Before ex-president Olusegun Obasanjo exited Aso Rock Villa presidential seat of power in 2007, as part of his privatization program, he unbundled a significant portion of the Nigerian National Petroleum Corporation, NNPC.

And the key components of that exercise were the sale of the refineries and other downstream operations assets such as the petroleum marketing companies that it had owned Jointly with International Oil Corporations, IOCs.

These include,AGlP, which was renamed Oando by the Mr Wale Tinubu’s consortium that bought it; African Petroleum,AP,also bought by Chrismatel group,owned by Mr Peter Okocha who won the bid,and operated it for a while,before offloading it later to Mr Femi Otedola who also recently sold it to the new owner that has renamed it, Ardova Plc.

There was also National Oil,which is now renamed Conoil after Chief Mike Adenuga successfully pitched for and won the bid to purchase it.Conoil operates six (6) oil blocks in the niger delta and Adenuga is Africa’s third richest man.

At the time of liberalizing the oil/gas sector,the four (4) refineries owned by government(currently under refurbishment) were somehow still viable and they were also unbundled .

One of them was sold to Dangote group,owned by Alhaji Aliko Dangote, Africa’s richest man,who is currently on track to completing the setting up one of the world’s biggest petroleum refineries, in lagos, Nigeria.

The sale of the refinery took place in the twilight days of the Obasanjo’s reign,just as the reformation and transition of NNPC from a corporation into a limited liability company is taking place barely ten(10) months to the end of the presidency of the incumbent, Mohammadu Buhari.

It is worthy of note that the reform in NNPC that took place as the sun was setting on Obasanjo’s regime,became one of the first casualties of his successor, president Umar Yar’adua of blessed memory,who upon assumption of office as president in 2007,reversed or repudiated the sale and purchase of the refineries.

That is one of the reasons that the current NNPC transition from a public corporation into a public limited liability company,PLC echoes the events of 2007, as it is once again being reformed into a commercialized entity as the current occupants of Aso Rock Villa seat of Presidential power are about to exit.

