By Emeka Ndu, FCA

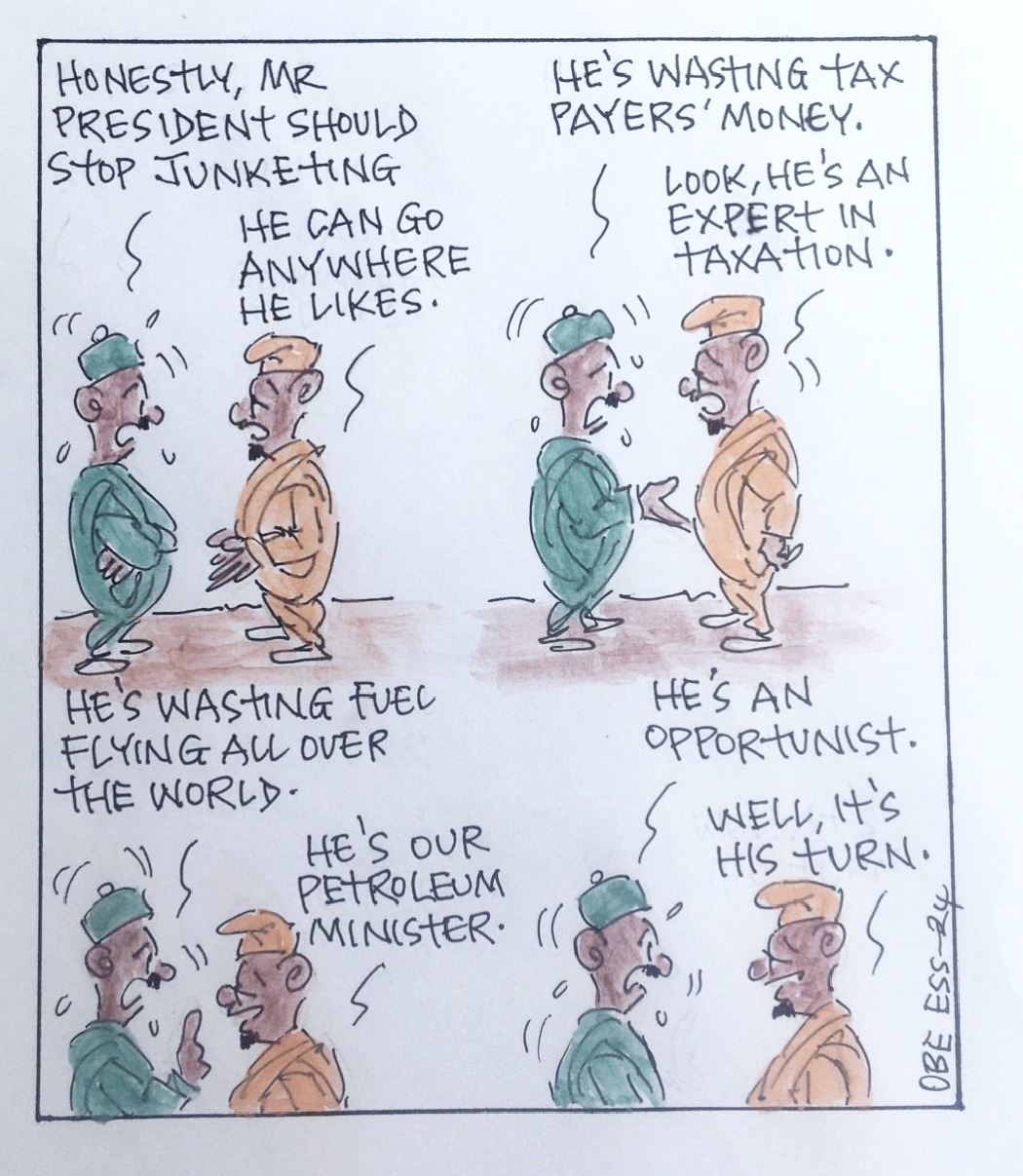

The recent furore generated by the tax reform bills sponsored by the Tinubu administration has elicited the need to look at the entire concept of tax action in Nigeria. This article will look at an often ignored aspect of taxation, that of taxing residual wealth from generation to generation.

