The Nigerian National Petroleum Company Limited (NNPC Ltd.) started its weekly activities with a resolve to quickly end the incessant queues at various filling stations in the Federal Capital Territory (FCT), Abuja.

By this resolution, the company in collaboration with the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA) stepped up the supply of Premium Motor Spirit (PMS) to the FCT from 70 to 140 trucks to combat the lingering fuel queues.

Speaking to newsmen during an inspection tour of filling stations in Abuja, NNPC’s Group Executive Director, Downstream, Mr Yemi Adetunji, explained that there were enough petrol in the nation’s strategic reserve to last 32 days.

“We have 1.9billion litres of PMS that can last for 32 day. NNPC is making every effort to ensure energy security for the country.

“We have sorted out Lagos. We are working with all relevant stakeholders to bring the situation in Abuja under control; normalcy will be restored in the next few days.”

Speaking earlier, the CEO of the NMDPRA, Mr Farouk Ahmed, said that the improvement in the supply of products from an average of 70 to 140 trucks was made possible by the Presidential approval of a ₦10 freight rate discount increase to petroleum products transporters as part of solutions to the fuel supply challenge.

He charged marketers to play by the rules as NMDPRA would not hesitate to sanction anyone found to be involved in underhand practices.

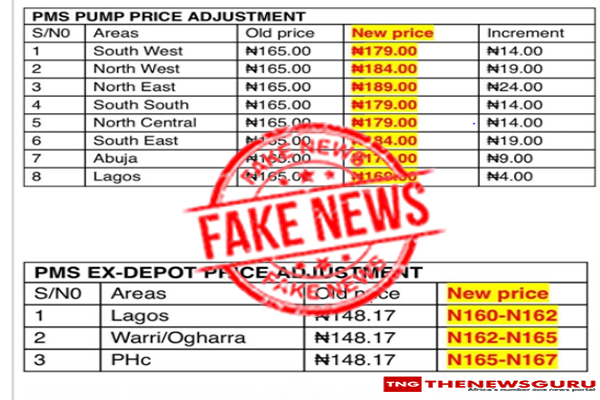

“We are doing everything to bring the situation to normal. We also want to state that there is no increase in the pump price of PMS, and any such sharp practice will be sanctioned accordingly by the Authority,” he said.

The tour of the filling stations was to monitor developments and ensure compliance.

In another development, Major stakeholders in the downstream sector of the oil and gas industry have suggested ways to mitigate the continuous rise in prices of diesel and cooking gas in Nigeria.

Among the stakeholders who spoke at a public hearing organised by the House of Representatives Joint Committees on Downstream and Gas Resources in Abuja were the Chief Executive Officer of the NMDPRA, Mr Farouk Ahmed and the Group Managing Director/CEO of NNPC Ltd, Malam Mele Kyari.

Leaders of Depot and Petroleum Marketers Association of Nigeria (DAPMAN), Independent Petroleum Marketers Association Of Nigeria (IPMAN), Major Oil Marketers Association of Nigeria (MOMAN) and Liquefied petroleum gas (LPG) Gas Marketers Association, among others, were also in attendance.

Fielding questions from members of the committee, Ahmed said that the current geopolitical crisis in Ukraine and Russia had affected the global crude oil supply resulting in the increase of petroleum products prices across the globe.

Ahmed said that the rise in the prices of petroleum products was a global phenomenon and not a local problem peculiar to Nigeria.

He added that the landing cost of petroleum product was also a major factor affecting the price of petroleum products.

“We need to see what can be done to alleviate the suffering of the people.

“If our refineries come back on stream and make foreign exchange available at the official rate of N400 per dollar, things will definitely improve.

“We also need to address the issue of vandalism,” he said.

On his part, the GMD/CEO of NNPC Ltd., Malam Mele Kyari, said the only way to tackle the rising price of diesel and cooking gas was to increase the production of crude oil.