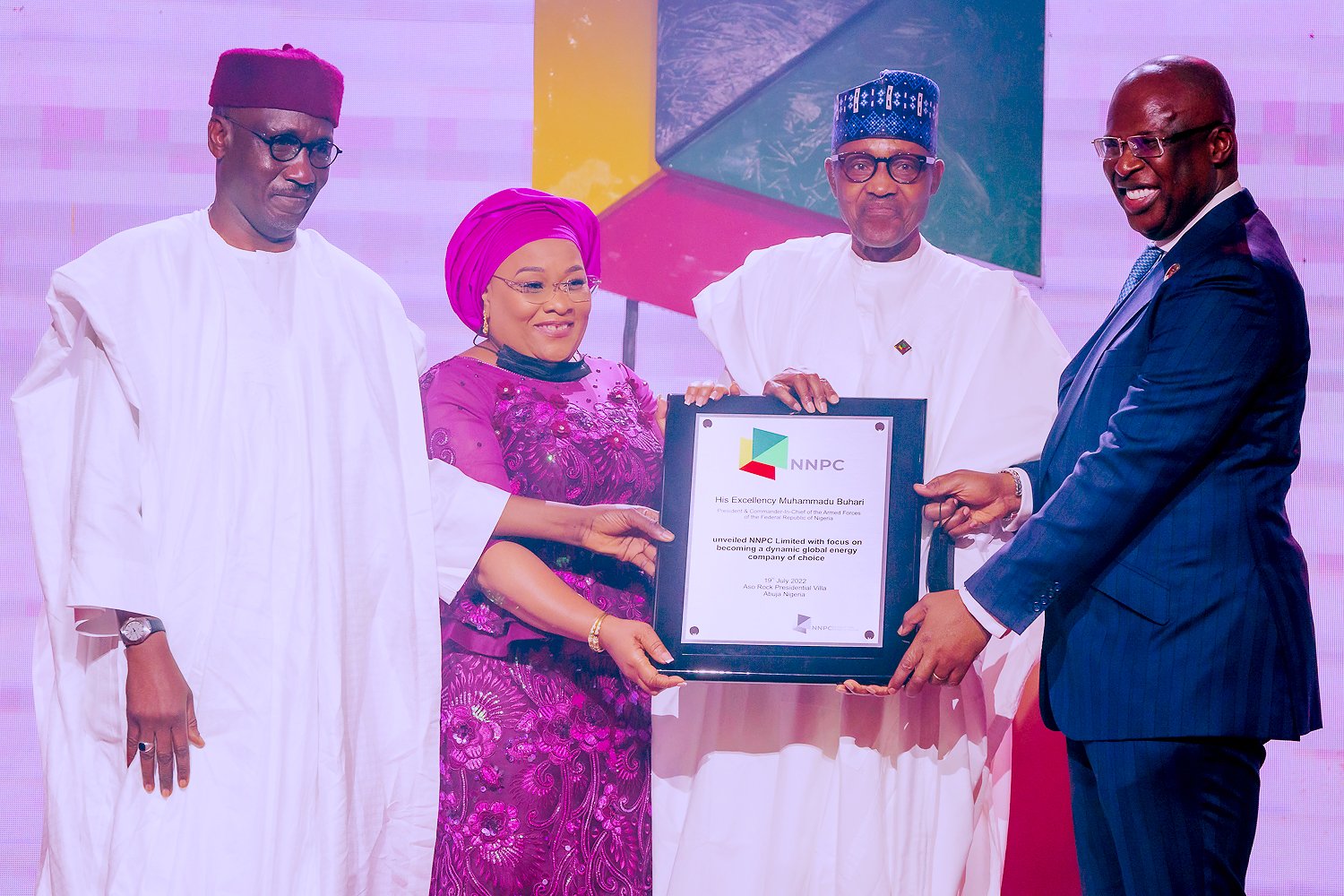

Commencing with the commercialization of its services and in the wake of the unveiling of NNPC Ltd by president Mohammadu Buhari in Aso Rock Villa on Tuesday 19th July,and a likely sale of some of its assets and subsidiaries scheduled to be put up for sale in the course of time,the journey for NNPC to be like Saudi Aramco and Petrobrass which are its equivalent in Saudi Arabia and Brazil respectively,has begun and the sun may be rising on Nigeria’s oil/gas sector.

In the event that all things remain consistent and in the likeness of the swan song that the drivers of the initiative are singing to Nigerians,it would be in the manner that another utility behemoth of Nigerian government,Nigerian Telecommunications,NITEL was unbundled for private sector participation, and which was quite successful.

But the successful privatization of NITEL has been attributed to the fact that the exercise was carried out by Obasanjo’s regime from the beginning to the end.

And there appear to be credibility in the belief that the reason the privatization of the oil/gas sector by the same Obasanjo regime did not see the light of day in the manner that a similar exercise in the telecommunications sector received accolades and applause both locally and internationally,was because Obasanjo exited office before the oil/gas sector transaction could be consummated in the manner that the current exercise is still in the pipeline,and at best in puberty and would not attain maturity,before the curtain falls on Buhari’s tenure.

The fear of atrophy is palpable because it is barely ten(10) months to the end of president Buhari’s watch over Nigeria,and in a country where there are no guarantees that even wives would continue with their husbands projects after they exit office and hand over the reins of power to them,there is real concern about the retention of,and sustenance of the policy/initiative by president Buhari’s successor.

As such,the question on the lips of most stake holders now is: would the reform initiative die,if it is not embraced by the next regime commencing 29th May next year?

Put succinctly,would history be repeating itself, if the ongoing reforms in NNPC limited suffers a similar fate that it experienced in 2007 when Obasanjo transferred the responsibility for completing the implementation of the divestment initiative to Umaru Yar’Adua,his successor, that was not enamored by the prospect of selling off NNPC assets which he considered critical national assets?

In any case,this is not the first time that the entity charged with managing Nigeria’s oil wealth is being reformed, refocused or rebranded.

From its early beginning in the 1970s as Nigerian National Oil Company, NNOC,

in 1977,it evolved into Nigerian National Petroleum Corporation,NNPC,before ending up as NNPC Limited in 2022 which it has become by virtue of its commercialization via the enactment of Petroleum Industry Act,2021.

Would this current exercise be different?

Right now,there are three front runners for the office of the president of Nigeria in 2023-Asiwaju,Bola Tinubu,Turaki,Atiku Abubakar,and mr,Peter Obi,the flag bearers of the ruling party at the centre, APC,main opposition party,PDP and Labor Party,currently creating a stir in the polity, but may end up being a storm in the tea cup after the votes have been cast and counted on 25 February next year.

The good thing is that the trio are literate in economics,so the concept and need for privatization of the NNPC are not gibberish to them.

But of the three,it is the PDP candidate, Atiku Abubakar that in my estimation is certain to take the oil/gas sector to the next level.

