The Nigerian Stock Exchange (NSE) on Friday postponed the planned cross border secondary listing of 3,758,151,504 ordinary shares of Airtel Africa.

The Exchange, in a mail, said that the postponement was necessitated by the need to ensure that the company met all the post NSE approval pre-requisites for listing on NSE.

“NSE will provide further communication on this issue when all the conditions for the listing in its market have been met,” NSE said.

The News Agency of Nigeria (NAN) reports that Airtel Africa listing was earlier scheduled to hold on July 5, with the listing of 3.76bn shares at N363 per share.

NAN also gathers that the company has not completed documentation with the Securities and Exchange Commission (SEC) for the commission to approve its application for listing.

A source close to the transaction told NAN that the company “has not completed its documentation.”

“They are still running helter-skelter to complete their documentation.

“Until that is done, the SEC cannot approve. So, the ball is in their court,” the source said.

NAN reports that on June 18, Airtel Africa officially filed an application with the SEC for listing of its shares on the NSE.

Tag: NSE

-

Transactions on NSE Rise by 54% in February

Data from the Nigerian Stock Exchange (NSE) showed that as at February 28, 2019, total transactions at the nation’s bourse increased by 54.06 percent from N122.08 billion recorded in January 2019 to N188.08 billion in February 2019.

The performance of the current month when compared to the performance of the same period (February 2018) in the prior year revealed that total transactions reduced by 11.30 percent.

These total transactions were executed by domestic and foreign investors, domestic investors are further categorized into retail and institutional investors.

In February 2019, the total value of transactions executed by foreign investors outperformed those executed by domestic investors by 6.00 percent.

A further analysis of the transactions executed between the current and prior month (January 2019) revealed that total foreign transactions increased by 48.00 percent from N66.85 billion in January 2019 to N98.94 billion in February 2019.

There was a significant increase in foreign outflows which increased by 97.80 percent from N27.81 billion to N55.01 billion and foreign inflows which increased by 91.24 percent from N22.97 billion to N43.93 billion between January and February 2019.

The value of the total transactions executed in the domestic market by institutional investors’ outperformed retail investors by 8.00 percent.

A comparison of the current and prior month (January 2019) transactions revealed that the total retail transactions increased by 38.26 percent from N29.66 billion in January 2019 to N41.01 billion in February 2019.

The institutional composition of the domestic market also increased significantly by 88.15 percent from N25.58 billion in January 2019 to N48.13 billion in February 2019.

This indicates a higher participation by institutional investors’ over their retail counterparts in February 2019.

Between 2011 and 2015, foreign transactions consistently outperformed domestic transactions. However, domestic transactions marginally outperformed foreign transactions in 2016 and 2017, and remained almost at par in 2018.

Foreign transactions which stood at N1.539 trillion in 2014 declined to N1.219 trillion in 2018. Over the 12 year period, domestic transactions decreased by 66.68 percent from N3.556 trillion in 2007 to N1.185 trillion in 2018.

Total foreign transactions accounted for about 51 percent of the total transactions carried out in 2018, whilst domestic transactions accounted for about 49 percent of the total transactions in the same period.

-

BREAKING: NSE suspends trading in Diamond Bank shares

Trading in the shares of Diamond Bank Plc has been placed on full suspension following the court sanction of the Scheme of Merger with Access Bank Plc.

The Nigeria Stock Exchange, in a notification to its dealing members posted on its website on Wednesday, said that the full suspension takes effect from March 20 (today).

“Dealing members are hereby notified that following the court sanction of the Scheme of Merger (Scheme) between Access Bank Plc and Diamond Bank Plc, trading in the shares of Diamond Bank has been placed on full suspension,” it stated.

The Exchange said that the suspension was required to prevent trading in the shares of the bank in order to determine shareholders who would qualify to receive the scheme consideration.

It noted that Diamond Bank obtained the court sanction of the scheme on March 19, being the effective date of the scheme.

The NSE stated that the bank’s shareholders passed a resolution approving the merger between Diamond Bank and Access Bank Plc at the court ordered meeting of the bank held on March 5.

The News Agency of Nigeria reports that the Exchange will de-list Diamond Bank from the daily official list at the exchange after the merger.