Kyari said that acts of vandalism of oil facilities have been responsible for the decline in production which in turn was responsible for the unavailability of foreign exchange.

He disclosed that 27,000 barrels were lost in a recent attack on one of the company’s facilities.

According to him, besides the Russia-Ukraine war which is affecting the supply of products across the world, most major oil companies are also shutting down in keeping with global emphasis on the shift from fossil fuels over environmental concerns.

“No one can guarantee stability of petroleum products supply; the world has never seen this kind of uncertainty. Today, countries are stockpiling products.

“Shortly before COVID-19, the world was already facing shortfall of 3 million barrel of supply of oil but with the ongoing intervention, by the end of July we will restore production to a level that is reasonable.”

The Chairman, House Committee on Downstream, Rep. Abdullahi Gaya, said that there was need to find solution to the high cost of diesel and cooking gas in order to alleviate the hardship on Nigerians.

Some of the lawmakers said that although Kyari and Ahmed candidly presented the worrisome situation the industry was faced with, they, nevertheless unanimously expressed confidence in their ability to bring the situation under control.

The stakeholders present at the hearing include the Independent marketers, suggested a short, medium and long term solutions to combat the challenges.

They also pledged to work with the NNPC and the regulatory agency to redress the situation.

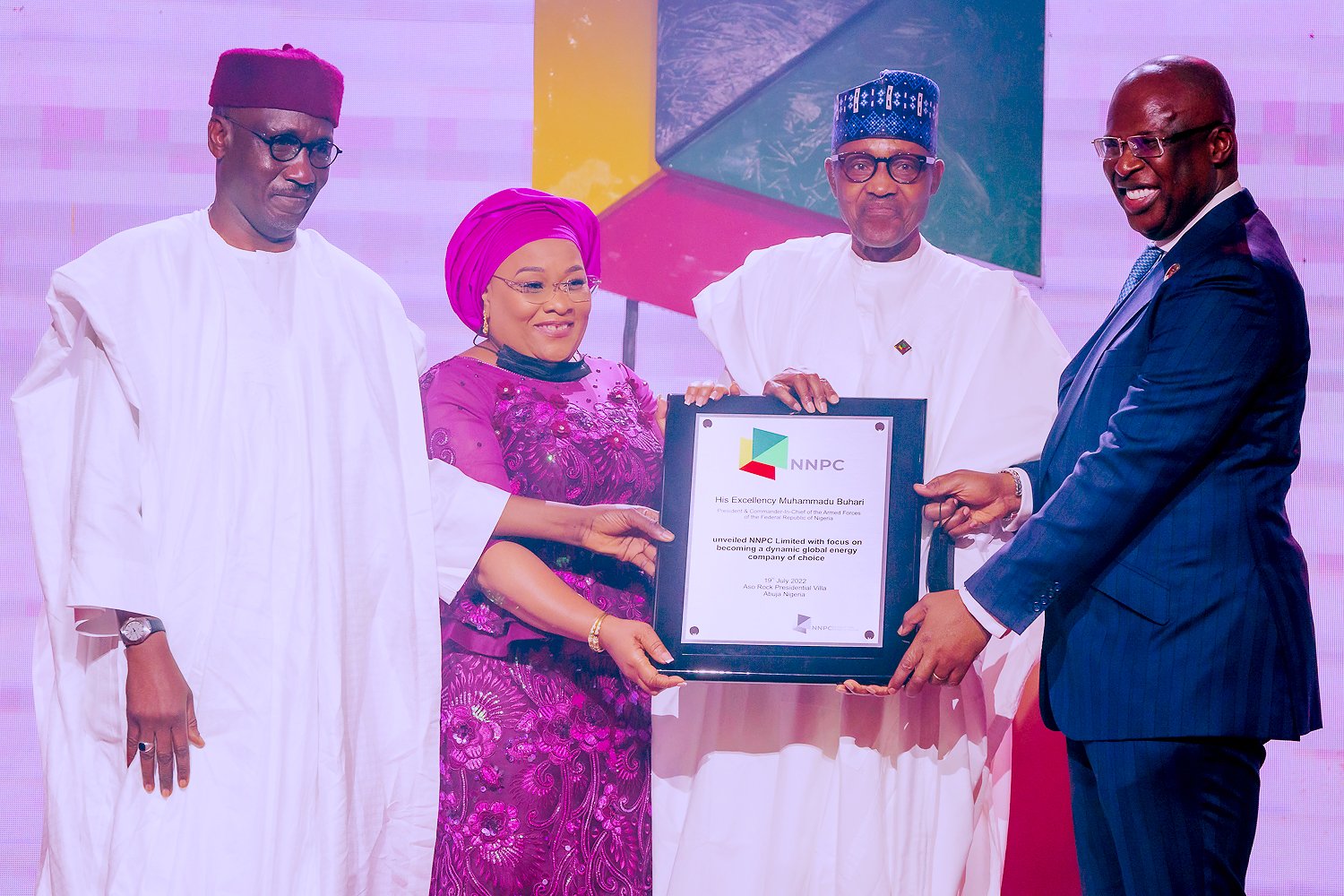

Meanwhile, the Management of NNPC Ltd. sensitised members of staff to the challenges and opportunities inherent in the transition from a corporation to a limited liability company.

This was in continuation of its stakeholders’ engagement to achieve a smooth transition.

The NNPC GMD/CEO, Kyari, said at a town hall meeting which held at the NNPC Towers, that it was imperative for all staff to embrace the change with courage and look beyond the temporary discomfort to the huge opportunities that lie ahead of the new NNPC.

He commended President Muhammadu Buhari for the courage to have signed the Petroleum Industry Act (PIA) into law, pointing out that the lack of effective regulatory framework and unbridled government interference were responsible for NNPC’s losses in the past.

“NNPC is now free of burden.