The assertion above is underscored by the fact that it is he that campaigned for the presidency in 2019 based on plans to liberalize the oil/gas sector in the manner that he,as Vice President of Nigeria, 1999-2007 played a key role in the reformation of the telecommunications sector which was directly under his purview.

As it may be recalled,he was assigned the responsibility by his then principal,President Olusegun Obasanjo.

Incidentally,mallam Nasir El-Rufai,the current governor of Kaduna state,a former minister of the Federal Capital Territory, FCT and ex Director General,DG of Bureau for Public Enterprise,BPE was Atiku Abubakar’s linchpin in the unbundling of public enterprises for private sector participation.

That is by virtue of the fact that BPE was, and still is the agency in charge of privatization of public enterprises,had a direct reporting line to the office of the Vice President .

So,at least we know,who amongst the three most likely Aso Rock Villa occupants in 2023 would certainly carry on with the reformation drive in the oil/gas sector.

Without waiting to unveil it in his manifesto which he would likely release before September when politicians are allowed to commence campaigning in ernest,the position of Atiku Abubakar on current NNPC reform that has seen it transform from a corporation to a commercialized entity has been made manifest in his response to the kick-off ceremony of NNPC’s new status as a commercialized entity in Aso Rock Villa on Tuesday 19th July.

Said he: “I had in 2018 made public my plans to reform the NNPC to make it more profitable, transparent and efficient. The APC led government denigrated me for my patriotic vision.

“But today, I am happy to note that the same government has taken a tentative step along the lines of the suggestions that I had made.

“It is a step in the right direction, but we are still far from what I had envisaged. “I hope I’ll have the opportunity to complete the process of turning the NNPC into a genuinely world class company in the mould of NLNG, Aramco of Saudi Arabia and Petrobras of Brazil, where Nigerians and institutions will invest in”.

Incidentally, APC’s Bola Tinubu was once the treasurer of EXXON Mobil, so he may be favorably disposed to the ongoing reforms in the oil/gas sector and may even have his own template; just as Labor Party’s candidate, Peter Obi, whose campaign team is forcefully telling everyone that he is the only messiah that can rescue Nigeria like a knight in shining armor, would also be inclined towards consolidating the ongoing oil sector reforms which is in tune with his mantra of turning Nigeria from a consuming to a producing country.

Meanwhile,the reform is taking place when Nigeria is unable to meet its OPEC production quota of 1.8m barrels daily and instead she is delivering a little above one million (1.3m) barrels per day.That is half a million less than the volume that our country is supposed to be pumping into the market that could have generated income that would have enabled our country survive the current cash crunch that has compelled borrowing from banks to workers salaries and emoluments.

And the causes of the shortfall are mainly due to divestments by the IOCs that commenced back in 2006,got ramped up in 2010 and became worse in 2012 owing to aging infrastructure,massive crude oil theft and insecurity of lives and property in Nigeria.

Broadly speaking,the delay in the implementation of the Petroleum Industry Act,PIA is a major culprit for the flight of IOCs out of Nigeria.

That is owed to the fact that they were in quandary about the future of the sector, as it took the better part of two (2) decades of the reform bill lying comatose in the National Assembly,NASS before it finally got passed into PIA,under the present regime which is currently driving the reforms.

Since nature abhors vacuum,in the intervening period of foot dragging by our law makers,investments that were meant to boost the business in Nigeria got diverted elsewhere, perhaps to Angola,Equatorial Guinea,even Ghana.

Hence,even as crude oil price has shot up to the region of $100 per barrel in the international market,Nigeria is suffering a double jeopardy of inability to meets its quota by nearly 50%,and also continues to import finished petroleum products (since it basically has zero refining capacity) and the price of diesel,Jet-A1 and Premium Motor Spirit,PMS, kerosine and cooking gas has skyrocketed,putting it beyond the reach of most Nigerians.

It needs also to be highlighted that the reform in NNPC is being implemented at the time that fossil fuel is being phased out globally.

Especially in the industrialized and advanced countries,most of which aim to have in the next decade replaced petrol engine cars with Electric Vehicles,EVs pioneered by the world’s richest man,Elon Musk,the owner of Tesla brand of electric vehicles.

So,all things being the same,the demand for fossil fuel would soon be slowed down radically as the market shrinks across the industrialized world.

Even then,Nigeria is hobbled by the militancy being wagged by those fighting for environmental rights in the oil/gas rich Niger delta.

And worse of all,theft of crude oil from the pipelines by those who should be protecting the product.