NAN reports that the shareholders of Diamond Bank and Access Bank at an Extraordinary General Meetings of both banks gave approval for the merger.

Access Bank Chief Executive Officer, Mr. Herbert Wigwe, told shareholders at the EGM that the merger enabled Access Bank to acquire a bank with 17 million retail customers and the most viable mobile payment platform.

Wigwe said that the expected revenue and cost synergies were material and promised significant long term value.

He said the bank, after the merger, would attract more opportunities such as trade finance from international partners.

“With the final merger of both banks and the status of the resulting entity as ‘the largest bank in Africa’s largest economy,’ this greatly bolsters the bank’s brand, opening doors of opportunity both in local and international markets,” he said.

He said the merger was expected to produce the largest banking group in Africa based on its number of customers with more than 29 million customers.

“The resulting entity which will maintain the brand name Access Bank, but with Diamond Bank colors, will have more than 29 million customers, 13 million of whom are mobile customers,” he said.

-

Why building collapse persists – NSE

Adedamola Falade-Fatila, the Chairman of the Ibadan branch of the Nigerian Society of Engineers (NSE) has hinged the rising cases of building collapse on quackery and compromise in standards.

Falade-Fatila, who spoke with the News Agency of Nigeria (NAN) in Ibadan on Saturday, was reacting to the collapse of a building in Ibadan barely 72 hours after a similar incident in Lagos.

He said: “If every client, builder or developer consults a registered engineer to design their structures, we won’t find ourselves in this situation.

“This is purely the result of quackery and compromises in materials, skilled labour and so on.

“ It is as they say in computer, garbage in, garbage out, what you put in is what you get.

“If you put in expertise, quality and professionalism, you will get a solid structure that will stand out and stand the test of time.

“The one that collapsed in Ibadan is still under construction and it gave way; that tells you that something is wrong some where.”

He said the association had been engaged in sensitisation programmes to encourage the use of engineers for projects.

“If you have a structure that is above two floors, get a registered structural engineer, and if it is not up to that, get a registered engineer to do your design for you.

“In doing that, the engineer will give you advice and supervise your project so that there would be no compromise by the time the structure is being put up.

“If you meet anyone who claims to be an engineer, ask for his proof; in the age we are now, it is easy to know a registered engineer.

“You can check on the internet; registered engineers have their names compiled by the Council for the Regulation of the Engineering in Nigeria (COREN).

“Google COREN and check the person’s status by typing in his or her name; if the person is truly registered, you will find his or her name and address there.

“Anyone who claims to be an engineer and his name is not in the database of NSE and COREN is a quack,’’ he said.

-

NSE reclassifies Nigerian Breweries from High to Medium-Priced stock

The Nigerian Stock Exchange (NSE) has announced the reclassification of Nigerian Breweries Plc (NB) Plc from High-Priced Stock Group to Medium-Priced Stock.

In a statement to dealing members, the nation’s stock exchange management said the reclassification became effective from Wednesday, January 9, 2019.

Explaining the rationale behind the downgrading of Nigerian Breweries, the NSE noted that the review of the brewery giant’s stock price trade activity over the most recent six month period provided the basis for reclassifying the security from the High-Priced Stock Group to the Medium-Priced Stock Group.

It emphasised that the stock price dropped below the N100 threshold on August 31, 2018 and traded below N100 up till close of business on December 31, 2018, indicating that Nigerian Breweries Plc stock price has traded below N100 in the 4 out of the last 6 months.

“Resultantly, Nigerian Breweries Plc (NB) will be reclassified from High Priced Stock Group to the Medium Priced Stock Group with effect from January 9, 2019,” the NSE said.

It disclosed further that this reclassification also necessitates the attendant change in the minimum volume required to change the security’s published price from 10,000 units to 50,000 units, as well as a tick size change from 10 kobo to 5 kobo in line with Rule 15.29: Pricing Methodology, Rulebook of The Exchange, 2015 (Dealing Members’ Rules).

According to the NSE’s Pricing Methodology framework, equity securities of quoted companies on its trading platform are classified into three Stock Priced Groups or Categories – High Priced, Medium Priced, and Low Priced Stocks – based on their market price.

