a board director for any company in Nigeria.

The above examples, though in simplistic terms, is to illustrate how it is easier to successfully convict people with illicit proceeds using the route of tax evasion prosecution. It is surprising that the EFCC and/or the Federal Inland Revenue Service (FIRS) do not yet appear to have a strong dedicated department for Tax evasion Crimes. Our tax administration, especially the capability to prosecute tax evasion offenders and people with illicit funds, needs to be further enhanced as a critical part of the federal government’s strategy to fight the corruption menace and promote ethical transparency in business transactions. This approach will also encourage voluntary tax compliance as taxpayers will have a sense that the tax laws is not exempting those who became “super rich” through questionable sources. This strategy will bring Nigeria to the same level with other leading countries as regards the prosecution of tax evasion crimes.

As President Buhari once said, “if we don’t kill corruption, corruption will kill Nigeria”. It is time for Nigerians to ensure that we have adequate strategies and processes to “kill” corruption. Nigerian government needs to demonstrate more seriousness in the fight against corruption.