Mr Austin Avuru,ex Managing Director of Seplat an oil production company and founder of AAH Holdings estimates that up to 80% of crude oil is stolen daily in Nigeria by organized oil theft syndicates.

Likewise,Mr Tony Elumelu,Chairman of HEIRS Holdings,the multi faceted conglomerate that recently purchased an oil production asset from Shell,Total, Eni.

He reckons that about 95% is siphoned off the pipeline daily by criminal elements that are deep in the oil/ gas system that about to plunge our county into insolvency crisis.

This is part of the reason Nigeria’s debt servicing obligations in June exceeded its income by over N310b by some estimates and which has the capacity to drag our country into a black hole in the order of Venezuela and Sri Lanka,

In the light of the doom and gloom besetting our country highlighted above,could the transition of NNPC to a limited liability concern with profit making as its philosophy,be a case of too little,too late,or just-in-time?

It can only be just-in-time if the new NNPC limited helps turn things around for the distressed masses who may not be paid salaries and pensions in their jobs at federal and tstate government levels, unless government borrows from the banks,since NNPC limited has actually stoped making remittances into the federation account which was the erstwhile major source of income for government to meet those obligations.

It is remarkable that the Minister of state Petroleum,Mr Timipre Sylva does not regard the exit of IOCs as a threat,but an opportunity.

That is evidenced by the fact that he is encouraging local investors to fill the void as it would be in their best interest just as it would serve our country better.

Which is a great and commendable attitude.

Especially if Nigerians have the financial muscle and expertise to,as it were,to step up to the plate.

And it is also commendable that it is during his tenure that PIB eventually got passed into an act of parliament and the implementation of the lofty contents are also afoot.

The commercialization of NNPC would go down well as a great accomplishment for both the minister of state and president Mohammadu Buhari who doubles as the substantive minister of petroleum resources.

By the reckoning of most Nigerians,the passage of PIA and its implementation,(not the construction of a new bridge across Niger River or resuscitation of railway lines) is the flagship of this regime’s accomplishments.

So,Mr Timipre Sylva,not Babatunde Fashola,works Minister or Rotimi Amaechi, minister of transportation) is the star-boy of Buhari’s government.

The former GMD,now CEO of the new NNPC limited,Mr Melee Kyari has regaled Nigerians during the unveiling of the new entity with talks about how he aims to make the new firm a Fortune 500 company; and his plan to quickly scale up the two hundred billion naira capitalized firm, into top 50 in ranking,in a couple of years.

But he did not elaborate on how he plans to execute his obviously fantastic plan.

As a pragmatist,l find it difficult to wrap my head around how the feat of transforming a dinosaur trapped in a time warp of which NNPC is emblematic,into a lion that can roar like Saudi Aramco and Petrobras of Brazil,that Melee Kyari has modeled it after.

One of the nagging questions is: like Saudi Aramco,does Mr kyari have plans to invest in renewable energy such as solar and wind energy that are abundant in the northern part of our country to complement the oil/gas in the niger delta in order to boost Nigeria’s energy mix and help mitigate the frequent embarrassing electricity power outages that presently defines our country ?

What are the mechanisms,if the answer is in the affirmative ?

In my considered opinion,it is a tall order to attain the standard of Saudi Aramco and achieve stellar performance with the same crop of personnel in NNPC that are rooted in corruption and ineptitude.

Therefore,it might just be too much of an ambitious target.

Echoes of gross acts of nepotism and corruption,are still reverberating as the NNPC is home to the children of the high and mighty that are working there,not based on merit,but on connection and a conclave of corrupt elements where predators like hyenas and jackals hibernate.

One of such grafts is the multi billion dollars fraud that is continuously being perpetrated in the corporation,including the petroleum subsidy regime involving oil retailing companies that were investigated for misappropriation of over N158 billion naira of the N2.19 trillion that was paid as subsidy for import of petrol between 2011 to 2012.

That is according to then finance minister,Ngozi Okonjo-lweala.

It may be recalled that a government panel under the chairmanship of Aigboje Aig-Imuokode,former GMD of Acess Bank Group,was mandated to investigate the NNPC which had become a cesspit of corruption.

Apart from that probe there was another investigation triggered by the National Assembly,NASS that alleged that NNPC misappropriated over N10 trillion from 2006-2016.

I personally had a sordid experience with NNPC Retail,which is the petrol retail arm of the behemoth.