In this regard, securities must have traded for at least four out of the most recent six month period within a Stock Priced Group’s specified price band to be classified into the category.

Meanwhile, at the close of business on Wednesday, the share price of Nigerian Breweries at the nation’s bourse was N78.90k per unit.

-

![NSE revokes licences of 39 stockbroking firms [Full list attached]](https://thenewsguru.ng/wp-content/uploads/2017/05/nse-1.jpg)

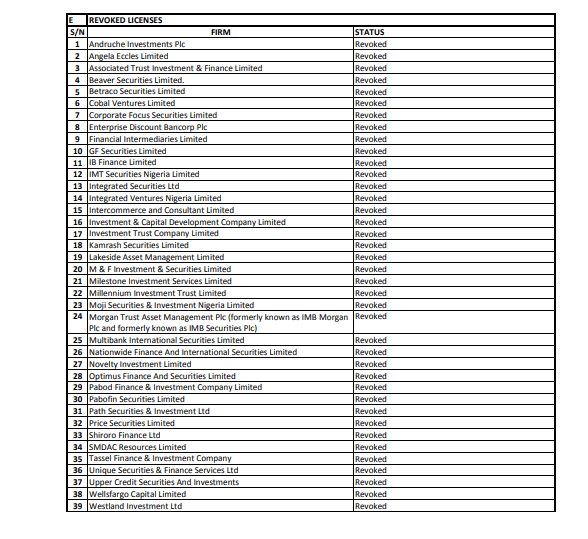

NSE revokes licences of 39 stockbroking firms [Full list attached]

…warns general public against further business transactions with affected firms

The Nigerian Stock Exchange (NSE) on Friday formally revoked the licences of not less than 39 stockbroking companies in the country.

TNG confirmed that the affected firms had their expulsion confirmed by the Council of the NSE on December 13, 2018.

As a result, investors have been cautioned not to deal with stockbrokers, who have been kicked out of the system.

They have been advised to approach the expelled stockbroking firms and request for transfer of their stocks to any active licensed dealing companies.

A document obtained by TNG on Friday revealed that the affected companies include Andruche Investments Plc, Angela Eccles Limited, Associated Trust Investment & Finance Limited, Beaver Securities Limited, Betraco Securities Limited, Cobal Ventures Limited, Corporate Focus Securities Limited, Enterprise Discount Bancorp Plc, and Financial Intermediaries Limited.

Others are GF Securities Limited, IB Finance Limited, IMT Securities Nigeria Limited, Integrated Securities Ltd, Integrated Ventures Nigeria Limited, Intercommerce and Consultant Limited, Investment & Capital Development Company Limited, Investment Trust Company Limited, Kamrash Securities Limited, Lakeside Asset Management Limited, M & F Investment & Securities Limited, Milestone Investment Services Limited, Millennium Investment Trust Limited and Moji Securities & Investment Nigeria Limited.

Also on the list are Morgan Trust Asset Management Plc (formerly known as IMB Morgan Plc and formerly known as IMB Securities Plc), Multibank International Securities Limited, Nationwide Finance And International Securities Limited, Novelty Investment Limited, Optimus Finance and Securities Limited, Pabod Finance & Investment Company Limited and Pabofin Securities Limited.

The remaining are Path Securities & Investment Ltd, Price Securities Limited, Shiroro Finance Ltd, SMDAC Resources Limited, Tassel Finance & Investment Company, Unique Securities & Finance Services Ltd, Upper Credit Securities and Investments, Wellsfargo Capital Limited, and Westland Investment Ltd.

TNG gathered that as Monday, December 24, 2018, the capital market has a total of 195 active dealing member firms, 51 inactive dealing member firms, 5 dealing member firms deregistered by the Securities and Exchange Commission (SEC), 5 resignation in progress, 39 revoked licenses and 121 expelled dealing member firms.

See more details below:

-

NSE lifts suspension on Unity Bank shares

The Nigerian Stock Exchange (NSE) on Friday suspended its ban trading in the shares of Unity Bank Plc hours after placing the ban.

Recall that the stock market regulator had earlier on Thursday announced a suspension on Unity Bank shares and that of five other listed companies for failing to release their financial statements as required by the listing rules.