As Nigeria continues to grapple with economic challenges, rising inequality, and the need for sustainable public revenue, the reinstatement of the scrapped Capital Transfer Tax (CTT) emerges as a compelling solution. Inheritance taxes have been successfully implemented in many economies to enhance revenue generation, reduce wealth inequality, and improve equity in taxation.

In Nigeria, the top 10% of the population holds almost 30% of the nation’s income.This figure has remained trended upwards in recent years, indicating a significant concentration of income among the wealthiest segment of the population. To put this into perspective, the income inequality ratio between the top 10% and the bottom 50% is 1 to 14. This means that, on average, an individual in the top 10% earns 14 times more than someone in the bottom 50%.

It’s important to note that income distribution figures can vary over time due to economic policies, market dynamics, and data collection methodologies. Additionally, while income distribution provides insight into economic inequality, wealth distribution—which includes assets like property and investments—can present a different picture and is often more skewed.

Addressing such disparities is therefore crucial for promoting economic equity and social stability in Nigeria. We can ill-afford to create a permanent elite class that enjoys privilege in perpetuity simply because their forbears were able, in whatever manner they did, to amass wealth in the past.

This article explores the need for Nigeria to adopt inheritance taxation as part of ongoing tax reforms and compares inheritance tax structures in the UK, US and South Africa.

These comparisons highlight the potential positive impacts of inheritance taxes in fostering equity, funding development, and closing the wealth gap in Nigeria.

The Historical Context of Inheritance Tax in Nigeria

Nigeria previously had a Capital Transfer Tax (CTT),introduced in 1979 under the Capital Transfer Tax Act, 1979 by the them Obasanjo military regime. The CTT was imposed on the transfer of assets, including inherited wealth, upon death or as a gift. However, due to administrative inefficiencies, tax evasion, and political pressures, the CTT was abolished in 1996, by the Abacha regime, in a move that cynical observers said was a move to protect the billions of dollars that he had spirited out of Nigeria. Since then, Nigeria has lacked any form of inheritance or estate tax, unlike its global counterparts.

The absence of inheritance taxes exacerbates wealth inequality, as large estates and inherited wealth accumulate tax-free over generations. As the country faces increasing fiscal pressure and economic disparities, it is imperative to consider the reintroduction of an inheritance tax system to address these challenges.

The Role of Inheritance Taxes in Equity and Revenue Generation

Inheritance taxes serve several purposes:

- Reducing Wealth Inequality:By taxing inherited wealth, governments can prevent the perpetual transfer of wealth to a small elite class, fostering social mobility.Even in traditionally feudalistic societies like the United Kingdom, these taxes have been used as a portent force for good in ensuring a reduction of a permanent upper class that is based principally on privilege. Inherited wealth invariably serves as a disincentive to wealth creation based on merit, as it entrenches a permanent upper class.

- Promoting Equity in Taxation:Inheritance taxes ensure that wealthier individuals contribute more to public finances, aligning with the principles of progressive taxation. There has been growing calls for the expansion of the tax net to capture even illicit wealth. It is a long established fact of tax law that the “burglar and the swindler, who carry on a trade or business for profit, are as liable to tax as an honest business man.”. So taxation can be used as a veritable tool to harness tax revenues from even dishonest activities. In the United States, when the government was unable to pin specific crimes against the Mafia dons, it resorted to tax evasion, which has a much less onerous burden of proof as it most times shifts this burden of proof to the tax payer rather than the tax man.

- Revenue Generation: Inheritance taxes provide a sustainable revenue stream for governments, which can be used to fund infrastructure, healthcare, education, and poverty alleviation programs. The International Monetary Fund (IMF) reported that Nigeria’s tax-to-GDP ratio was 9.4%in 2023, indicating a huge shortfall from the African average of 18.8% and the OECD average of 34,2%.

Comparative Analysis of Inheritance Tax Systems

To highlight the benefits of inheritance taxes, it is useful to analyze inheritance tax structures in the UK, US and South Africa. Each of these countries implements inheritance or estate taxes with varying thresholds, rates, and impacts.

The United Kingdom

In the UK, inheritance tax (IHT) is levied on estates valued over £325,000 at a rate of 40%. However, the tax applies only to the portion exceeding the threshold, and several exemptions exist for spouses, charitable donations, and small businesses.

Inheritance tax contributes significantly to the UK’s tax revenue, generating approximately £7 billion annually. It is noteworthy that the new Labour government has widened the inheritance tax net to include family owned farms, with a net worth of over £1 million, in a bid to plug the much talked about £22 billion “black hole” in UK government finances.