It may be recalled that following the perennial petroleum products shortages that have been wreaking havoc on Nigerians,the regime of general lbrahim Babangida authorized the establishment of retail petrol stations by NNPC across Nigeria.

The contract was awarded to the construction giant,Julius Berger NNPC mega petrol stations were planted nationwide.

But as well equipped and sophisticated as they were,the mega stations were not optimally utilized and most of them became decrepit.

When another wave of shortage arose reared it’s ugly head and government once again felt that the independent marketers were taking it for a ride,another wave of mega petrol stations were built by NNPC in all the state capitals.

And the years,l had been thinking of how repair/maintenance of vehicles businesses can be raised to international standards.

So,l sought and obtained the franchise of Bosch Car Service,BCS which is a division of Bosch Automotive of Germany engaged in cars quick service/maintenance in Europe,North America and some parts of South and North Africa .

Having identified the opportunity intrinsic in the establishment of NNPC mega stations which were well appointed with elaborate space that was under utilized,we felt we could partner with NNPC Retail by leveraging their nationwide outlets for our automobile quick repair/ maintenance services,so we approached NNPC Retail with our proposal.

Arising from the high turnover of CEOs,l found myself making proposals to a series of Managing Directors,MDs of NNPC Retail beginning about twenty (20) years ago with Mr Eromosele,all the way to Mrs Esther Nnamdi-Ogbue and continuously to Mr Adeyemi Adetunji,who bought into it.

But Adetunji could not implement the plan because he was soon after reassigned as executive director in the mother corporation.

And finally,on his prodding,Sir Billy Okoye who took over from him as the CEO at the time accepted to move our transaction forward.lt was under his watch that the perfidy was perpetuated.

l understand that Mrs Esther Aliyuda is currently at the helm of affairs in NNPC Retail.

Nigeria being a business or political environment where continuity is not a strong virtue,and because there was no grand strategy with regards to private businesses or rolling plans in the case of government or public institutions,most leaders charted their own paths different from that of their predecessors,each time they found themselves at the helms of affairs.

Such an attitude or philosophy does not augur well for business .

To attract or generate more foot falls into the expansive mega petrol station facilities spread around the country,l pressed on with the proposal that my firm,Inspire Auto Services ltd,a franchise holder of Bosch Automotive After-Sales of Germany,which is the only automotive parts manufacturer quoted on New York stock exchange,be granted the concession to manage the auto repair bays in the mega petrol stations as well as create other activities to make them mini local business hubs.

To cut the long story short,after presenting our proposal on how to optimally utilize the facilities,we proposed that a quick service restaurant,neighborhood grocery store and car wash should be located in the mega petrol stations to make it local mini business hubs.

The management liked it,in fact lapped it up and directed us to use four(4) stations located in Abuja,lagos,Kano and Port harcourt as the pilot for the project.

Then my expatriate team and l embarked on trips to the locations and we had a ready to be implemented Action Plan in two weeks,complete with drawings, diagrams and graphs illustrating what we wanted to do,and underscored our business plan with facts and figures from feasibility studies and surveys to justify the viability of our proposal.

After our presentation,the management invited us to a meeting and informed us that it was an open bidding project,and they had invited another party to bid.

We were aghast because it was our

initiative which had consistently tried to get the NNPC Retail to buy into for about two decades spanning about give (5) managing directors.

We figured out that the team we were working with was up to no good when they insisted that a concept that was introduced by us was open to other bidders after we did the spade work because that caveat was not made known to us ab initio,but only introduced in their bid to bring in another firm to reap where it did not sow.

So we excused ourselves.

They have since activated our plan,of which we gave them the blue print and the concept has been unfurled in Abuja,NNPC mega station in Central Business District,CBD and lagos NNPC mega station on kingsway road,lkoyi.

Now,l can imagine that some readers would be shocked to know that a division of my business concern lnspire Group imports and distributes automobile spare parts like batteries,spark plugs,oil and filters as well as brake pads, wiper blades etc and also engages in automobile maintenance and repair services.

I would not be surprised,if the thought of me as an automobile mechanic,makes some readers literally jump out of their skin.

But yes,Inspire Auto Services ltd has a state of the art mechanic workshop located at Lapal House showroom in Igbosere,lagos island,fully equipped with cutting edge tools and manned by craftsman trained by Bosch of Germany who are our partners.

Dear readers,do not ask me what a public intellectual is doing operating a mechanic workshop,because l would simply plead with you to indulge me by allowing it to be a topic of discussion another day.