However in a notice to the investing public on Friday, the stock market regulator announced lifting of the suspension on trading in the shares of bank

“We refer to our Market Bulletin dated November 1, 2018 notifying the public of the suspension of six listed companies for non-compliance with Rule 3.1, Rules for Filing of Accounts and Treatment of Default Filing, Rulebook of The Exchange (Issuers’ Rules), which provides that; ‘If an Issuer fails to file the relevant accounts by the expiration of the Cure Period, The Exchange will: (a) Send to the Issuer a ‘Second Filing Deficiency Notification’ within two business days after the end of the Cure Period; (b) Suspend trading in the Issuer’s securities; and (c) Notify the Securities and Exchange Commission (SEC) and the Market within twenty-four (24) hours of the suspension.’

“Unity Bank Plc, which was amongst the companies suspended has, submitted its outstanding Audited and Interim Financial Statements to The Exchange.

“In view of the submission of the company’s accounts and pursuant to Rule 3.3 of the Default Filing Rules, which provides that; ‘The suspension of trading in the issuer’s securities shall be lifted upon submission of the relevant accounts provided The Exchange is satisfied that the accounts comply with all applicable rules of The Exchange. The Exchange shall thereafter also announce through the medium by which the public and the SEC was initially notified of the suspension.’

“The general public is hereby notified that the suspension placed in the trading of the bank’s shares was lifted today, November 2, 2018.

“This is for your information and update,” the notice signed by Mr Godstime Iwenekhai, the Head of Listings Regulation Department at the NSE, said.

-

NSE suspends trading in Unity Bank, five others’ shares

The Nigerian Stock Exchange has suspended trading in the shares of Unity Bank Plc and five other listed companies.

The Head, Listings Regulation, NSE, Godstime Iwenekhai, in a statement on Thursday, said the companies were suspended for failing to file their financial statements.

Iwenekhai, who announced the suspension, said it was in pursuant to Rule 3.1, Rules for the filing of accounts and treatment of default filing, Rulebook of the Exchange.

He said the rules provided that if an issuer failed to file the relevant accounts by the expiration of the cure period, the Exchange would send to the issuer a second filing deficiency notification within two business days after the end of the cure period.

He added that trading in the issuer’s securities would be suspended, after which the Securities and Exchange Commission and the market would be notified within 24 hours of the suspension.

The statement read in part, “Trading in the shares of the following companies via the facilities of the Exchange has been suspended effective today, November 1, 2018: Unity Bank Plc, Fortis Microfinance Bank Plc, Thomas Wyatt Nigeria Plc, Multi-Trex Integrated Foods Plc, Golden Guinea Breweries Plc and Deap Capital Management & Trust Plc.

“In accordance with the rules set forth above, the suspension of the above-listed companies will only be lifted upon the submission of the relevant accounts and provided the Exchange is satisfied that the accounts comply with all applicable rules of the Exchange.”

Meanwhile, the market capitalisation of equities listed on the Exchange dropped by a further N168bn on the back of 24 losers led by Cadbury Nigeria Plc.

The market capitalisation, which stood at N11.852tn on Wednesday, dropped to N11.684tn at the end of trading on the floor of the Exchange on Thursday.

The All Share Index dropped by 1.4 per cent from 32,466.27 basis points on Wednesday to 32,006.65bps on Thursday, shedding 459.62 bps.

The year-to-date loss moderated to -16.3 per cent, while the volume and value of trade increased by 67.4 per cent and 29 per cent to close at 355.757 million units and N4.9bn, respectively.

Sector performance was bearish as all indices closed on a negative note.

The industrial index recorded the largest decline due to losses in Dangote Cement Plc, while the consumer goods and oil and gas indices followed, declining by 1.1 per cent and 0.8 per cent, respectively, on the back of losses in Nestlé Nigeria Plc, Dangote Sugar Refinery Plc, Oando Plc and Eterna Plc.

The banking index dropped by 0.6 per cent, while the insurance index dropped by 0.1 per cent.