The UK’s progressive inheritance tax system ensures that the wealthiest estates contribute more to public finances. Funds are often reinvested in public services, reducing the wealth gap. The UK system balances fairness with exemptions to protect middle-income families while ensuring wealth redistribution across the wealthier families.

The United States

In the US, inheritance taxes are more complex, as they combine federal estate taxes with state-level taxes. At the federal level, estates exceeding $12.92 million for individuals (as of 2023) are subject to estate tax rates ranging from 18% to 40%. States such as New York and Maryland impose additional inheritance or estate taxes. The impact of some of these taxes may help explain the benevolence of wealthy Americans such as Warren Buffet and Bill Gates who plan to distribute majority of their wealth to charitable causes rather than leave their fortunes to be ravaged by inheritance taxes. A number of them have enrolled in the Giving Pledge, where they pledge to give away 50-99% of their wealth to charitable causes.

Estate taxes contribute billions to federal revenue. For example, in 2020, estate taxes generated $17 billion in revenue. By taxing the largest estates, the US ensures that ultra-wealthy individuals contribute proportionally to public finances while avoiding undue burdens on smaller estates.

South Africa

South Africa imposes an estate duty of 20% on estates valued below R30 million and 25% on amounts exceeding this threshold. In addition, Donations and transfers to spouses are exempt. A primary threshold of R3.5 million ensures that smaller estates are not burdened unduly. Estate duties contribute a moderate amount to South Africa’s revenue base but are essential for addressing the country’s significant wealth inequality,nespecially along race lines. Given South Africa’s history of economic disparity, estate taxes help address structural inequalities by redistributing wealth.

Lessons for Nigeria: Benefits of Reintroducing Inheritance Taxes

From the above comparisons, several lessons can guide Nigeria in reintroducing inheritance taxes:

- Revenue Generation for Development

Countries like the UK and US demonstrate that inheritance taxes can contribute billions in revenue annually. For Nigeria, these funds could be used to improve much needed infrastructure (roads, railways, and power supply, education and healthcare etc. In addition, a portion of such taxes may be targeted at poverty alleviation and skills enhancement effortsthat eventually reduce poverty and reduce social inequality.

- Reducing Inequality

Nigeria faces a growing wealth gap, with significant disparities between the elite class and the broader population. By taxing inherited wealth, Nigeria can reduce the concentration of wealth within a small elite and promotesocial mobility and economic opportunity for underprivileged groups. In a country such as Nigeria with a vast gulf between the haves and the havenots, reducing inequality is key to societal stability and peace.

- Promoting Tax Equity

Inheritance taxes ensure that wealthier individuals contribute more to national development. Unlike consumption taxes (e.g., VAT), which disproportionately burden low-income earners, inheritance taxes target unearned wealth transfers, promoting fairness in taxation. So far, the uproar has largely been on the distribution of VAT revenues amongst states and regions of the federation.

- Administrative Considerations

To ensure the successful implementation of inheritance taxes, Nigeria must set reasonable exemption thresholds to protect middle-income families (e.g., estates below N50 million – this is just a suggestion, as an ideal figure will need more empirical research).

In addition, the proposed tax must simplify tax administration to prevent evasion and improve compliance, so that it doesn’t become burdened by evasion that is induced by complexity of enforcement. We must also enlighten the general public on the benefits of inheritance taxation for national development.

Conclusion

The reintroduction of inheritance taxes or the Capital Transfer Tax in Nigeria is a necessary step in achieving tax equity, reducing wealth inequality, and generating sustainable revenue for development. By adopting lessons from countries such as the UK, US, and South Africa, Nigeria can design a fair and progressive inheritance tax system that balances revenue generation with social justice.

At a time when Nigeria faces significant fiscal challenges and economic disparities, inheritance taxes offer a powerful tool to address inequality and fund essential public services. It is time for policymakers to prioritize equity in taxation and ensure that the wealthy contribute meaningfully to Nigeria’s development goals. Reintroducing the Capital Transfer Tax would not only align Nigeria with global best practices but also foster a more inclusive and equitable society.

Mr Emeka Ndu, is a Price Waterhouse-trained chartered accountant and serial entrepreneur who has a passion for societal development and empowerment. (Dr Dakuku Peterside will return to this column next week).