For now,it is enough to know that not all of us can be in the crowded ‘oily’ business, telecom,fintech and financial services space,where the big boys dominate.

Assuming the sordid past of NNPC has been consigned to the past as it transitions into NNPC limited,what is the new entity offering Nigerians?

Would the pump price of petrol return to the rate of N87 per liter in December,2015?

Can diesel price be affordable to the critical mass of Nigerians so that businesses can thrive and homes running with diesel generators can be homely again?

How about the cost of cooking gas that has gone over the roof ?

Could the astronomical cost compelling people to go for fire wood that would negatively impact our ecology and ultimately aggravate climate change challenges be reversed?

It is only when the answers to any or all of the posers above is in the affirmative that the common man can be said to have gained from the new NNPC limited.

For now,the realization of such an ideal appears to be dim and utopian.

So,for the common man,and l dare add the average man or woman in lagos,Abuja,Portharcourt,Kano and Enugu or llorin,Warri and lbadan etc,that glam unveiling of new NNPC limited event in Aso Rock Villa is mere hoopla.

That is simply because,it conjures up images that reminds them of the fantastic optics of imposing rice pyramid that lured them into thinking that the essential commodity was going to be available in abundance only for it to turn out to be a pipe dream and the vision became just an illusion or mirage as rice in the pots of most Nigerians has become more elusive, post presentation of the Abuja rice pyramids last year.

For now,Nigeria Liquified Natural Gas, NLNG model commends itself for emulation by NNPC limited because it has been relatively successful since it’s founding .

It is a joint venture between the federal government of Nigeria and IOCs.

Unlike the other Joint Ventures,JVs where government is the senior partner by virtue of having higher equity share,in NLNG arrangement,the equity ratio is : 51/49 with the lOCs having the lion share.

And the majority shareholding of the company by the IOCs is the secret of its success,because it is professionally run without external interference.

Is that type of model not beckoning or ripe for adoption by NNPC limited ?

But by virtue of it’s ownership,hook-line-and sinker by Nigerian government, although refocused and to be driven and under guarded by private sector ethos which may make it not susceptible to the meddlesome inclinations of Nigerian political actors,NNPC limited may appear to be a good idea.

And l do not see it’s horizon in its current composition going beyond the level of commercialization that has been attained by Bank of industry,Bol which is similarly owned 100% by the federal government.

According to reports,it’s four (4) moribund refineries posted N154 billion loss last year.

Nigerian Extractive Industries Transparency Initiative,NEITI,reports that as at 2020, NNPC was also spending N212 billion naira on its staff strength of 6,621 employees nationwide.

And it is estimated that roughly 30% of the workforce are engaged in the four (4) moribund refineries currently undergoing refurbishment.

It is also worth pointing out that of the forty (40) members of the senior management team,24 are northerners and 16 southerners.

That is according to a recent reporting by International Centre For Investigative Journalism, lCIJ.

Is that a worthy aspiration of the initiators of the commercialization of NNPC?

I hope not !

That is why I have been pondering and l am inclined to not believe that the operations of NNPC limited can be scaled up to the high standards obtainable in Nigerian Sovereign Wealth Funds,that is owned wholly by federal government of Nigeria and managed by Uche Orji.

Rather,it would just be like the scandal ridden Asset Management Corporation of Nigeria,AMCON,also fully owned by the federal government,that had Mustapha Chike-Obi as its pioneer chief executive officer,and currently being led by Ahmed Kuru?

Another point to ponder is that of the four (4)presidents of Nigeria since the founding of NNPC in 1977,two (2) have tried to take control of it by playing the role of minister of petroleum resources and president at the same time.

These are,ex president Olusegun Obasanjo and incumbent,president Mohammadu Buhari.

The ball is now in the court of who becomes president of Nigeria 2023 to score the goal by ending the debilitating petrol subsidy that has been constricting Nigeria as if it is in the grip of the vicious reptile, boa constrictor that crushes it’s victims to death by wrapping its body around it ;or sustain the dribbling of Nigerians by making them continue to suffer the avoidable hardship of literally paying for petroleum products through their nose,when they succeed in their endless search for the commodity,that God in His infinite mercy has abundantly endowed Nigeria with,but is sadly fast becoming a scourge instead of blessing.

Magnus onyibe, an entrepreneur, public policy analyst ,author, development strategist, alumnus of Fletcher School of Law and Diplomacy, Tufts University, Massachusetts, USA and a former commissioner in Delta state government, sent this piece from lagos.

To continue with this conversation, pls visit www.magnum.ng.