“Nigerians are looking up to us, they expect NNPC to lead the way in making profit and adding value for the benefit of the over 200 million stakeholders.”

Kyari said that given the volume of the Company’s assets that was signed and transferred officially on July 1, 2022, by the Ministers of Petroleum Resources and Finance respectively, the new NNPC would be the most capitalised company in Africa and would be poised to announce its first Initial Public Offer (IPO) in the next three years.

He also informed that the company’s financial statement for the year 2021 would be better than that of year 2020 when NNPC reported a profit after tax of 287 billion naira.

In her remarks, the Chairman of the NNPC Ltd., Sen. Margery Chuba-Okadigbo, assured of the Board’s continuous support towards the realisation of the goals of the new NNPC Ltd., while encouraging members of staff to imbibe the concepts of dynamism and creativity required for global competitiveness.

She said that deducing from her experience at the helm of the NNPC Board, she had conviction to endorse the GMD’s policies on transparency and accountability, noting that the company as envisioned by the PIA can only achieve its objectives through firm commitment to excellence on the part of the entire workforce.

Also in the week under review, the Nigerian Upstream Petroleum Regulatory Commission (NUPRC) concluded the marginal oil fields bid rounds kick-started in the year 2020 with the award of Petroleum Prospecting Licences (PPLs) to 161 successful companies.

The commission also officially unveiled the Host Communities Development Regulations and model PPLs.

Speaking at the event in Abuja, the Minister of State for Petroleum Resources, Chief Timipre Sylva, said that the presentation of the Licences was part of the implementation of the PIA 2021.

He also noted that the category was being handled for the first time.

The minister who commended the management and staff of the NUPRC for ensuring the successful completion of the process, described the conclusion of the process as a giant milestone for the administration.

“The implementation of the PIA 2021 is in top gear. Consequently, the new awardees should note that their assets will be fully governed by the provisions of the PIA 2021.

“As you develop your assets with the special purpose vehicles (SPVs), ensure that good oilfield practice is employed, environmental considerations and community stakeholders’ management are not neglected.

