The hike in the pump price of petrol first reported in Abuja, the Federal Capital Territory (FCT), on Tuesday morning, has trickled down to other parts of the country, resulting in fuel queues.

A correspondent, who moved round the Lagos metropolis, observed that most filling stations had adjusted their pump price.

The correspondent also noticed that fuel is sold between N580 and N600 at most filling stations, owned by both major and independent marketers.

The hike in price of petrol is sequel to the increase in ex-depot price of petrol from N446.57 per liter to N580 per liter.

However, the situation has triggered panic buying as motorists raced to filling stations to buy petrol.

There were queues at Mobil Filling Station on Ikorodu Road, TotalEnergies at Mobolaji, Amuf at Bariga and Conoil in Ikorodu while there were vehicles on a long stretch within and outside most of the facilities.

A visit to Northwest Station in Gbagada showed N570 per litre, Mobil at Anthony, N580, Amuf in Palmgrove, N558 and Conoil in Ikeja, N590.

Also some of the NNPCL retail outlets monitored were selling at N600 per litre.

Consequently, queues extended to the roads from the facilities, compounding traffic woe.

Petrol hits N617 per litre in Abuja

TNG reports the hike in price of petrol from 537 to 617 naira per litre was first reported in the Federal Capital Territory.

A correspondent who monitored the petrol situations in Maitama, Wuse, Gwarimpa, Jabi, Wuye and Kubwa areas of Abuja reports that there are long queues in filling stations still selling at the old price.

Most stations have adjusted their pump prices to N617 to N620 but AA Rano, Nipco in Jabi are still selling the old price and some other few places.

Also, the Nigerian National Petroleum Company Limited (NNPCL) station is selling at the new price.

A fuel attendant whom pleaded anonymity said that they would adjust their pump price before the end of today.

A customer who confirmed this development, Mr Emma Uzor, said that it is a terrible situation.

“We are still battling with new price and with two months they increase it again, this is not fair to the masses.

“No information or reasons for the increment, how do they want the poor masses to survive? The salaries have not been increased and food prices have risen.

“The government should go back to their drawing board and come up with favourable conclusion from the citizens,” Uzor said.

PMS sells for ₦640 per litre in Awka

In Awka, the capital of Anambra State, the price of Premium Motor Spirit (PMS), otherwise called fuel, has risen from between ₦630 to ₦640 per litre.

A correspondent who monitored the situation in Awka on Tuesday reports that independent marketers adjusted their pumps on Tuesday morning.

The increase was against the price range of between ₦530 to ₦540 which prevailed until Tuesday.

The NNPC in the town was not selling as it was closed to customers.

However, RainOil outlets in Awka were still selling at N600 per litre as at press time.

Some motorists who spoke to NAN expressed shock over the sudden increase in PMS price.

Mr Anthony Umeh said he was just recovering from the effect of subsidy removal before the recent increase.

Umeh said it was unfair that one could only get eight litres of PMS with N5,000 in a country that is one of the largest producers of crude oil in Africa.

“The increase is unfortunate, normally ₦5,000 will give me 25 litres but I just got eight litres.

“This is unacceptable in a crude oil-rich Nigeria,” he said.

In a reaction, Mr Chinedu Anyaso, Chairman of IPMAN, Enugu Depot Community in charge of Anambra, Ebonyi and Enugu, acknowledged that there was an increase in price of products.

Anyaso said the adjustment was as a result price list issued by NNPCL.

Motorists express shock over new petrol price in Ibadan

Meanwhile, motorists and commuters in Ibadan have expressed shock over the new pump prices of Premium Motor Spirit (PMS), otherwise known as petrol, announced on Tuesday by Nigerian National Petroleum Company (NNPCL).

NNPCL had, on Tuesday morning, announced the adjustment of the pump price of petrol from N539 per litre to N617 per litre, saying this was in response to market realities.

A correspondent, who moved round Ibadan metropolis, observed that as the news of the fuel price increase filtered out, some filling stations hurriedly closed shop, with their managers saying that they were awaiting further directives from the authorities.

The few filling stations that were selling the product witnessed long queues of vehicles, while they were selling for between N560 and N650 per litre.

A motorist, Mr Anu Alani, said he woke up on Tuesday to see that many filling stations were not opened for business and those who were selling increased their price to N650 per litre.

“I was thinking that when I go farther, I would see where I could buy fuel at the normal price but I didn’t. I don’t know what to do again as the economic situation is already bad,” Alani said.

Another motorist, Mrs Ayoola Olaoba, said that she would have to find a means of leaving the country, as things did not look like it would get better soon.

“I bought fuel some days ago at N520 only for me to see some of my colleagues saying it has increased to N620. I said just like that!

“I do not think I can continue with the uncertainty trailing the present economic situation,” she said.

A commercial motorist, Mr Gbenga Oriowo, said that the new price would definitely have an attendant effect on transport fares.

“I am still in queue now and there is little or no probability that I will get fuel, and even if I get, I cannot but increase the transport fare. We will all have to bear the situation,” he said.

Oriowo said that government needed to explain to Nigerians what was going on and the rationale behind the new price regime.

Another motorist, Mrs Funmi Alli, said some major marketers had closed their filling stations, saying that this had contributed to long queues where the fuel was available.

She expressed the fear that the fuel price increase would have spiral effect on food prices and every other thing, which might increase the hardship already being faced by Nigerians.

Recall that there had been speculations that fuel price might go up to N700, though it was debunked by stakeholders in the petroleum sector.

Ogun motorists express shock over hike in petrol price

Similarly, motorists and commuters in Sango-Ota, Ogun, have expressed shock over the new pump prices of petrol, otherwise known as Premium Motor Spirit (PMS), announced by Nigerian National Petroleum Company (NNPCL).