The top traded stocks by volume were First City Monument Bank Plc (168.727 million), Guaranty Trust Bank Plc (85.757 million) and Zenith Bank Plc (24.365 million), while the top traded stocks by value were GTB (N3.2bn), Zenith Bank (N562.8m) and FCMB (N261.2m).

The top five worst-performing stocks were Cadbury, CAP Plc, Eterna, Cement Company of Northern Nigeria Plc and Africa Prudential Plc, whose share prices declined by 10 per cent, 9.97 per cent, 9.92 per cent, 9.82 per cent and 9.82 per cent, respectively.

The top five best-performing stocks were Japaul Oil & Maritime Services Plc, Neimeth International Pharmaceuticals Plc, WAPIC Insurance Plc, Learn Africa Plc and Presco Plc, which saw their respective share prices increase by 10 per cent, 9.09 per cent, 7.50 per cent, 7.27 per cent and 6.49 per cent.

Analysts at Afrinvest Securities Limited said, “Following three consecutive days of profit-taking, we anticipate a mild upturn in prices of bellwethers that have declined, thus driving a positive performance in today’s (Friday) session.”

-

NSE issues 24 hour deadline to quoted companies for submission of third quarter reports

Companies quoted on the Nigerian Stock Exchange (NSE) have up till the close of business tomorrow to submit their financial statements and reports for the third quarter of this business year.

Companies that fail to meet the deadline will be sanctioned and flagged with a red alert of poor corporate governance.

Several companies have not submitted their earnings reports and are, therefore, expected to submit the reports before the close of work tomorrow to avoid sanctions that range from N100,000 to N100 million.

More than half of the companies expected to submit their third quarter reports have not submitted as at the weekend, according to the tally provided by the NSE. Thirty eight companies had rushed through the last week to submit their third quarter reports.

Not less than 43 companies have been sanctioned so far this year with fines ranging from N100,000 to N35 million. Companies that delayed their financial statements and accounts also face threats of suspension and delisting in addition to the monetary fines. A total of 23 companies are currently under suspension for failure to meet earlier deadlines for earnings reports.

Under the extant rules at the Exchange, quoted companies are required to submit interim or quarterly report not later than 30 calendar days after the end of the relevant period. Most quoted companies including all banks, major manufacturers, oil and gas companies, breweries and cement companies use the 12-month Gregorian calendar year as their business year. The deadline for the nine-month period ended September 30, 2018 is thus Tuesday, October 30, 2018.

Quoted companies are also required to publish the earnings reports within five business days after the date of filing, in at least two national daily newspapers, and post it on the company’s website, with the web address disclosed in the newspaper publication.

Also, an electronic copy of the publication shall be filed with the Exchange on the same day as the newspaper publication. Where the company chooses to audit its quarterly accounts, it shall be required to file such accounts not later than 60 calendar days after the relevant quarter.

However, general waiver is usually given in the event of general disruption to industrial activities such as strike, national crises, many public holidays and other circumstances that in the judgement of the Exchange may significantly impact the 30-day timeline given to companies to prepare and submit the quarterly report. There were no general disruptions during the period under review.

Under the rules at the Exchange, late submission under the first instance of 90 days could attract N9 million, the additional period of 90 days will attract N18 million while such delay beyond the first 180 days to the next 180 days could attract as much as N72 million, bringing fines payable by a defaulting company within a year to N99 million.

Meanwhile, investors traded 1.45 billion shares worth N15.26 billion in 16,682 deals last week at the NSE as against a total of 1.38 billion shares valued at N15.15 billion traded in 14,033 deals two weeks ago.

The traditional most active financial services sector remained atop activity chart with 1.22 billion shares valued at N9.48 billion in 10,520 deals; representing 83.94 per cent and 62.11 per cent of the total equity turnover volume and value respectively. The conglomerates sector followed with 92.19 million shares worth N452.95 million in 719 deals while consumer goods sector ranked third with a turnover of 76.57 million shares worth N3.71 billion in 2,471 deals.

The three most active stocks were First City Monument Bank Plc, Access Bank Plc and Sterling Bank Plc. The three most active stocks accounted for 695.4 million shares worth N2.0 billion in 3,494 deals, representing 47.83 per cent and 13.10 per cent of the total equity turnover volume and value respectively.