“It is my strong belief that the awardees will take advantage of the current attractive oil prices to bring these fields into full production within a short period to increase production, grow reserves and reduce cost of production.

“The onboarding of new oil and gas players in the petroleum sector is part of this government’s policy to encourage more indigenous participation in our petroleum operations,” Sylva said.

He added that the development would boost activities in the oil and gas sector, increase production output and create additional employment opportunities for Nigerians.

On his part, the Chief Executive Officer of NUPRC, Mr Gbenga Komolafe, said that the Marginal Field Bid Round was one of the major tasks inherited by the commission on its inauguration in 2021.

He listed some of the constraints that caused the delay in the conclusion of the exercise to include, the interruption brought about by the COVID-19 pandemic, partial payment of Signature Bonuses by some awardees, and the unwillingness of some co-awardees to work together in forming SPVs for field development.

Recounting the history of the marginal field’s award initiative, Komolafe said that the process which began in 1999 was borne out of the need to entrench the indigenisation policy of the Federal Government in the upstream sector.

He also said that the aim was to boost local content, stressing that since its inception, a total of 30 fields had been awarded with 17 currently producing.

He disclosed that the 2020 Marginal Field Bid Round exercise raked in revenue of about 200 million naira and 7 million dollars into the Federal Government coffers.

Komolafe added that the conclusion of the 2020 Marginal Fields Bid Round brought to an end the era of Marginal Field awards as stipulated by the PIA.

“Section 94 (9) of the Act states that no new marginal field shall be declared under this Act.

“Accordingly, the minister shall now award PPL on undeveloped fields following an open, fair, transparent, competitive, and non-discriminatory bidding process in line with Sections 73 and 74 of the Act.”

He urged the winner of the marginal fields to take advantage of the current market realities and quickly bring their fields to production, stressing that Nigeria was not benefiting much from the upswing in crude oil prices because of production disruptions occasioned by sabotage, theft, and other operational challenges.

A total of 57 marginal fields were presented in the 2020 bid round out of which 41 were fully paid for and 37 fields were issued with the PPL, having satisfied all conditions for award.

Out of the 665 firms that expressed interest in the exercise, 161 emerged as potential awardees.

Some of the successful companies that received their licences include: Ardova Plc, Matrix Energy Ltd., Sun Trust Oil Company Limited, Deep Offshore Integrated Service Ltd., Island Energy Ltd., Sigmund Oil Field Ltd., and Shafa Exploration and Production Company Ltd., among others.

Still in the week, NNPC Ltd. said it was committed to fast-tracking efforts to identify new gas resources and develop existing ones amidst current global yearning for cleaner fuels.

NNPC also said it was making efforts to identify new gas resources to boost revenues for investment in other sectors of the economy as part of its preparation for the global energy transition.

The NNPC GMD/CEO, Malam Mele Kyari, stated this in a keynote address at the First E&P’s 10th Year Anniversary event which held in Lagos.

The GMD, who was represented virtually by NNPC’s Chief Financial Officer, Mr Umar Ajiya, delivered the address with the theme, “Scarcity in Abundance: How Gas can Enable Energy Access in Nigeria and Africa”.

He said that though Nigeria remains determined to achieve net-zero carbon emission by 2060, there was absolute need to harness the country’s abundant hydrocarbon resources to actualise that objective.

He emphasised that with the enactment of the PIA, and the introduction of such initiatives as the Decade of Gas and the Gas Transportation Network Code, Nigeria sought to open up robust and quick business opportunities for both indigenous and foreign investors in the gas sector.

“I make bold to say that harnessing our abundant resources remains Nigeria’s major pathway towards leveraging gas, the least carbon-emitting fossil fuel, as a transition fuel.

“To this end, massive gas development efforts are ongoing, including the construction of a 614km gas pipeline which is aimed at enabling gas transportation to the North of the country and ultimately beyond Nigeria.”

Kyari also congratulated the Board, Management and Staff of First E&P on the 10th anniversary of the company which he described as “historic milestone”.