A correspondent of NAN, who monitored the development around Sango-Ota and its environs, discovered that the few filling stations selling the product had adjusted their pump price.

The few filling stations like NIPCO, NNPC and Mobil Filling Station, that were selling the product witnessed long queues of vehicles.

Some of the filling stations were hoarding the product while long queue at various filling stations resulted to traffic gridlocks on some of the major roads in Sango-Ota.

Mr Bola Martins, a motorist, described the situation as uncalled for, as Nigerians were still struggling with the petrol price that was recently increased.

“Nigerians are really going through hard times and there is urgent need for the Federal Government to ensure measures that will help to ameliorate the sufferings of the people.” Martins said.

Mr Jide Onabanjo, a commercial motorist, said that the new price of petrol would be added to transport fares for the people.

Onabanjo said that this development would further increase the prices of goods and services in the country.

“We can’t continue like this because we have been pushed to the wall.” he said.

Onabanjo said that it was unbelievable that the fuel that he bought for N488 per litre at one of the NNPCL stations had gone up to N617 today.

Mrs Sade Aderanti, a civil servant, said that the new pump prices of petrol would automatically has huge impacts on living standards of Nigerians.

Aderanti said that she had been on the queue for over three hours and yet had not been able to buy fuel.

She appealed to Federal Government to expedite action in putting palliative measures in place for civil servants as well as Nigerians, at large, to reduce the untold hardships.

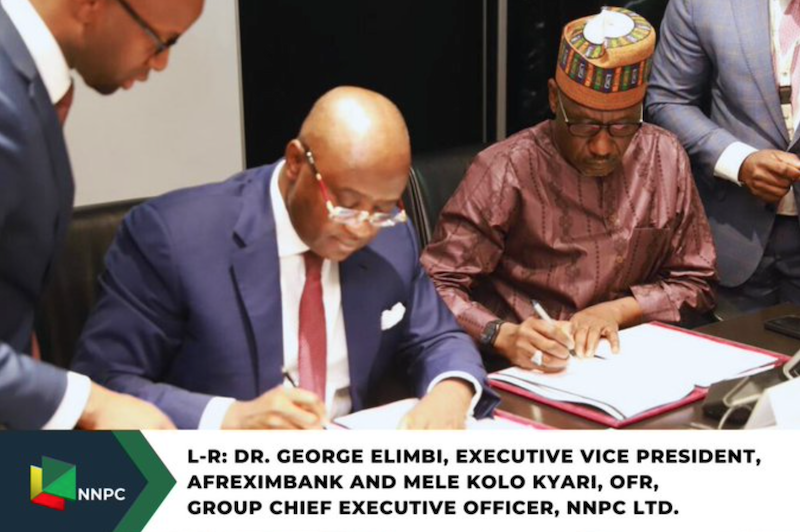

N617 per litre price of fuel reflection of market realities – NNPC

Meanwhile, the Nigerian National Petroleum Company L.td., has attributed the increase in the price of Premium Motor Spirit (PMS) also known as petrol to the market realities.

The company’s Group Chief Executive Officer, Malam Mele Kyari, stated this in an interview with newsmen shortly after a private meeting with the Vice President, Kashim Shettima, at the Presidential Villa, on Tuesday in Abuja.

Kyari explained that the increase in the price of pms has nothing to do with supply issue, adding that there are robust supply of the product in the country.

”I don’t have the details this moment. You know we have the Marketing Wing of the company, they adjust prices depending on the market realities.

”And this is the meaning of making sure that the market regulate itself so that prices will go up and sometimes they will come down also and this is really what we are seeing in reality this is how the market works.

”There is no supply issue completely when you go to the market you buy the product you come to the market and sale it at prevailing market price there is nothing to do with supply we don’t have supply issues.”

”There are robust supply, we have over 32 days supply in the country, that’s not a problem. What I know is that the market forces will regulate the market, prices will go down sometimes and sometime it will go up but there will be stability of supply.

He assured Nigerians that the policy was the best way for the country going forward.

”And I am also assuring Nigerians that this is the best way to go forward so that we can adjust prices when market comes.

”I know that a number of companies have imported petroleum pms so many of them are online. Market forces have started to play, people have confidence in the market and private sector people are now importing product.

”And there is no way they can recover their cost if they cannot take market reflective cost,” Kyari said.

On his part, Alhaji, Farouk Ahmed, Chief Executive Officer, Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA), said the authority doesn’t set price of the product but it was market determine itself.

”As a regulator you know I told you back in May we are not going to be setting price the market will determine itself and as you saw back in early June when prices came out it was based on the cost of importation plus other logistics of distribution and of course the profit margin by the importer.

”This market is deregulated, is open to all participants. As a mentioned also yesterday (Monday) when I was in Lagos we have about 56 marketing companies that have applied for and obtained license to import.

”Out of those 10 of them have indicated to supply within the third quarter which is July, August and September. And out of those already we received some cargoes from some of these Marketers.

Prudent Energy, AYM Shafa and Emadeb Cargo is arriving tomorrow (Wednesday), So this is like just an encouragement to see that the market is liberated and everyone is free to import so long you are working within the framework especially in tems of quality.”

He insisted that the authority as a regulator would not put cap on the price because it was not part of those importing the product.

”But the pricing as a regulator we are not going to put the cap on the price because we are not part of those importing, we are not a marketing company, we are just a regulator.

”So when you say market forces are working basically what it means is that you can see the price of the Crude Oil going up, couple of week ago recovering around 70 dollars per barrel now is around 80 dollars per barrel

”So of course the crude price also drive the product price you know because the imposters are importing they are basen it on the course of importation plus other cost element in terms of local distribution.”